What a move by Oracle: up +39% today as I’m writing.

What’s behind this massive upside move? Is this pure euphoria or is this the prelude to a broader bullish move for the market?

Let’s dive a bit deeper into their latest earnings call.

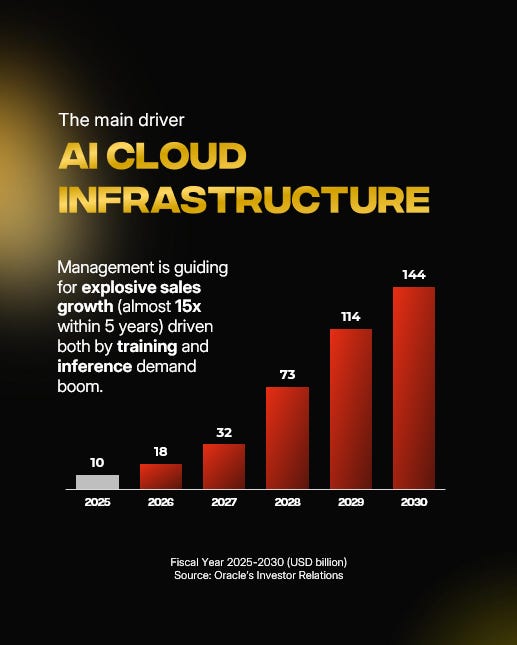

Blasting AI Cloud Infrastructure Demand

Management just announced pretty unbelieavable estimates regarding the AI Cloud Infrastructure division.

You may have already read some numbers.

Remaining performance obligations (RPO) hit $455 billion, up 359% year-over-year

Cloud infrastructure revenue grew 54% year-on-year to $3.3 billion

A scale-up projection from $18B in FY2026 to $144B in FY2030 (almost 15x from the latest fiscal year)

But what are the growth levers behind these projections?

According to what we’ve witnessed during the latest conference call, they are:

AI Training: world-class players like OpenAI, Meta, and NVIDIA are choosing Oracle to run their large-scale training models as it’s “2x cheaper”, or “2x faster”, depending on the perspective;

AI Inference: Larry Ellison called it the “tsunami approaching”: once models are trained, the deployment phase (inference) becomes an even bigger market. As more and more enterprises will implement AI-driven applications, Oracle is fighting to dominate the infrastructure backbone.

Multi-cloud expansion: Oracle has embedded its database regions inside AWS, Azure, and Google Cloud, with 71 multi-cloud data centers expected in the next year. This “co-opetition” strategy massively expands distribution.

The AI Database: by vectorizing enterprise data, Oracle lets customers connect securely with leading LLMs (ChatGPT, Gemini, Grok, Llama) without exposing private data. This is a powerful differentiator for large corporates and governments.

In short, Oracle is aggressively becoming the cost leader in a space with apparent infinite demand (to rephrase their words).

On the flip side: The Challenges

Let’s try to temper out the vibrant enthusiasm from this conference call and, as usual, come out with a balanced view.

What if this ends up being a massive overpromising + underdelivering statement?

These are the risks and challenges I could think of - that seem to be inevitably connected to the growth levers:

Concentration risk: Cloud infrastructure is the story now, while other lines are weakening (software revenue down 2%). This is called putting all the eggs in one basket!

Commoditization risk: if Oracle can truly be so much cheaper than alternatives - is the company going to be able to protect its stack and truly last over the years as the cost leader? We know one thing: Cost Leadership & Tech are two dangerous concepts to have in the same sentence.

Execution risk: Scaling this fast comes with operational risks. Is all this CAPEX truly needed? But most importantly, how much of it is pure Growth CAPEX and how much is Maintenance?

Global competition: perhaps I’m being too creative here - but what if some Chinese challengers replicate Oracle’s model, just like another DeepSeek type of black swan?

Quite a dense list of warning points here.

Valuation?

If Oracle were to truly deliver the anticipated $144B AI cloud revenue by 2030, this could be worth $1T alone.

Let me do the back-of-the-napkin math:

→ Revenues = $144B

→ Operating Margin = 30%

→ Operating Profits = $43B

→ Market Multiple = 23-24x

→ Valuation = $1T

But the key investor question: has the market already priced all this in?

ORCL 0.00%↑ is already approaching the $1T club after today’s news.

Which brings some inevitable questions:

How much are the other business lines worth? For sure not zero…

Can the incremental ROIC of these massive CAPEX match the historical one for Oracle?

Can the company command higher multiples, or will it fall back to historical ranges between 12 and 18?

For sure, the +40% move in one day seems bold.

For me to call it a screming buy from these levels, multiple volatile situation would need to manifest in my favor.

Meaning, all the expectations met (if not renewed), plusall challenges overcome.

At this point, it’s clear that I cheer for ORCL shareholders but I’ll remain on the sideline unless new crazy stuff comes out.

All in all

I’m always inclided to thinking that parabolic expectations can be as dangerous as they are exciting.

On top of that, Management’s tone during the conference call did sound a bit too confident.

To all investors out there, my only conclusion for now is to tread lightly and let the market digest the shocking move.

How’s your view? Let me know down in the comments!

How I can help you

If you want to finally level up the game - skipping the guesswork and get the exact frameworks and working tools that are allowing me to create consistent alpha in the markets ⬇️

Availabilities for 1:1 coaching reopen in October.

⬇️

Want to discover if this is for you?

Le’ts have a free discovery chat.

I’ll leave the link here:

📈

Thank you again for your valuable time.

Happy Investing!

Francesco