I’ll be concise.

Whether you’re new or experienced, you’re likely busy reading economic headlines or, better, digging into quality companies.

I canceled the review of my Q1 - planned for today - to share a few behind-the-scenes thoughts and moves amid a time of epic volatility.

Let’s skip the noise, and face this market head-on.

1️⃣ Cash is king, if it does something

Another Warren Buffett quote, to say what?

It’s simple:

Budget money you don’t need for your primary needs and wants

Save it, consistently

Always keep cash on the sideline

Invest it. Gradually, but invest it

Regarding point 3, I always keep between 5% and 25% in cash.

Meaning, if my overall portfolio(s) equals 100, I try to never keep below 5 in cash or equivalents, and never more than 25.

My plan?

Coming late March, I had reached 21%

The moment I’m writing, my cash position lands at 13%

Targeting my minimum of 5% in case we don’t see a sharp recovery

Should we get multiple legs down before the next recovery - respectively -25%, -30/35%, -40% - I’m ready with

new deposits

further self-financing (through some unwanted selling) or, ultimately

a small margin position inside my broker (very ultimately)

No rush, no urgency. Yet…

“Opportunity comes to the prepared mind”, as Charlie Munger would say.

Being financially ready for any scenario must become an advantage.

2️⃣ This time ain't different

I tend to rely heavily on the VIX as a sentiment gauge.

When it breaks above the "fear zone" (around 35ish) it often signals that the market may be overreacting.

During this recent spike, with the VIX pushing past 35 and even hitting levels above 45, I decided to take action.

Historically, investing during these extreme fear moments has led to above-average returns.

We know history is just a statistics that’s made to be broken.

But if you ask me, I believe this time will be no different.

3️⃣ Be selective, and choose the best

Whenever you don’t know where to look during market chaos, start with what’s been working for years.

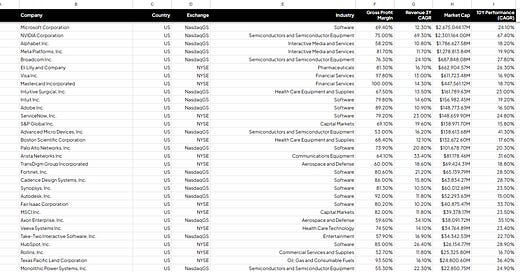

As simple as it sounds, this weekend I opened Finchat and applied a filter for:

Stock performance - 10Y CAGR > 15%

Market cap > 1B

Revenue 3Yr CAGR > 10%

Gross Margin > 50%

Country: US

A solid starting point of more than 50 companies who’ve been outperforming the broad market for at least 10 years now.

Second, find some specific niches of interest.

How? Start by filtering for companies that:

You understand (or could understand with some effort)

Are missing from your portfolio

You’re genuinely curious to explore

For me, right now, two areas stand out among the rest:

Semiconductors supply chain: I’m monitoring Synopsys, Cadence, ASML, and LAM Research.

Healthcare / Healthtech: Veeva Systems and Intuitive Surgical are both on my watchlist.

Third, take your time. Once you’ve narrowed down your focus, dive in:

Why has this company outperformed?

Does it show signs of quality?

How does it make money, and what does its 3 to 5 year trajectory look like?

Stay curious, zoom out, and explore with intention.

➡️ 4 moves, with confidence

Long story short, this is exactly what I did over the past few trading days.

Check of my cash position, budget, and planning

Reassessment of a few selected investing ideas - by going through the various steps of my investing process, built for maximum productivity and efficiency

Actions:

Sized-up 2 positions to adjust their desired weight in the portfolio

Entered 2 new positions on their validated investment theses

It’s been the most active week since 2022.

Honestly, I’m glad it happened. For now, I could only welcome this correction.

➡️ A few more thoughts

I’m leaving you today with some last spare ideas.

Beta

If lowering my blended Beta has been my obsession for almost a year, now it’s already time to reconsider about this.

Indeed, on paper the market has already entered bear market territory, and reducing expected volatility would mean counter-productive effects should the market recover quickly.

In short, at this point I don’t mind keeping my beta where it is (1.88).

Healthy Balance Sheet

The Balance Sheet becomes more important than ever in these situations.

Prioritize companies with:

Higher cash on hand than long-term debt (negative NFP)

Current Ratios above 2

High Insider Ownership

Diversified shareholder basis

Low Goodwill

Operating Cash Flow per Share

Finally, never lose sight of what I consider perhaps the most important metric.

Because, in the end, that’s what stocks ultimately catch up to.

Looking for a safe shortcut?

If you’re thinking:

“I’d love to invest in quality companies and become profitable without massive time waste and unnecessary risks”

Then, my mentorship may be of your interest.

I’m indeed on a mission to help busy professionals who:

don’t work in the finance industry

would love to invest to retire a little bit earlier

are open-minded and curious

As a former Corporate Finance Manager, I perfectly know how discouraging can be to approach Equity Markets without a clear, back-tested strategy.

From this perspective, you can see the program as:

your insurance against mistakes

a sharp acceleration that will immediately bring you where I am today (of course with lots of learning ahead)

If that’s relatable, just send me a message and I’ll add you to the waitlist.

If you’re ready to speak with me about it, just book a call down below:

➡️ Book a discovery call

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest

Hello there,

I hope this communique finds you in a moment of stillness. Have huge respect for your work.

We’ve just opened the first door of something we’ve been quietly crafting for years—

A work not meant for markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, patience, and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral. But it’s built to last.

And if it speaks to something you’ve always known but rarely seen expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to open it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.