Remember 2022?

While most equities plunged, the Healthcare sector stood firm (granted, a simplified view).

Fast forward to today: Warren Buffett is piling up cash and pausing even Berkshire’s buybacks. Are we going to see another crash?

Instead of panicking or, worse, timing the market, why not blending quality with defense?

Today, I am bringing you inside some of my Healthcare-related research.

XLV, IHI, IHF: Solid Idea Engines

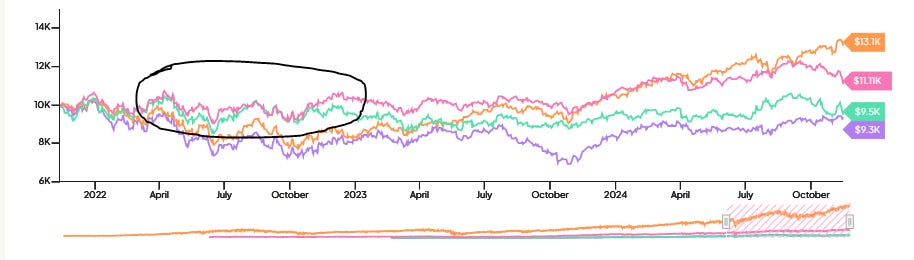

Over the last few years. these Health Care ETFs have proven how this sector can be seen as a solid defensive option, in light of:

Lower volatility compared the broader market;

Reduced correlation with the broader market;

Resiliency: thanks to the need-based nature of many healthcare businesses.

In the chart below (shout out to FinChat!), you can see how stable the overall sector was compared to the S6P 500 (orange line).

Defensive quality investing carries one simple idea: enjoying superior returns without excessive volatility and unsystematic risk.

I’m not going to lie: this is not my blueprint.

However, we can’t always find the next world-changing, 10x type of opportunity. Sometimes, it’s good to play defense.

In today’s episode, I am bringing 6 companies that may fit well in this category for the medium-long term.

Let’s discover them!

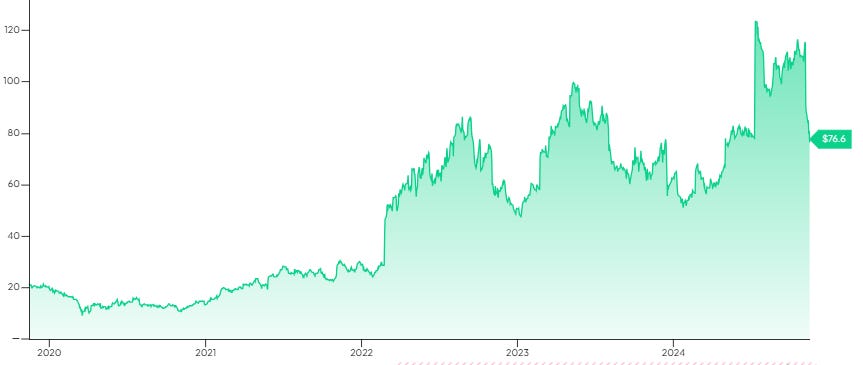

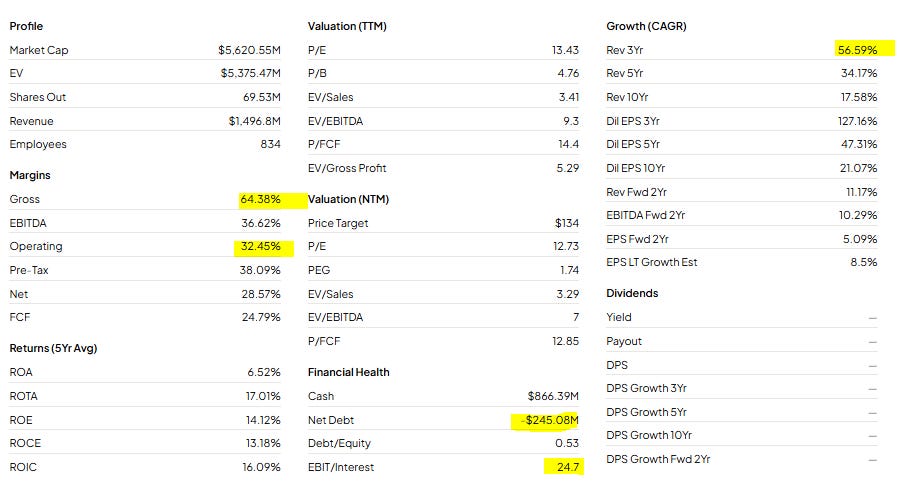

6. Lantheus Holdings | LNTH

What they do: the company specializes in diagnostic imaging and therapeutic solutions, primarily focusing on radiopharmaceuticals products for cardiovascular conditions, cancer detection, and treatment.

Summary KPIs:

Stock 5-year GAGR: 28.85%

Beta: 1.09

Operating Cash Flow / FCF: 75.5%

Operating Margin: 32.45%

I’d also highlight:

Negative NFP: Cash > Long-term Debt

Explosive 3-year Revenue Growth: 56%

Reduced Forward Revenue Expectations: ‘only’ 11%

Not to miss:

R&D/Revenues: 9.73%

ROIC: 46%

Shares Outstanding 3-year change: +0.9%

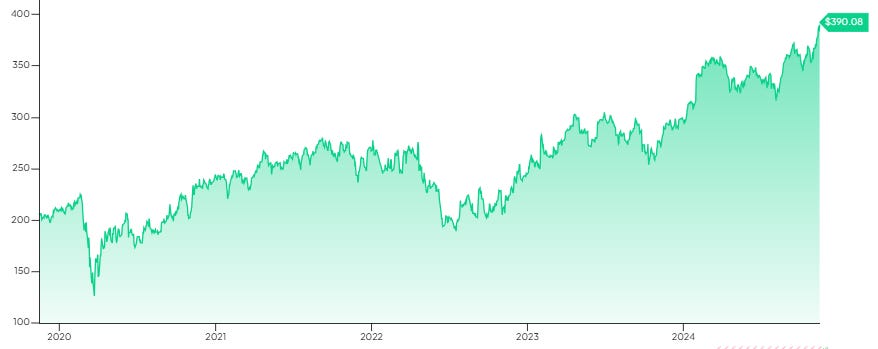

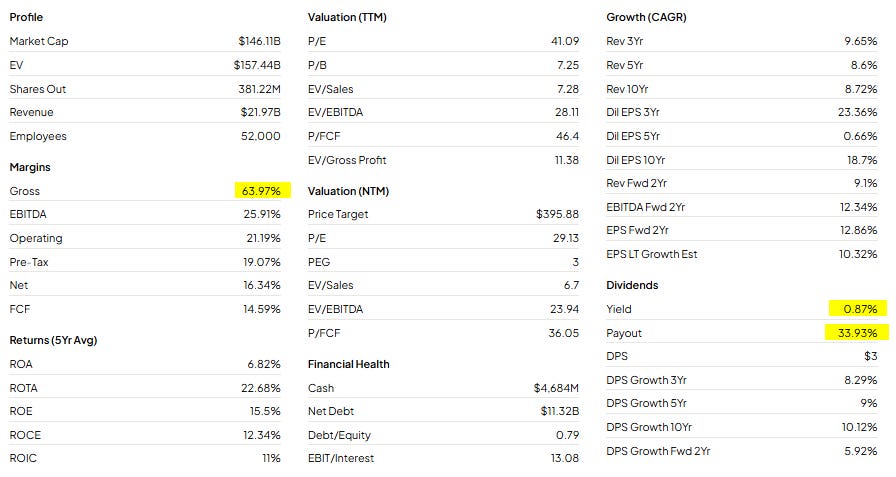

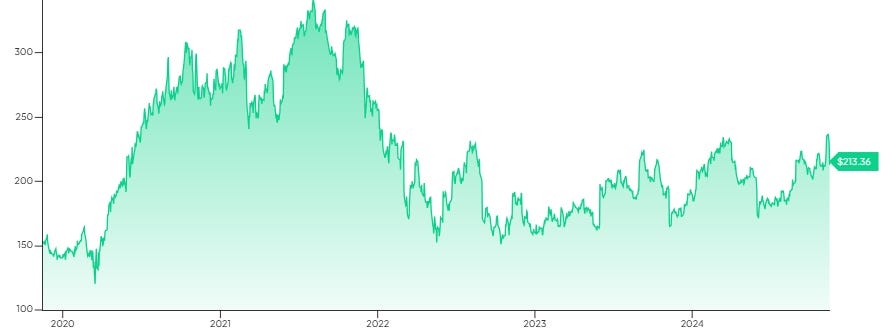

5. Stryker | SYK

What they do: Stryker offers a broad range of products in orthopedics, medical and surgical equipment, neurotechnology, and spine treatments. Their solutions focus on improving surgical efficiency, patient mobility, and hospital workflows worldwide.

Summary KPIs:

Stock 5-year GAGR: 13.58%

Beta: 0.92

Operating Cash Flow / FCF: 82.1%

Operating Margin: 20.7%

I’d also highlight:

Gross Margin: 64%

Solid FCF + Modest Dividend Payout: this makes SYK a dividend king candidate, an elite-status for Wall Street

4. Veeva Systems | VEEV

What they do: fair enough, VEEV sounds more like a Tech company, but I thought this one was worth the mention. They’re a cloud-based software company, tailored for the global life sciences industry. Its platform supports pharmaceutical and biotech companies in areas like regulatory compliance, clinical trials, and customer relationship management.

Summary KPIs:

Stock 5-year GAGR: 6.85%

Beta: 0.81

Operating Cash Flow / FCF: 97.5%

Operating Margin: 22.94%

I’d also highlight:

EPS growth estimate: +18%

No Debt

FCF margin: 37%

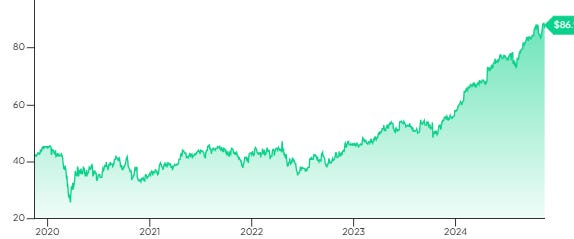

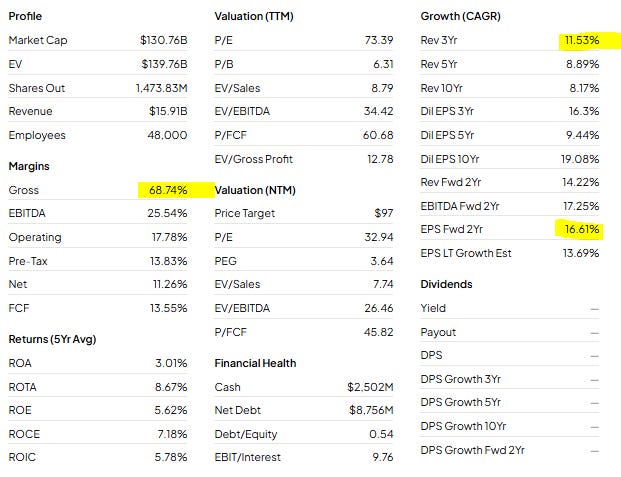

3. Boston Scientific Corporation | BSX

What they do: the company develops and manufactures medical devices used in a variety of interventional medical specialties. Its products support treatments in cardiology, endoscopy, neuromodulation, and urology, focusing on minimally invasive solutions to improve patient outcomes and reduce healthcare costs.

Summary KPIs:

Stock 5-year GAGR: 15.49%

Beta: 0.89

Operating Cash Flow: 13.5%

Operating Margin: 17.8%

I’d also highlight:

Top-line modest re-acceleration: 11.5% (3y)

Gross Margin: 68.7%

Expected solid EPS growth: +17%

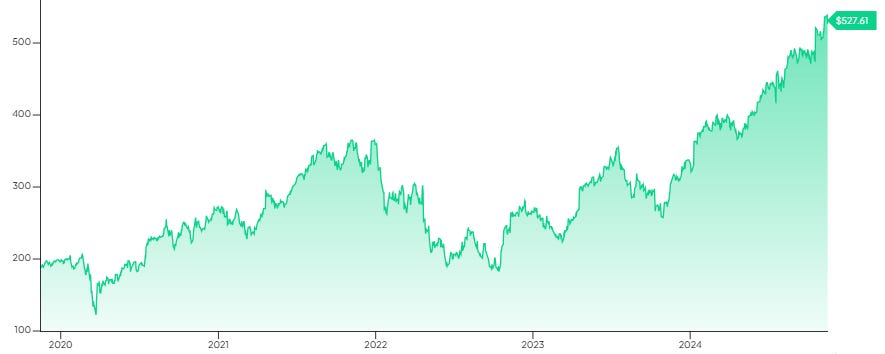

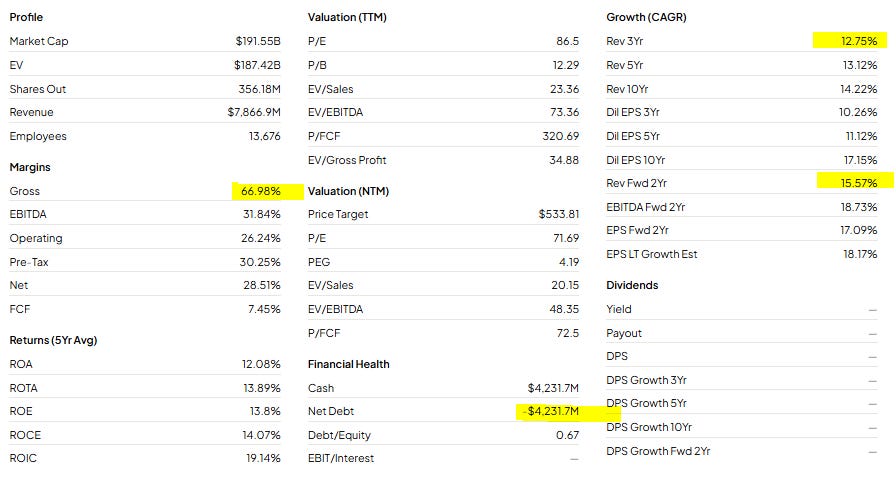

2. Intuitive Surgical | ISRG

What they do: Intuitive Surgical is a leading robotic-assisted surgery. Its flagship product, the da Vinci Surgical System, enables minimally invasive procedures in specialties such as urology, gynecology, and general surgery, reducing recovery times and improving patient treatments.

Summary KPIs:

Stock 5-year GAGR: 22.65%

Beta: 1.39

Operating Cash Flow / FCF: 32.2%

Operating Margin: 26.2%

I also highlight:

Supposed Revenue re-accelaration: +12.75% (past 3y) vs + 15.57% expected

Negative NFP

Gross Margin: 67%

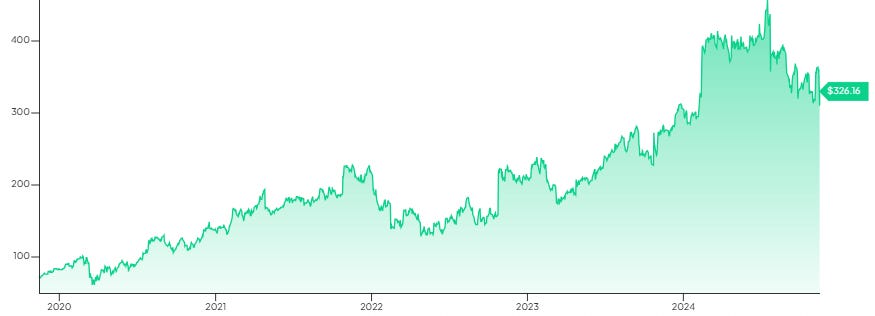

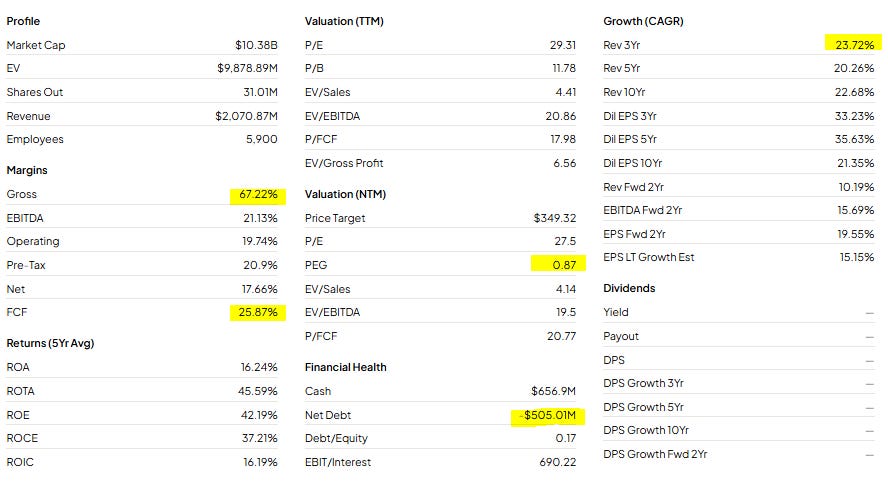

1. MedPace Holdings | MEDP

What they do: Medpace is a clinical contract research organization (CRO) that designs and manages clinical trials for pharmaceutical, biotechnology, and medical device companies. They specialize in streamlining drug and device development processes across various therapeutic areas.

Summary KPIs:

Stock 5-year GAGR: 34.97%

Beta: 1.22

Operating Cash Flow / FCF: 93.2%

Operating Margin: 19.74%

I also highlight:

Gross Margin: 67%

PEG Ratio: 0.87

Negative NFP

Solid 3-year Revenue Growth: +23%

Disclaimer

I don’t think I need to tell you what I’m about to say.

Please do not anything I mentioned here as financial advice.

These are just a bunch of numbers I went trough with the objective to start my research regarding these companies.

Any investing strategy, including mine, is built upon more comprehensive analyses and additional quantitative/qualitative aspects.

Steal my strategy 👇🏼

As certified Financial Educator, Independent Investor, Financial Manager & Bocconi University Alumnus, I am available to lend a hand to anybody who’d love to learn how to become a profitable business investor.

➡️ I have a few slots open for my 1:1 Mentorship Program! ⭐

The program may fit well with your goals, if you:

You would like do allocate a portion of your main investments to individual companies, but lack a proven method

You’re struggling to achieve satisfying returns

You don’t know when to buy or sell, or value stocks

You don’t want to wait years (and repeat the same mistakes I did years back)

➡️ To apply, just turn on the chat below and I’ll understand if I can help.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest