If that’s too much volatility, I totally get it.

If you’re brand new, I know how it feels: getting used to wild portfolio fluctuations takes time.

But even if you’re experienced, market moves may hit differently when the size of your account reaches a certain level.

Good news is, there are low volatilty stocks delivering outperformance.

Curious on some examples?

Stay with me 👇🏼

Criteria & Disclaimers

I found these companies by applying this simple screening filter on Finchat:

10Yr Performance (CAGR) > 15%

Beta < 0.8

Market Cap > $1B

With a few obvious disclaimer notes:

Past results are not a proxy of future performance

Beta is a 5-year backward-looking parameter, and it might change

Volatility is measured against the US market. It becomes irrelevant if your benchmark is another index or another asset class

As usual, this is not financial advice!

This time more than ever, what matter is the approach, not the mere individual cases.

6️⃣UnitedHealth Group - UNH

Overview:

💰 Market Cap = $548B

📌 Sector = Health Care Providers and Insurance

📈 10Yr Peformance (CAGR) = 17.3%

📳 Beta = 0.62

Financial KPIs:

ROIC = 10.4%

Revenue 3Yr Growth: 11.7%

Gross Margin = 22.3%

Gross Profits 3Yr CAGR = 8.7%

Operating Margin = 8.1%

EBITDA / Interest Expenses = 9

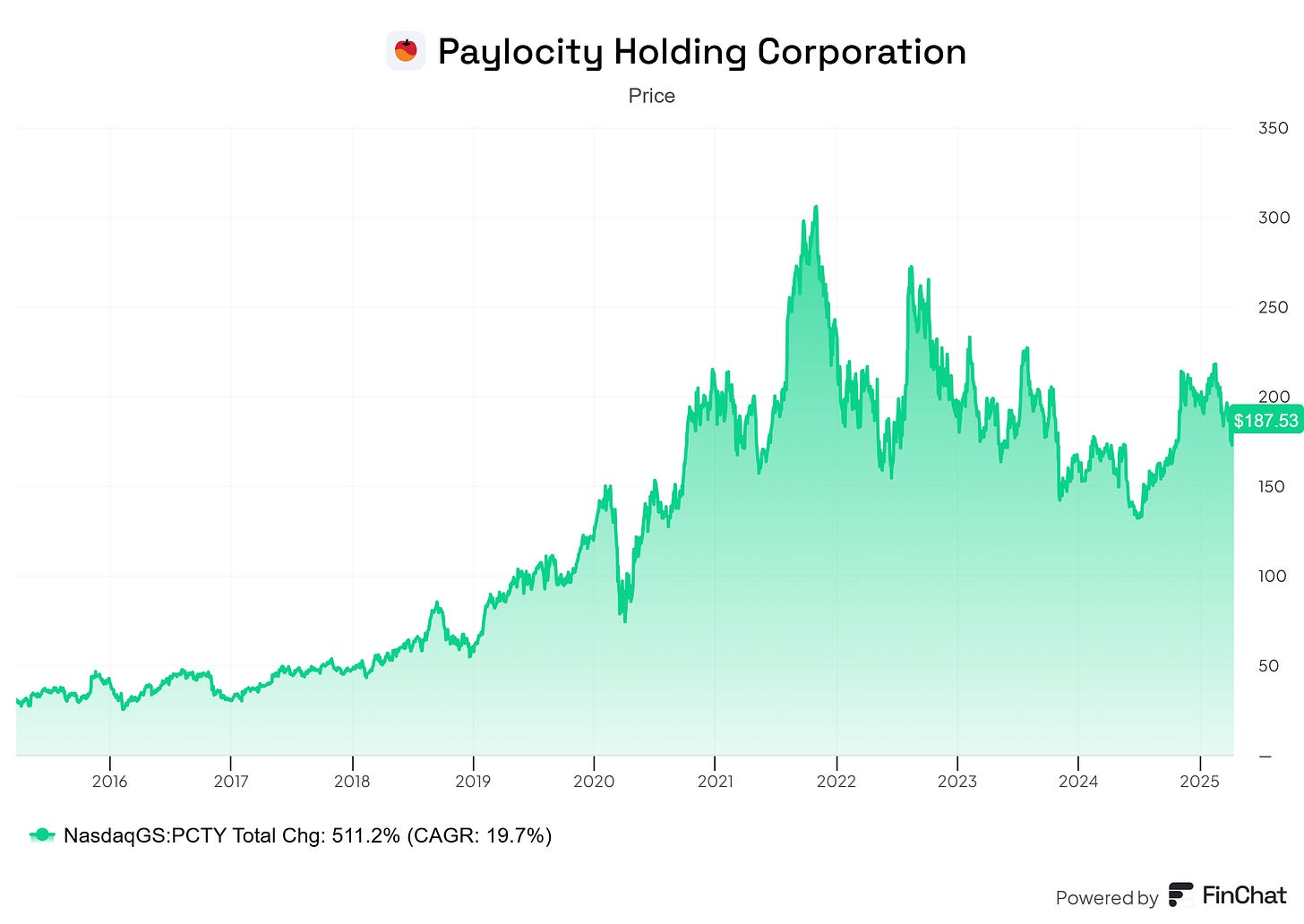

5️⃣Paylocity Holding Corporation - PCTY

Overview:

💰 Market Cap = $10.47B

📌 Sector = Software / Professional Services

📈 10Yr Peformance (CAGR) = 19.7%

📳 Beta = 0.76

Financial KPIs:

ROIC = 3.8%

Revenue 3Yr Growth: 27.0%

Gross Margin = 68.6%

Gross Profits 3Yr CAGR = 28.7%

Operating Margin = 18.4%

EBITDA / Interest Expenses = 55.2

4️⃣Boston Scientific Corporation - BSX

Overview:

💰 Market Cap = $138.54B

📌 Sector = Health Care Equipment and Supplies

📈 10Yr Peformance (CAGR) = 18.1%

📳 Beta = 0.73

Financial KPIs:

ROIC = 6.0%

Revenue 3Yr Growth: 12.1%

Gross Margin = 68.4%

Gross Profits 3Yr CAGR = 12.1%

Operating Margin = 17.9%

EBITDA / Interest Expenses = 14

3️⃣Brown & Brown - BRO

Overview:

💰 Market Cap = $34.07B

📌 Sector = Insurance

📈 10Yr Peformance (CAGR) = 22.0%

📳 Beta = 0.75

Financial KPIs:

ROIC = 7.8%

Revenue 3Yr Growth: 15.6%

Gross Margin = 48.9%

Gross Profits 3Yr CAGR = 17.7%

Operating Margin = 29.2%

EBITDA / Interest Expenses = 8.3

2️⃣Waste Management - WM

Overview:

💰 Market Cap = $92.29B

📌 Sector = Commercial Services and Supplies

📈 10Yr Peformance (CAGR) = 15.3%

📳 Beta = 0.67

Financial KPIs:

ROIC = 9.5%

Revenue 3Yr Growth: 7.2%

Gross Margin = 39.3%

Gross Profits 3Yr CAGR = 8.4%

Operating Margin = 19.5%

EBITDA / Interest Expenses = 11

1️⃣AutoZone - AZO

Overview:

💰 Market Cap = $61.22B

📌 Sector = Specialty Retail

📈 10Yr Peformance (CAGR) = 18.1%

📳 Beta = 0.54

→ in my opinion, one of the most incredible charts in the entire stock market:

Financial KPIs:

ROIC = 29.4%

Revenue 3Yr Growth: 6.2%

Gross Margin = 53.1%

Gross Profits 3Yr CAGR = 6.6%

Operating Margin = 20.1%

EBITDA / Interest Expenses = 8.9

The full list

Curious to get the full list of market-beating low volatility stocks?

Just drop me a message here below:

And I’ll share it with you straight away.

Survey for newbies!

Your opinion means everything.

To keep improving my content, I’m therefore asking your what follows:

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest