Down -7% Year-To-Date, -23% over the last 12 months, -28% from all-time highs: is LVMH a buying opportunity?

In today's episode, I’ll briefly address the following points:

Is the luxury powerhouse experiencing temporary or permanent issues? Can investors capitalize on the cyclicality of the luxury industry?

Business Case: is LVMH a quality company on sale?

Am I personally planning to add more shares to my current position?

What needs to happen to double your money (+100%, IRR +15%/year) if you enter at current levels?

H1 2024: where is growth?

The price action of the stock over the past 12 months reflects Mr. Market’s fear - apparently confirmed by the results of the 1st semester - of stagnation across all business segments.

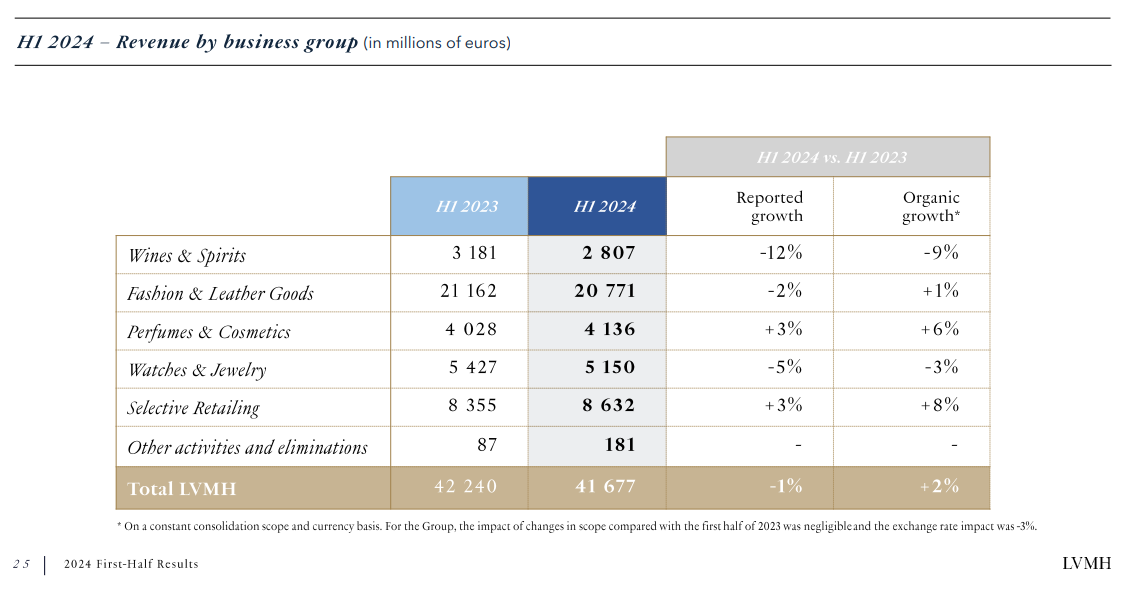

Here’s a quick summary taken from their latest IR presentation:

So here’s the million dollar question: are we in front of temporary headwinds or a permanent decline?

Let’s consider the following points:

Comps are terrible. LVMH bounced back from the pandemic hit with an incredible resilience, hitting +43.5% and + 22.9% revenue growth rate in 2021 and 2022 respectively. Prior to Covid-19, this growth rate for the group was not normal:

Cyclicality: By definition, the luxury market is cyclical. In the table below, I have summarized the annual average growth rates for the luxury segments in which LVMH operates, along with the best estimates I could find for the coming years. These estimates, sourced from Fortune Business Insights, Bain & Company, and Statista, indicate an overall positive growth trend in the mid-single digits. The table also highlights how LVMH has outperformed the industry in the Fashion & Leather Goods and Watches & Jewelry segments, while maintaining a competitive position in other areas.

In the Business Case illustrated in the next paragraph, I will make the assumptions that LVMH will at least meet the organic growth rates of the overall industry.

Zooming Out: Is LVMH a quality business?

Disclaimer: I own LVMH. As I’m writing, it represents 5.7% of my allocated portfolio. So, my opinion may be biased but I will make my best for this not to happen.

That being said, I think LVMH does not need an endorsement by me to deserve the label of top-quality business:

LVMH is a founder-led group of 75+ luxury brands. I count 4 LVMH Brands in the top 100 best global brands list by Interbrand (Louis Vouitton, Dior, Hennessy, Sephora)

The company exhibits an unparalleled history of successful acquisitions

Revenues are well-diversified both geographically (no macro-region accounting for more than 33% of total sales is great in my opinion) and most importantly by segment.

The Balance Sheet is solid and shareholder yield has been increasing for years (dividend growth + shares buybacks)

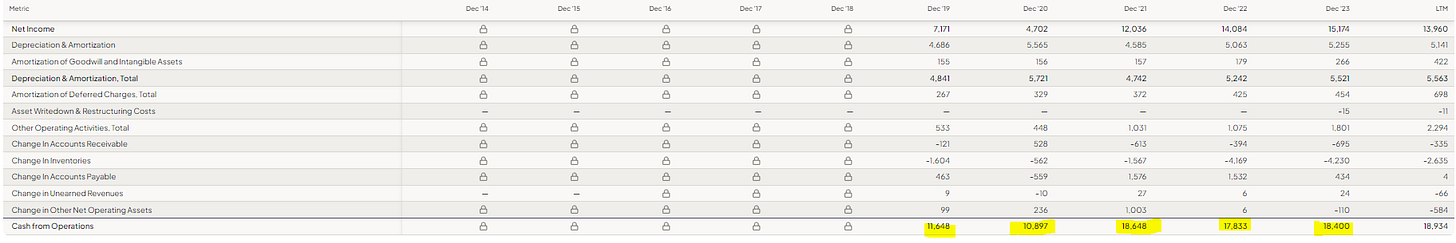

That being said, there is one financial metric that I believe investors should closely monitor: Cash Flow from Operations Growth.

Why is this important?

The entire investment case for LVMH is built on the company's ability to execute strategic acquisitions, and the key to anticipating the likelihood of such acquisitions is understanding how much cash the core business generates. This cash flow enables management to pursue new expansion opportunities actively.

Over the past five years, LVMH has significantly increased its cash generation from operations, rising from €11.6 billion in 2019 to €18.4 billion in 2023 (Source: FinChat).

While no one can predict future M&A activity with certainty, investors can build an aggressive business case that anticipates additional acquisitions in the coming years, consistent with the company's long-standing strategy over the past decades.

Business Case

Today’s business case presents some similarities to last week’s Lululemon analysis.

Here’s a recap of how I built this simplified exercise:

The time horizon is once again 5 years

I simulate top line scenarios only, assuming earnings optimization

I break down revenue expansion by business segment

I get the help of a basic sensitivity analysis to find the estimated market capitalization in 2029

To do that, I combine projected net profit margin and a series of normalized end multiples - between 16 and 22 - for 2029

I develop 2 cases: organic only vs new acquisitions

Organic growth only (conservative scenario)

As usual, I ask myself in the first place: how much money can I lose?

That’s why this first scenario looks conservative:

I am excluding the possibility of major new acquisitions

I am slashing historical growth rates for Fashion Leather & Watches/Jewelry

I am assuming no outperformance on the other main categories

Here below I report the details of LVMH revenues from 2015 to 2024 (projected), together with the estimates for the period 2025-2029:

In short, based on these figures, the group would be growing at 6.6% CAGR from 2025 to 2029.

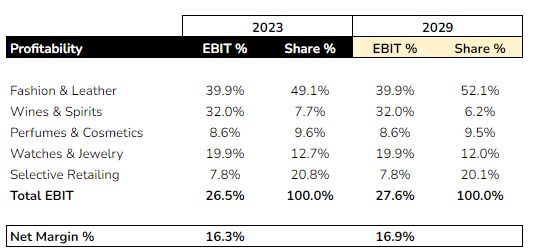

Now that we have the projected revenue growth and the change in revenue mix, we plug in EBIT margin by category (Source: FinChat).

The third and final step of the business case consists of a simple sensitivity analysis:

I take the 16.9% profit margin for 2029 as a mid-point of a profit margin range.

I plug in a series of end multiples - from 16 to 22 - to find the expected LVMH market cap.

Finally, I take a look at all the possible outcomes and check the following: what are the worst, average, and best scenario?

Conclusion: I have enough evidence to conclude that the downside risk for LVMH is well-protected. While there is a possibility that LVMH could halt acquisitions and experience slower growth, I believe that the potential for losing money even in this scenario is limited.

External Growth Scenario (bold scenario)

What if Arnauld’s empire expands once again further down the line? Also, what if Management finds alternative ways to achieve more solid growth?

In the second and last scenario, I assumed the following:

Growth rates by segments higher than before to reflect new acquisitions in core categories (12% CAGR Fashion & Leather, 10% CAGR Watches & Jewelry)

Growth across the other categories hitting the high-end of the industry estimates

Same profitability margins

Here’s how the new estimates and the business plan look like:

Based on these figures, the group would be growing at 9.7% CAGR from 2025 to 2029. Still not impossible for the company in my opinion.

Finally, I report the margins and sensitivity calculations:

Conclusion: the case for LVMH to growth slightly below 10% per year gives me confidence in believing the stock is trading at a pretty attractive discount.

The 100% Recipe

Long-time readers may have anticipated this final step: what needs to happen to double my money should I purchase more shares today?

Reverse DCF (Simplified)

In essence, at a 20x FCF multiple in 2029, the company should be growing between 15% and 21% per year. That’s quite a lot.

Buy Target Prices from Today

Alternatively, you can just wait and see if LVMH keeps dropping.

What stock price would more likely increase the chances of a 2x, keeping all the other variables and business fundamentals unchanged? (market caps taken from the previous simulations).

Conclusion

I view LVMH as my personal luxury ETF and the epitome of a "sleep-well" investment. I don't anticipate either huge returns from the stock or significant downturns.

Currently, I see more compelling opportunities in the market, which is why I am content to hold my position for now. However, if the stock price continues to decline in the near term, I would be happy to increase my position.

What do you think of LVMH? I’m all ears in the comments section!

If you made it this far, congratulations and thanks for your patience!

📢 If you find value in my episodes, feel free to restack, like, or comment below.

For any ideas or request, feel free to reach out via DM.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest

LVMH is a great conglomerate! I own them too and going to add more shares. // Why do you use Net Profit Margin, not EPS projected growth, in your estimates?

This makes Dior even more attractive.