In investing, we would “rather be vaguely right than precisely wrong” (British economist John Maynard Keynes).

And do you know what a common way to be precisely wrong actually is?

Looking at GAAP earnings only, and always.

In fact, many times accounting profits don’t tell the true story.

They don’t reflect the true economic value of a company.

And by the way, it’s not me saying this.

It’s Warren Buffett, who - in his 1986 Berkshire Hathaway Shareholder Letter - presented a more truthful representation of a business’ true earnings power.

The Owner’s Earnings model.

In today’s episode, we’ll discover its power with a few examples.

→ Plus, a quick heads-up if you stay until the end!

How Buffett was valuing companies in 1986

In my modest opinion, going beyond mere accounting metrics was also what made Buffett the legend he is.

This is what he was mentioning back then:

Which I’ll summarize briefly.

A company’s true earnings power is not equal to the pure GAAP profits or loss.

We should indeed correct the latter by:

Adding back the non-monetary effect of depreciations and amortizations

Adding back other non-cash charges - such as the amortization of goodwill, stock-based compensation costs, impairments of various nature

Subtracting the portion of Capital Expenditures that is only utilized to maintain the current status-quo of the operations (=maintainance), and

Correct for substantial change in Working Capital, if needed.

And so, in the end, the true economic power of a business is much closer to the Cash Flow from Operations than any other metric.

Note: it’s not even Free Cash Flow what Buffett is looking at.

In fact, we are NOT subtracting Growth CapEx from real economic power - meaning the portion of capital expenditures allocated to new investments and growth opportunities.

Read it this way.

The Owner’s Earnings Formula tells you how much value is actually unleashed for shareholders, in cash, and net of creative accounting metrics.

Next, Iet me bring you an example that is really representative of this whole idea.

3 Cybersecurity champions you’d always miss with GAAP

This example will take the concept to the extreme, but I believe that’s useful as it made me decent money and I think it will continue to do so.

Many cybersecurity stocks have the following elements in common:

Negative Operating Margin (GAAP)

Negative EPS (GAAP)

Strongly positive Cash from Operations and Free Cash Flow (Non-GAAP)

High non-cash charges (Stock-based compensation, primarily)

Therefore, you will never spot them with these classic filters:

P/E or Forward P/E → on a GAAP basis, they produce losses;

EBITDA/Net Interest → They don’t have positive EBITDA

Return on Invested Capital → Their NOPAT (Net Operating Profits After Taxes) is also negative

Instead, you should uncover their true economic power by digging a little bit deeper and appreciate their cash flows.

Here’s how (full year 2024 data):

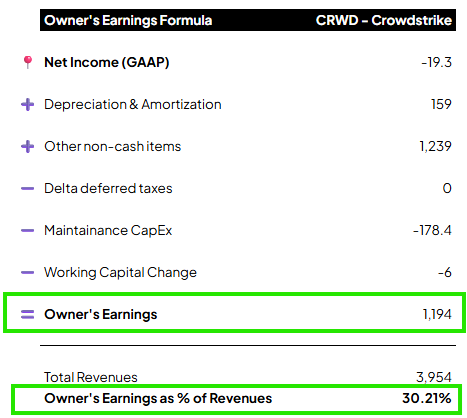

1️⃣ Crowdstrike - CRWD

As you can see, I’ve applied the workarounds mentioned by Buffett to find the true Owner’s Earnings:

So, starting from a GAAP loss of USD -19.3 millions, it turns out the actual earnings power might be around 30%.

Not too bad.

We just simply need to add back everything that we’ve mentioned and divide the new number by revenues.

A 30% earnings power company that’s been growing at an incredible clip over the past several years.

Are you now that surprised of Crowdstrike being a market-obliterating investment (40.4% CAGR) over the past 5 years?

I’m not.

2️⃣ Cloudflare - NET

Second company, Cloudflare.

Another monster 41.5% CAGR stock over the past 5 years.

But how is this possible, with a negative EBITDA?

Once again, the market is not crazy.

Here’s their actual true economic power:

This time the earnings power is not astronomically high, but let’s also remember how much these companies are investing in intangibles (R&D, mainly).

All these forward-looking costs do hold down the cash from operations and do not count as growth CapEx.

And regardless, we have a company growing revenues 35% per year, easily approaching 15% earnings power.

Now to the final one.

2️⃣ Zscaler - ZS

Finally, a stock I currently own.

I wouldn’t have purchased it without a clear leading runway for profitability:

Once again, a case of negative GAAP with a 30% earnings power.

Sure, Stock-Based Compensation costs may dilute shareholders in the future.

But I love how this biases down earnings and keeps many investors away for a long time.

In fact, Non-GAAP can sometimes become a leading indicator of GAAP, if Management keeps executing.

Quick alternative: Cash From Operations

You don’t want to spend your precious time by reconciliating GAAP to Non-GAAP?

I get that.

But here’s the good news: the Owner’s Earnings are very similar to a metric I love.

Cash From Operations.

I consider it the most important metric of all, because it tells you:

If the company is financially independent already by relying on its regular business operations

How much room there is for acquisitions, growth investments, buybacks, dividends, or debt repayment

If the company is efficient and ready for scale

Let me prove this by completing the previous examples.

As you can see, the Owner’s Earnings and the Operating Cash Flows are pretty similar - you just need to subtract maintainance CapEx to it as well:

How to read these 3 last tables?

Look at the Owner’s Earnings (first line), and look at OCF minus maintainance CapEx. It’s almost the same.

Beyond Numbers

Can we conclude that GAAP is overrated, while Non-GAAP underrated?

Sometimes, yes.

As investors however, we should always move beyond numbers.

Behind them, there’s always a story you don’t see immediately.

And it’s our job to read between the lines.

Also, let me clarify something important.

I’m not saying GAAP earnigns are always useless.

And I’m perfectly aware of how certain non-cash charges may not favor the position of current shareholders.

However, what I stressed in this article remains valid in my opinion.

If you’re screening stocks by Price to Earnings or economic ROIC, you may be missing something.

And you may end up being late.

Accounting for Investing Masterclass - [Early Access]

Here’s the quick announcement!

I am preparing a self-paced Masterclass to help aspiring investors remove the bottleneck of Financial Statements and start investing with higher confidence.

Over the past 3 years as Finance Creator and Coach, I’ve noticed how many enthusiast or new investors find Accounting intimidating, to the extent that they:

Postpone their first leap

Make valuation-related mistakes

Give up due to a lack of financial knowledge

When I went all-in equities back in late Q3 2020, I had the accidental advantage of having worked as Financial Consultant for large corporations.

Analyzing Income Statements was my daily job. And it all luckily came help me for my investing career.

Find out more about the syllabus and the topics covered:

➡️ Have a look here - early access officially open!

If you notify your interest today, you'll get access to it at a ridiculously unfair value.

All details inside the early sign-up form.

📈

I’ll see you inside the masterclass.

Meanwhile, thank you again for your valuable time.

Happy Investing!

Francesco