Last May, I became a Shopify shareholder.

Why did I buy this stock?

What worked well?

What went wrong?

Stay with me and I’ll share some insights of one of my 2024 investments!

If you’re new, don’t miss out some of my recent updates:

As usual, this is not financial advice. Do your own research, always.

Let’s dive in.

SHOP: a High Quality Company

Shopify had been on my ‘dream watchlist’ for years.

Indeed, the company exhibited multiple leading signs of a quality, long-term oriented business:

✅ Founder-led: Tobias Lütke, Co-Founder of the company, still serves as visionary CEO

✅ Innovation Champion: 17%-22% Research & Development spending over Net Revenues and proven track record of disruptive innovations

✅ Revenue Quality: the company has been diversifying into multiple scalable revenue streams with the ramp-up, among the others, of the B2B segment

✅ Owner-Operated: Insiders hold 6-7% of total shares, indicating nice shareholder alignment

✅ FCF > Net Income: constant, increasing free cash flow as a proxy of future earnings power

✅ Market Share Increase: 26% 3-year Revenue CAGR, suggesting competitors’ market share erosion

✅ Customer-Oriented: very high retention rates and NPS

✅ Solid Balance Sheet and reduced shares dilution

The stock became a symbol of the 2021 market euphoria and the subsequent bubble burst in 2022, experiencing an epic -80% crash from its highs.

After the valuation reset, the stock has been on a bumpy uptrend for 2 years. So, what made me buy?

Uptrend in Strategic Fundamentals

Long story short, I noticed a combination of key strategic KPIs trending in the right direction. In particular:

Attach Rate (Revenues / Gross Merchandise Volume)

First off, the attach rate (call it take rate if you wish) was going up. Meaning, the money Shopify can keep in its pockets for every $1 generated on their ecommerce stores was steadily increasing.

This was mainly driven by:

Offer Diversification and enrichment: where Shopify Plus and teh B2B segment played a key role in outpacing the rapid expansion of the lower-margin Payments segment

Pricing Power: Shopify’s take rate was still low compared to similar alternatives (think of Amazon third-party solutions with a take rate over 20%). The company’s brand and quality reputation may still allow price increases for the foreseable future without creating demand shortages or churn

Gross Margin % (Gross Profit / Revenues)

Gross Margin, often a proxy of pricing power and/or bargaining power against suppliers, actually went down for a couple of years.

In the first half of 2023 though, the company entered into a definitive agreement to sell the majority of the logistics business to Flexport, a global logistics platform.

As a result, by scaling down this segment, the Gross Margin rebounded to over 50% and beyond, creating a significant ripple effect that amplified profitability on the bottom line.

Free Cash Flow % (trailing 12 months FCF margin)

Free Cash Flow bottomed in late 2022 and started climbing back up across the divestiture of the logistics business.

The margin was slowly approaching 20%, a strong leading sign of earnings power.

Attractive Risk-Reward

What use did I make of the above mentioned fundamentals KPIs?

As part of my investment process, I proceeded as follows:

Put together my fundamentals assumptions into a 5-year business case;

Broke down the projection into 3 scenarios: bear, base, bull; like I always do

I derived 5-year forward earnings power and revenue CAGR

Completed a detailed risk assessment analysis on a series of checklists I built over time

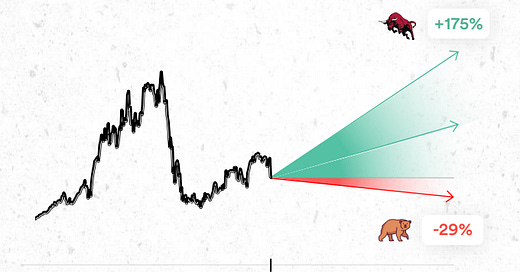

Arrived at a final Risk-Reward profile, that you can see simplified in the infographic below.

Brief note:

Throughout my investing process, I don’t seek an instrinsic value as single reference point for my buying or selling decisions.

I accept the fact that an intrinsic value may not even exist, and that stocks rarely trade around that line.

Since they either trade undervalued or overvalued, the idea of moving within the extremes of a wider range definitely helps me buy, but especially hold and sell with much more confidence.

In short: I don’t buy when price falls below intrinsic value; I buy when risk-reward suggests a protected downside and significant room for upside. I look for asymmetric opportunities.

For Shopify, here’s some of the assumptions I made when building my 3 scenarios.

🐻 Bear Case

For the worst case, I assumed:

Revenue Growth in line with the overall industry: 11% per year (a very conservative deceleration)

Attach Rate flat at 3.05%: no more pricing power (again, conservative)

Gross Margin back to 53% in 5 years: a modest increase

SG&A / R&D spending: same incidence (%) on revenues (no cost efficiencies)

⚖️ Base Case

For the base case, I assumed:

Revenue Growth slightly outpacing the overall industry: 17% per year

Attach Rate up to 3.55%: moderate pricing power and diversification (again, quite conservative)

Gross Margin going up to 54.6% in 5 years: matching the top of previous years

SG&A / R&D spending: same incidence (%) on revenues (no cost efficiencies)

🐂 Bull Case

For the bullcase, I assumed:

Revenue Growth outpacing the overall industry: 19% per year

Attach Rate up to 3.70%: solid pricing power and diversification

Gross Margin going up to 56.1% in 5 years

SG&A / R&D spending: same incidence (%) over revenues for R&D, but assumed optimizations for SG&A. From 23% SG&A/Revenues to 15%

Business Case Output

Plugging all the assumptions into my stock predictor, I ended up with the following risk-reward:

🐻 Bear Case: $40 per share → -29%

⚖️ Base Case: $89 per share → +61%

🐂 Bull Case: $157 per share → +175%

Decision

Despite the downside not being fully protected, I decided to enter the position with 5% of my portfolio at $56, eventually targeting the $40s range as buy-the-dip opportunity.

Here’s comes the hard part: Psychology

So far so good.

When you think you’ve done everything right in terms of analysis, that’s where the most difficult part kicks in: emotions and behavior.

These aspects played a key role even in this case. Let me walk you through a brief behavioral diagnosis of my investment.

A - Before the purchase

Before becoming a Shopify shareholder, I encountered some behavioral traps.

As I illustrate below though, I was able avoid them multiple times:

✅ Avoided Urgency Bias: I waited years before jumping onboard, despite being very attracted to the company.

✅ Avoided Denial Bias: that’s when your mind denies a rapid move up or down. Thoughts like “it’ll come back down”, or “the stock will inevitably come back” are warning signs. In my case, the stock was already up +100% since the bottom, but I had no problem entering after a shocking move up.

B - During the purchase

✅ Avoided Overconfidence: I entered with a reasonable size, despite being bullish on the back of my thesis

✅ Avoided Confirmation Bias: I looked up to bearish theses, and did not shoot overly bullish assumptions.

C - After the purchase

That’s were my execution could have been better. In fact:

❌ Anchoring Bias: early August, the stock fell back below my entry price for just one trading day. I could have increased my position in light of a strong Q2, but I didn’t as I was too anchored to my bear price of $40 per share. I thought: “I’ll wait a bit more”.

❌ Hindsight Bias: the stock bounced back fast after the early August black Monday. Looking back, “that was an obvious buying opportunity”. But the reality is, it’s way easier with the benefit of hindsight.

Investment case wrap up

With Shopify as illustrative example (this was just the tip of the iceberg), you saw how 3 main pillars shape my investing strategy:

Business Research & Analysis

Valuation Principles & Tools

Behavioral Diagnosis

Where many times the third point determines 80% of the final outcome! Just like D. Kahneman would say.

Being up 92% since May means nothing.

We will see 3 or 4 years from now if mine was a solid decision.

For now, I must analyze my process:

Strategy & Analysis, I was solid;

Psychology-wise, execution was not perfect.

So overall, this served as an example to conclude the following:

Psychology can ruin or amplify your investing results

Seeking quality is key, but not sufficient

A structured process will help you strategy-wise, a behavioral diagnosis on the emotional side

Work with me

As certified Financial Educator and Independent Investor with a current 32.5% avg return per year, I am available to lend a hand to anybody who’d love to learn how to become a profitable business investor.

➡️ I have a few slots open for my 1:1 Mentorship Program!

The program may fit well with your goals, if you:

You would like do allocate a portion of your main investments to individual companies, but lack a proven method

You don’t know when to buy or sell, or value stocks

You don’t want to wait years (and repeat the same mistakes I did years back)

You would love to invest with full control over your decisions

➡️ To apply, just turn on the chat below. We’ll understand together if I can help.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest

So inspiring, Francesco. Thanks a lot for sharing this piece with the community.

I have a question: what could have been done in order to avoid the anchoring bias that prevented you from increasing your position on SHOP?

I am really interested in brainstorming around this since you presented your Risk-Reward framework as more efficient than a simple DCF (aiming at identifying a static "fair value") because it should lead to deal way better with the anchoring bias (which is definitely true, don't get me wrong).

Don't you think that the identification of a "fair value" leads to anchoring bias especially on the sell side, while your Risk-Reward framework doesn't fully eliminate the anchoring bias on the entry/add-up side?

Keep doing the great job!