If you’re reading this, chances are we have a few things in common.

One of them being Adobe on our watchlist.

What a weird journey this stock had.

From May 1993, when I was born, to March 2020, it delivered an impressive 18-19% CAGR, navigating through two major multi-year crises.

But since then, something has changed.

Is this the beginning of the end or just the end of a new beginning?

Or is the reality somewhere in between?

Let’s take a balanced, quick look at Adobe.

Any Quality signals?

As long-time readers may know, I never let valuation be the front-dog of my analyses.

Quality first. How I define it?

This is what I’m typically looking for:

➡️ Ownership Excellence:

🟡 Adobe is not founder-led - both Founders passed away in recent years - but the CEO Shantanu Narayen has been in charge since 2007 (after many years as insider)

🔴 Insider Ownership falls short at 0.33%, with the CEO holding 'just 0.09% (still roughly 200 millions though)

🟢 Employee/Talent Retention: the company ranked #25 in the Fortune 100 Best Companies to Work For® 2024 list; Employee turnover seems lower (10%) than the average in Tech (13%) (source: amazingworkplaces.co)

➡️ Customer centricity:

🟢 Strong Brand Value: Adobe has been a constant presence in the Interbrand Best Blobal Brands list for more than a decade, ranking 17th in 2024 (+12% vs 2023)

🟡 Retention Rates: as retention data seems scattered, I don’t highlight this point as green (although some data suggests 110% or even higher retention rate on some verticals)

🟢 Reccuring Revenues > 95%. This company simply locks customers through their subscriptions model, making it a very stable operating cash flow machine.

➡️ Innovation footprint:

🟢 Relentless R&D spending: representing 18.3% of revenues as of last full-year data.

🟡 Despite the solid track record of new products and features released, it must be said that Adobe has been more a follower than a leader over the last few years.

➡️ Quality flywheel:

Looking at some first numbers, the situation looks intriguing.

Free cash flow > 40%

ROIC > 24%

Blended 2Yr Revenue Growth expected: 9.6%

The ingredients for medium-term compounding effects on earnings look solid.

I don’t count them out

💡 Recently, I’ve been digging into product reviews and industry trends.

Are creators, marketers, and freelancers flocking to AI-powered design apps? Are Canva, Affinity, Figma, or Gimp more viable (and cheaper) alternatives?

Here’s the bottom line.

Theoretically, every Adobe Creative Cloud tool has a substitute.

But no competitor matches its depth, integration, and interoperability.

For a solo freelancer using just one app like Illustrator, switching might make sense.

But for businesses needing multiple tools, Adobe’s bundled solutions remain the smarter (and perhaps still cheaper!) choice.

➡️ Adobe’s ecosystem solutions creates a switching costs type competitive advantage.

Beyond that, I believe Adobe’s brand legacy cements its position with large enterprises - its most lucrative segment - especially amid legal uncertainties in AI.

For example, Adobe markets Firefly’s AI models appear as “commercially safe” and designed to avoid copyright issues, something many emerging apps can’t always guarantee.

➡️ Could things change? Maybe. But I don’t see Adobe’s competitive edge vanishing anytime soon.

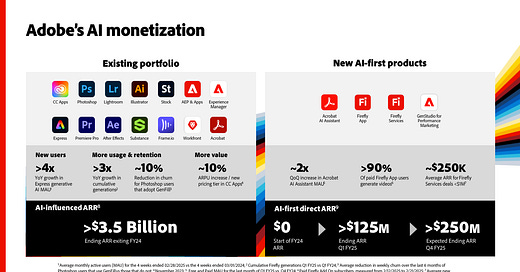

Segment mix is brewing

Looking at Adobe’s different streams of revenues, there are some interesing data points.

Document Cloud is growing fast (19% 4-year CAGR) → this is a strong upselling opportunity, as mentioned in various occasions in their IR reports

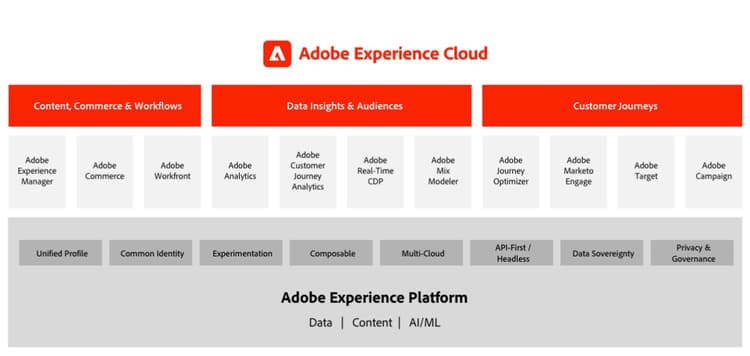

Experience Cloud experiencing solid growth (13% 4-year CAGR) → that’s a crucial diversification source mainly driven by larger enterprises

Creative Cloud - the core business line - growing 10%.

Additionally, several other product lines seem far from maturity.

Firefly - their AI video generation app - still in a early rump-up stage

GenStudio - Adobe’s new performance marketing one-stop solution - approaching 1B USD in annual recurring revenues, apparently with a significant expansion potential

New AI Agents (Agent Orchestrator): the company just introduced this new feature to support businesses in their CRM and marketing operations. I have no clue how much this could be worth!

New potential acquisitions looming, considering the missed opportunity with Figma

I underestimated the speed at which the company is rapidly catching up with the latest technological trends, despite remaining a follower (not to say copier?).

➡️ Okay Francesco, now give me your numbers.

Risk-Reward looks pretty attractive

As you know, I don’t anchor myself to a fair value.

I work with business fundamentals and market sentiment to derive an educated 5-year risk-reward profile.

In a very conservative bear scenario, I assumed:

🔴 Significant top-line slowdown

🔴 Resulting into very weak sentiment - weaker than it’s ever been

🔴 Margin compression - due to a mix of pricing pressure and additional investments

If the above ended up manifesting, it would justify a money-losing investment over 5 years.

On the contrary, I can see a bull scenario where:

🟢 Revenue re-accelerates and remains consistently above 10%

🟢 Margins stay high - consider that FCF is above 40% now

🟢 Sentiment comes back to a historical average, as the market wipes out the AI-related fears

In this case, Adobe would deliver a 2x in less than 5 years.

➡️ Conclusion

I’ll be honest with you.

I’ve been skeptical about Adobe for many months, but after diving a little bit deeper into the business, I may have turned more bullish for the reasons above.

The risk-reward looks nice.

I’m not buying shares at the moment because I see other compelling opportunities, but if I had to choose between black and white, I’d buy it today to size up in the $320-$330 area.

Survey

Your opinion means eveything.

Was this episode helpful?

Let me know down below:

Join the Waitlist

Interested in working directly with me inside my 1:1 coaching program?

You can join the waitlist by messaging me:

Text me and we’ll explore opportunities to speak and work together.

I can only handle a few spots per moenth to ensure the highest quality.

If you’re ready to take modern value investing seriously, I’ll see you inside!

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest

Have been looking at Adobe myself and there's a lot I like. Just unsure of the reinvestment opportunities or lack thereof.