Does Airbnb need any introduction?

In today’s episode - which is coming to you from a nice Airbnb listing in Umbria, in the heart of Italy - I’ll briefly touch on:

Is Airbnb a prospect quality stock?

In terms of fundamentals, are Airbnb revenues of high quality too?

Back-of-napkin 5-year valuation + a random idea

Let’s get into it!

Source: company website; finchat.io

Yes, ABNB shows some fine quality

In this previous article, I indicated Airbnb as a quality business. In particular, I looked into some leading signals that I love to see regarding a stock’s underlying fundamentals:

✅ The Founder Brian Chesky is still CEO

✅ Insiders own 33.2% of shares

✅ Customers seem to love the product: Net Promoter Score 74 (>50)

✅ more than 20 acquisition deals succesfully done, with space for more ‘strategic acquisitions where relevant’

✅ It keeps innovating: R&D spending at 17.56% of revenues (>15%)

✅ +22% in Brand Value vs 2022 in the top 100 global brands by Interbrand

✅ Blue Ocean Sector: online travel industry expected to grow more than 10% CAGR in the next 5 years

On top of a very nice surface picture, the company exhibits very solid Balance Sheet and Cash Flow Statement. In particular:

Debt Ratio: 0.1. Cash & Equivalents cover 10 times long-term liabilities

ROIC: 22%

Free Cash Flow Margin: 41% (!)

Total Shares Outstanding: going down more recently despite the 11% Stock-based compensation to revenues, balanced out by shares buyback.

Goodwill under control: only 3.6% of total assets

Without even looking at the current valuation, the stock chart, the outlook, and other aspects, I must admit that this is one of the most interesting profiles I came across recently.

But let’s dive a little deeper: are fundamentals confirming high quality?

Strategic Revenue Analysis

Quality is always what I am seeking also when it comes to analyzing the first pillar of business fundamentals: revenues.

Aiming for perfection - which almost never exists - a company should pass the following criteria:

Recurring revenue streams, instead of one-off sales models

Constant revenues, opposed to seasonal

Multiple revenue sources, instead of single revenue stream (one brand, one product, one country)

Need-based product, over discretionary purchases

Wide and high-spending customer base, instead of concentrated and price-sensitive

Increasing market share vs shrinking market share

Upselling or cross-selling opportunities clearly visible

Now, it’s clear that very few companies can check all the conditions above (Microsoft maybe?) and therefore we must accept some weaknesses here and there.

That being said, how’s the situation for Aibnb? Apparently, that’s where the first market’s concerns come from.

⚠️ As you can read in the table below, Aibnb revenues present discretionary seasonality, lack of recurrence, and product concentration.

In the last column to the right, I’m noting down some of the anticipated strategic moves that could eventually increase the quality of the company revenues:

One-off transactions can find recurrence pattern only if the product keeps improveing and if the company enhances business travel and long-term rentals;

Same can be said for the high seasonality;

Diversification should come into place with the expansion into new verticals such as Experiences, Icons, and potentially even Hotels (!)

The notes and the relative concerns I just outlined were written prior to the latest earnings release.

So, has Management announced any relevant update during the latest earnings call?

Promising signs…

Cutting down to the chase, CEO Brian Chesky has made it clear during the latest Q2 2024 conference call:

We're now beginning to prepare the next chapter of Airbnb. And I want Airbnb to be one of the most important companies of our generation and to do that, we're going to do more than one thing. We're going to do multiple new things. We're going to have to have multiple new products and multiple new services.

What I found particularly valuable is the outlook he provided on long-term stays, the un-seasonal, need-based, recurring stream that myself as investor I would be welcoming:

But we're ready to go beyond short term rentals. So, the new Airbnb, to answer your question Ron, will be about a lot more than short-term rentals. It's going to be about long-term stays. It's going to be our guest services, host services and many new offerings and you'll begin to see that next year.

As long-term business investor, this is what I wanted to hear, despite remaining quite blurred in terms of numbers.

Overall, I very much like what I’m seeing!

What about Earnings Power and Valuation?

To answer this question, we would need a whole separate analysis.

Nevertheless, let’s do some back-of-napkin calculations to test how attractive or not the stock is at current prices.

5-year Assumptions

📈 Top Line growth: I’m assuming a conservative 12% growth rate per year, which factors in industry growth amplified by take rate increase (+1%) and little to modest expansion into new verticals

💸 Bottom Line growth: is a 27% net profit margin possible 5 years from now?Additional analysis suggest it is. Indeed, discretionary costs such as stock-based compensation and digital marketing will likely increase at a slower pace than revenues, thus freeing up more marginality. I believe it’s fair to assume that profit margin could gain a +3% upside from the savings on both variables. Remember ABNB generates a 41% free cash flow margin today.

Shares Outstanding: I’m assuming for simplicity that they will remain the same.

➡️ If this is true:

Revenues may hit $18B in 2029

With a profit margin of 27% and an End Multiple of 20, this would mean

A Market Cap of $97B in 2029, which would represent a +90% total return from now.

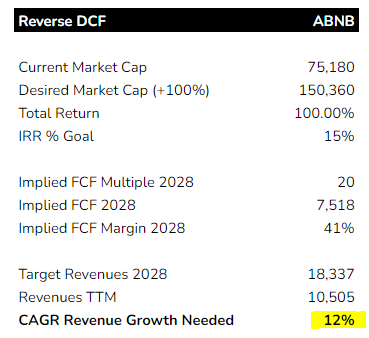

Still not convinced? Let’s use a simplified reverse DCF model.

The 100% Recipe

How much should ABNB grow in revenues to double in market valuation from now?

In essence, at a 20x FCF multiple in 2029, the company should be growing revenues 12% per year. Did we just say 12%? Interesting.

Final (random) question: should Airbnb acquire Tripadvisor?

Think about it: would it make sense?

Viator would immediately boost the Experience segment

Airbnb & Tripadvisor together could provide an unparalleled end-to-end customer experience

Tripadvisor could continue to operate through its brand, but sustained by the cash flow of the holding company in terms of product improvement and marketing efficiencies

Out of curiosity, let me know what your view:

Let’s make Business Invest grow!

📢 If you find value in my episodes, feel free to restack, like, or comment below.

For any ideas or request, feel free to reach out via DM.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest