It’s even part of the word ‘share-holder’.

As such, we don’t simply buy and forget. We buy and monitor our thesis.

This is what I am going to do in today’s episode. In particular, I’ll walk you through:

What 3 names I am holding

Why I remain a happy (share)holder

What their current Risk-Reward profiles look like, after earnings

Without further ado, let’s dive in.

1. Spotify

Thank you, SPOT.

And no, not because of the returns, but because of the emotional rollercoaster this stock forced me to experience which, without any doubt, has made me a better investor.

This stock allowed me to tested on the ground every possible feeling and emotion:

Despite being hit by urgency and overconfidence in being part of a company I understood and admired, I was somehow able to wait and avoid my first entry throughout 2020 and almost all 2021, amid the broad-market valuation reset;

I saw the stock plummeting from my first entry point of $230 to $67, a crash that triggered underconfidence, impatience, defeat, and other negative feelings.

With the back of my business case and conviction, I was still able to average down my purchase price - up to $102 - with multiple entries;

I observed the quick recovery above my average purchase price and up to my initial price point; I thereafter felt so many times the temptation to sell and capture my profits;

I actually did it, in part, a year ago (long-time readers may remember) to rotate some money to another opportunity. With the benefit of hindisght, this has been my only yet impactful mistake so far with this investment.

Now sitting on a +518% return in 3.5 years, is it time to take some more profits off the table?

Let me try to answer briefly by mentioning why I invested in the first place - long story short. My thesis was built around some key pillars:

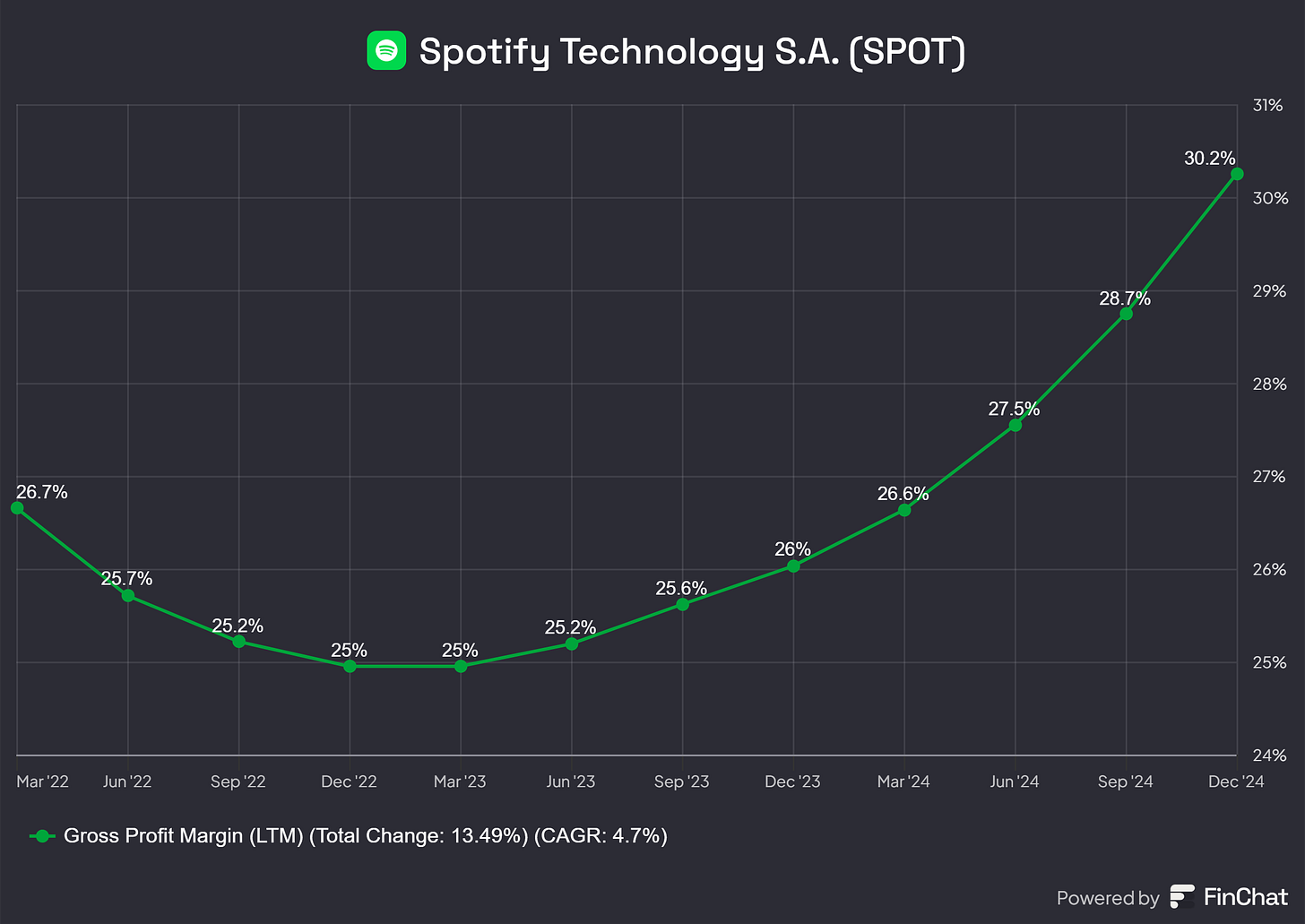

Gross Margin Expansion: driven and inspired by a long-term guidance from the Founder & CEO between 35% and 40%

Revenue mix improvement with the ramp-up of audiobooks and podcasts

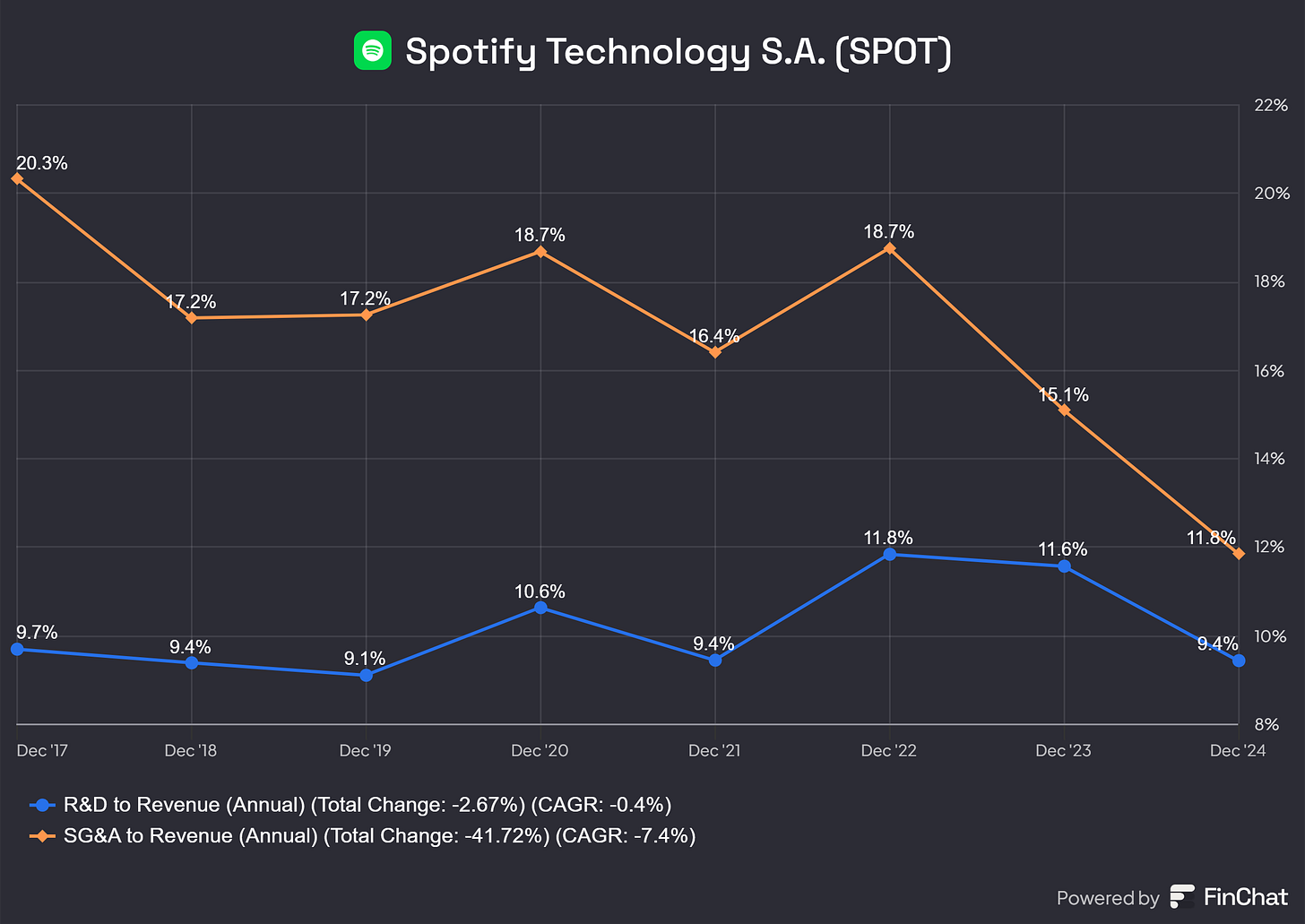

Free Cash Flow and Operating Margin expansion, as a result of a mix of positive factors, above all the incidence of SG&A on total revenues.

Monitoring the pattern alongside these KPIs, the thesis has been playing out pretty well:

Gross Margin (%) is on a stable uptrend:

Incidence of SG&A on Revenues (that includes marketing and Stock-Based Compensation) on a a clear downtrend - unleashing the power of operating leverage;

The company is relentlessly investing in new product innovations (see R&D to Revenue incidence in blue), no different than 8 years ago.

If we combine these positive trends with a incredibly resilient user-growth and sticky customer base, this seems a hard one to get rid of.

However, from a risk-reward perspective, I must honestly reckon how the market may have priced in many years of future growth with the most recent rally.

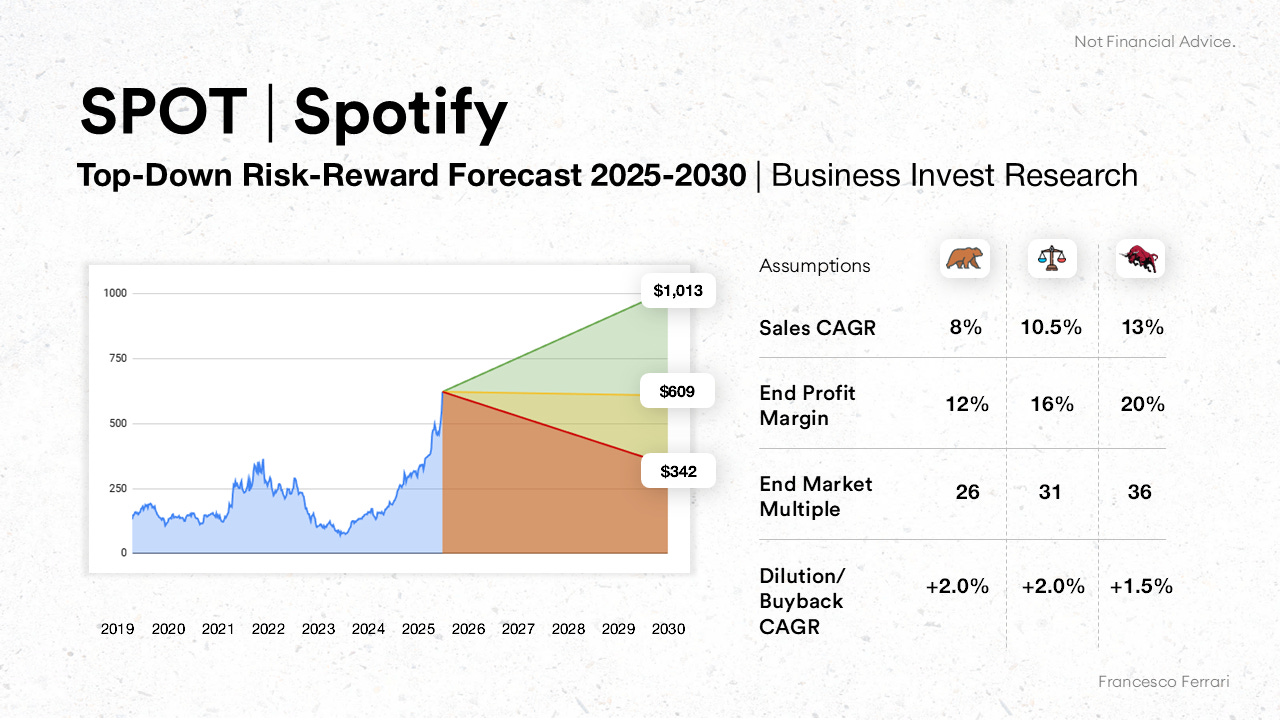

My updated risk-reward picture is the following:

➡️ The new overall Risk-Reward seems not so favorable anymore.

Stretching a bull-scenario with optimized profit margins and sustained revenue growth rate, I can still project a +59% from there. In parallel though, a -47% is far from being impossible, should the business slow down temporarily for any reason and market sentiment shift again.

If I were forced to choose a ‘sell’ among the 3, SPOT would probably be the one.

2. Airbnb

I’m owner of ABNB since Q3 of 2024 (I mentioned my move in this previous article).

I made one move only back then, with no multiple entries and no selling ever since.

The company represents a classic sleep-well quality business to me:

✅ The Founder Brian Chesky is still CEO

✅ Insiders own 33.6% of shares

✅ Customer appreciation: Net Promoter Score 74 (>50)

✅ More than 20 acquisition deals succesfully done, with space for more ‘strategic acquisitions where relevant’

✅ Innovation Spirit: R&D spending at 17.56% of revenues (>15%)

✅ +22% in Brand Value vs 2022 in the top 100 global brands by Interbrand

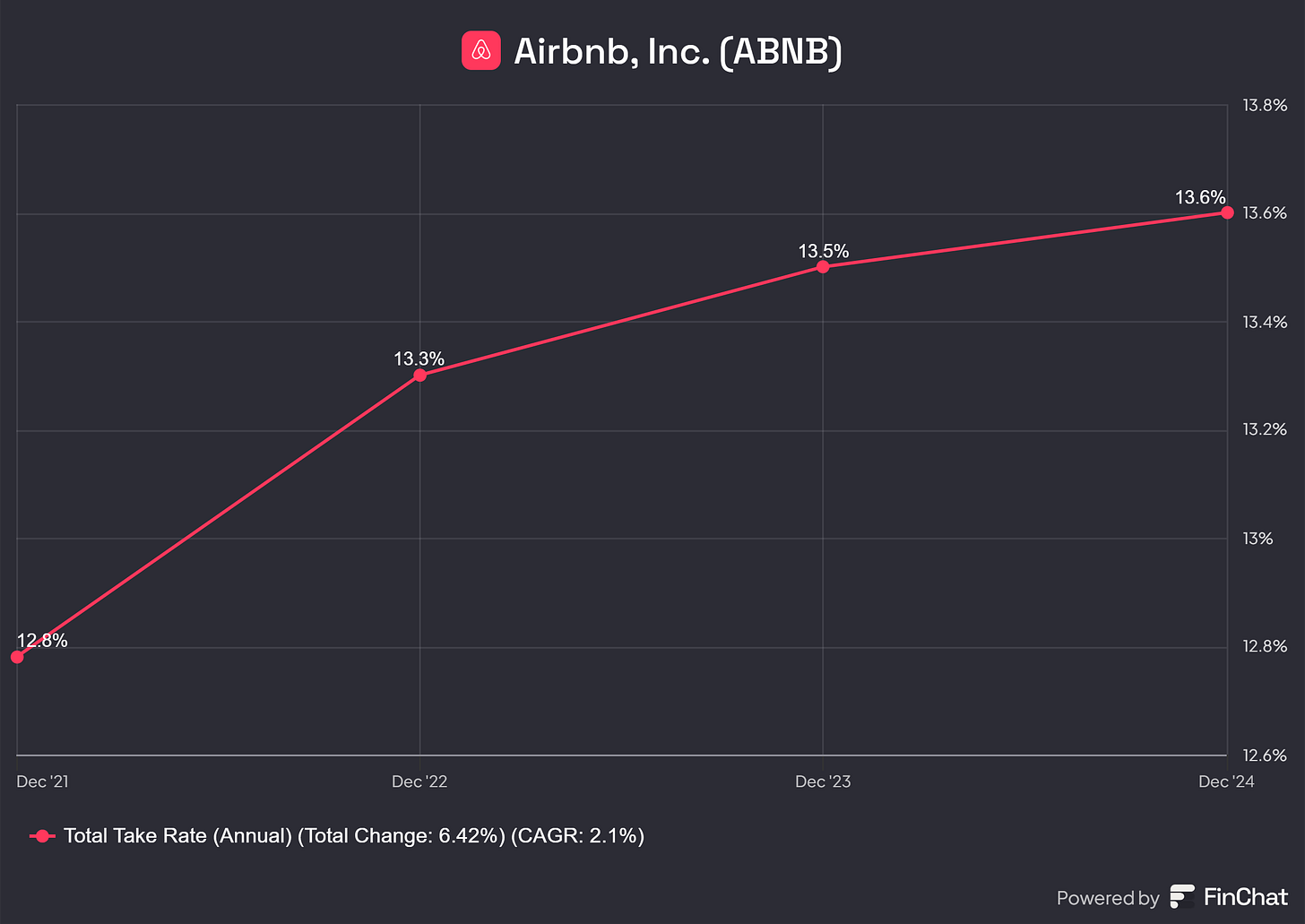

Over the past few years, the most critical Business KPIs have been moving to the right direction.

Take Rate: on a constant uptrend and still below the main competitor Booking.com (with peaks at 25%)

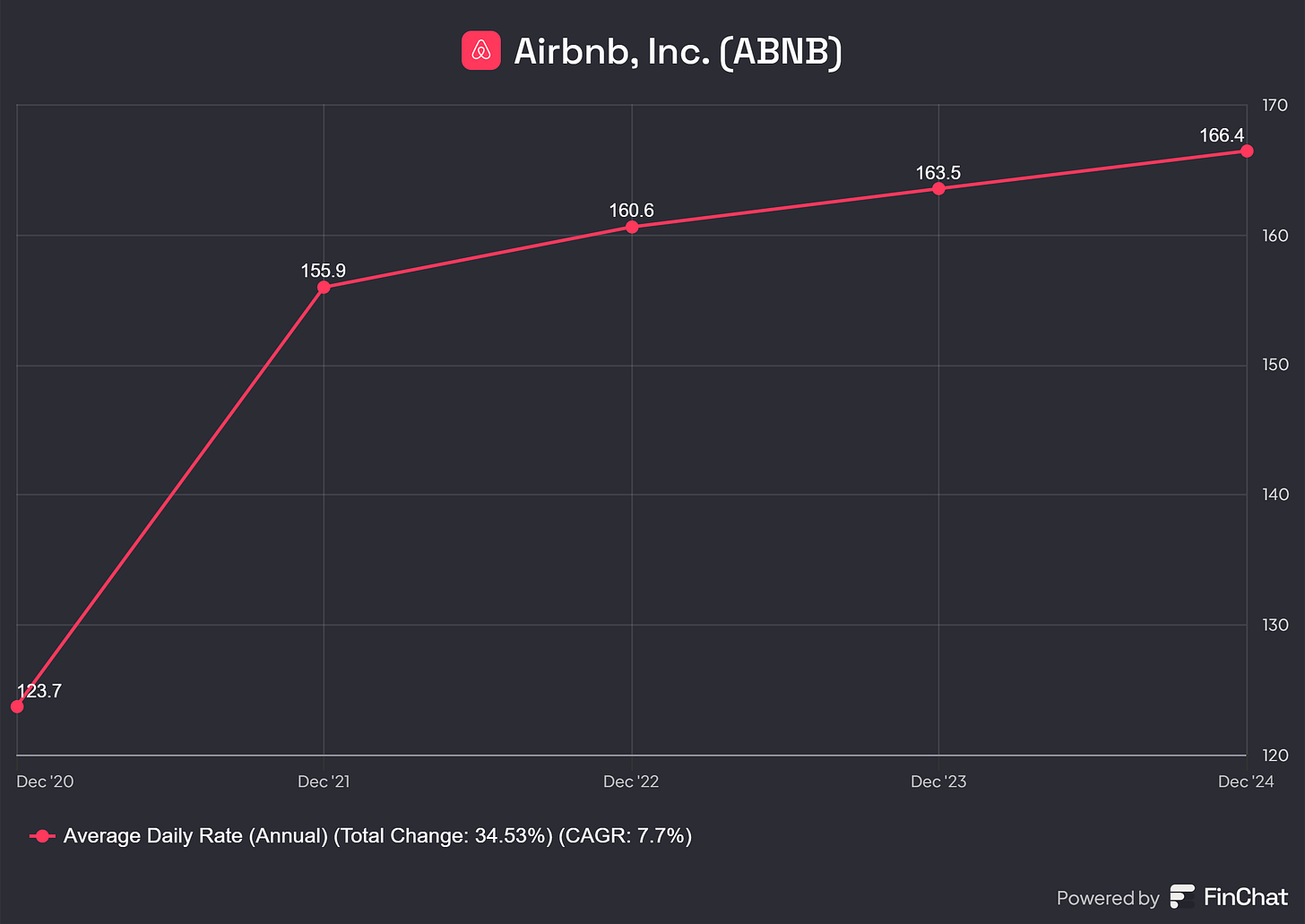

Average daily spending: also on a positive uptrend, signalling both Airbnb’s pricing power, and new upselling opportunities.

Above all, what I still find most intriguing is the leeway for a ‘new era’ for the company, as depicted many times by Brian Chesky during the most recent earnings calls.

He is guiding for new product innovations coming soon as part of a new era for the company:

You know, over the past several years, we've been preparing for Airbnb, Inc.'s next chapter and we wanted to make sure that guests and hosts love our core service before we introduce something new.

B. Chesky - Q4 2024 Earnings Call

During the same call, it was mentioned how:

This year, we plan to invest $200 million to $250 million towards launching and scaling new businesses, which we'll introduce in May. Even with these investments, we expect to maintain strong profitability, delivering a full-year adjusted EBITDA margin of at least 34.5%. Because these investments will roll out throughout the year, their impact on our quarterly adjusted EBITDA margin will be the most pronounced in the first nine months of 2025. As these new businesses scale over the coming years, we expect them to make a significant contribution to revenue growth.

Ellie Mertz - Airbnb’s CFO

I personally love to see patterns for profitable growth.

While this is not quantifiable yet, these statements keeps market sentiment high without assuming the shape of hype. Having a visionary Founder onboard seems to me like an insurance agains overly vague promises and the considition for concrete long-term oriented actions.

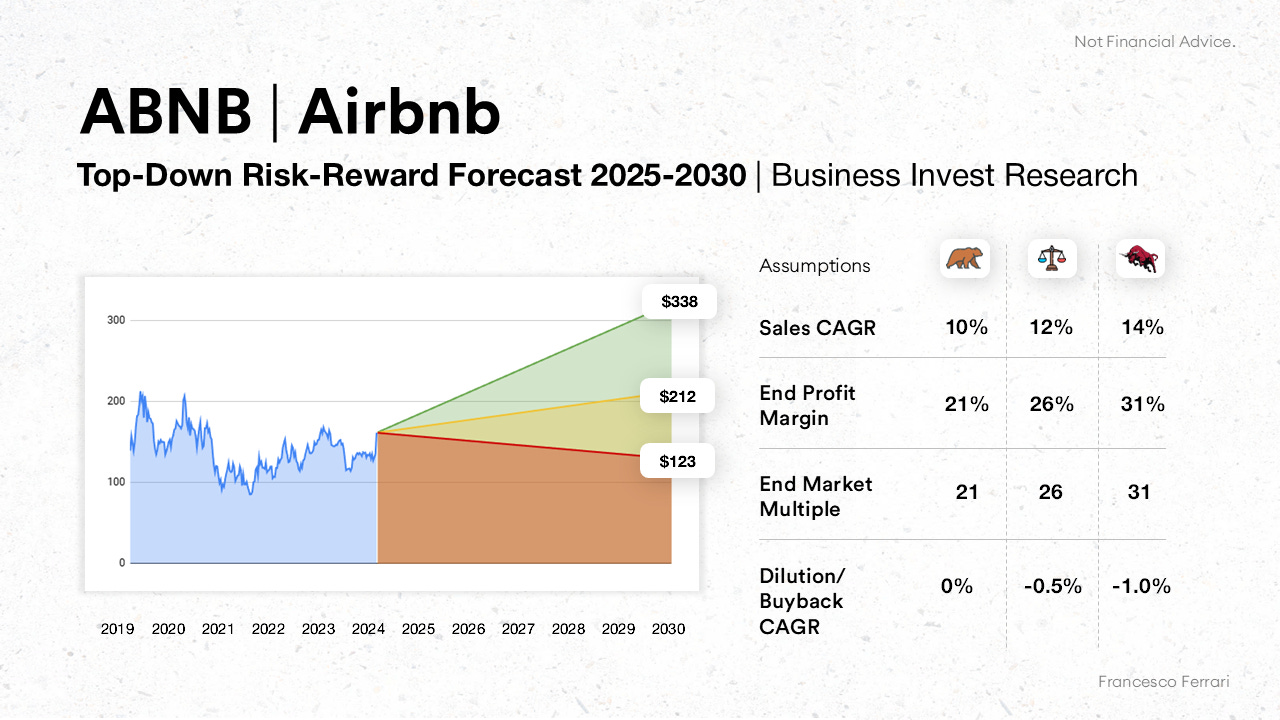

But what about ABNB’s risk-reward?

➡️ Overall Risk-Reward seems still quite favorable.

It will be essential to see how much the new initiatives can bring in terms of revenue reacceleration. A -20% vs 110% Risk Reward seems a solid starting point, knowing everything can happen price-wise in between.

3. Shopify

Finally, we’ve got some SHOP.

Cutting down to the chase for this one, I don’t think this company needs any introduction.

As simple as it sounds, I took advantage in April of last year of what seemed a temporary discount.

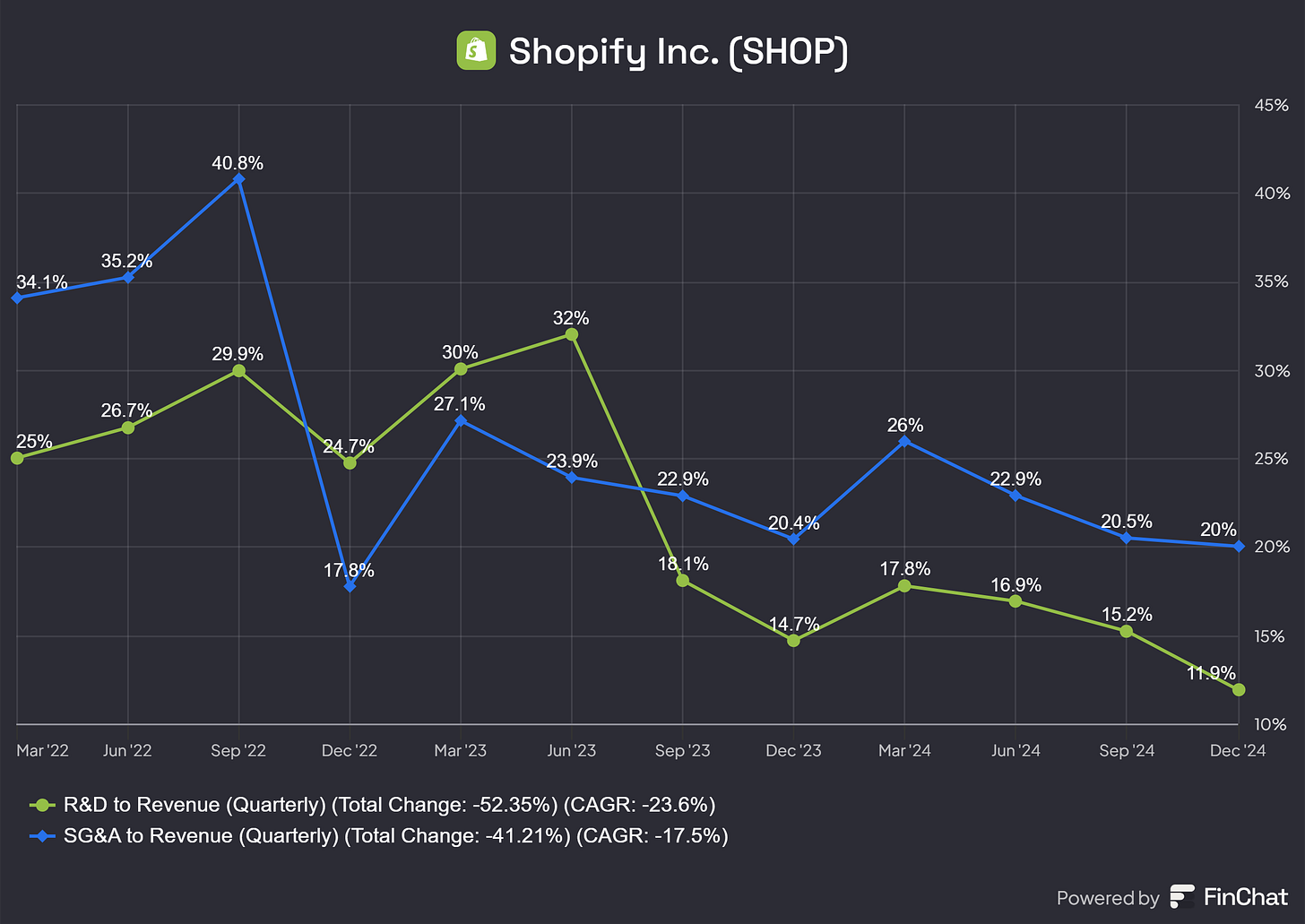

Two critical KPIs also anticipate a multi-year positive pattern for the company:

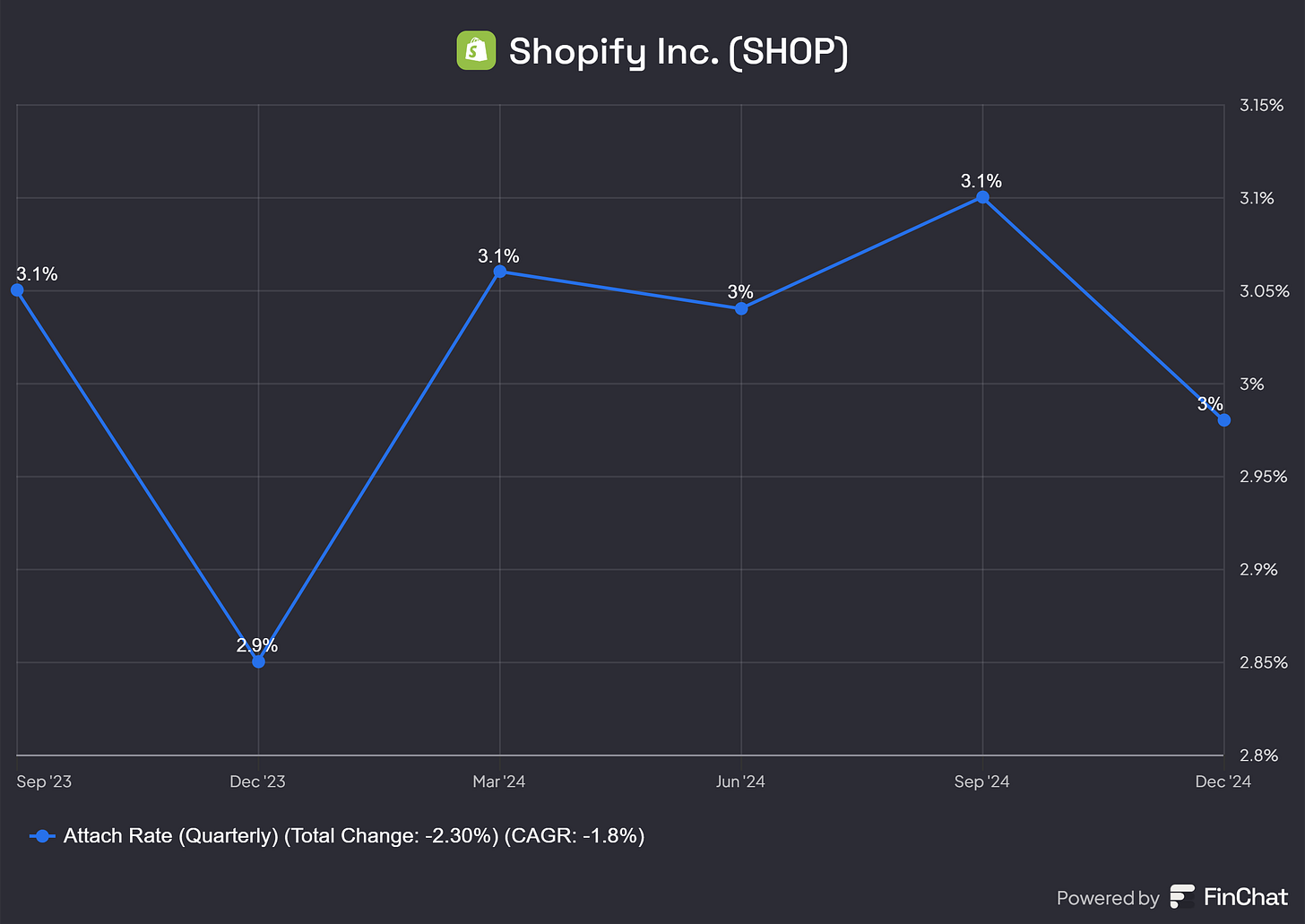

Attach Rate: hovering around 3% and apparently with more room for improvement for the next quarters.

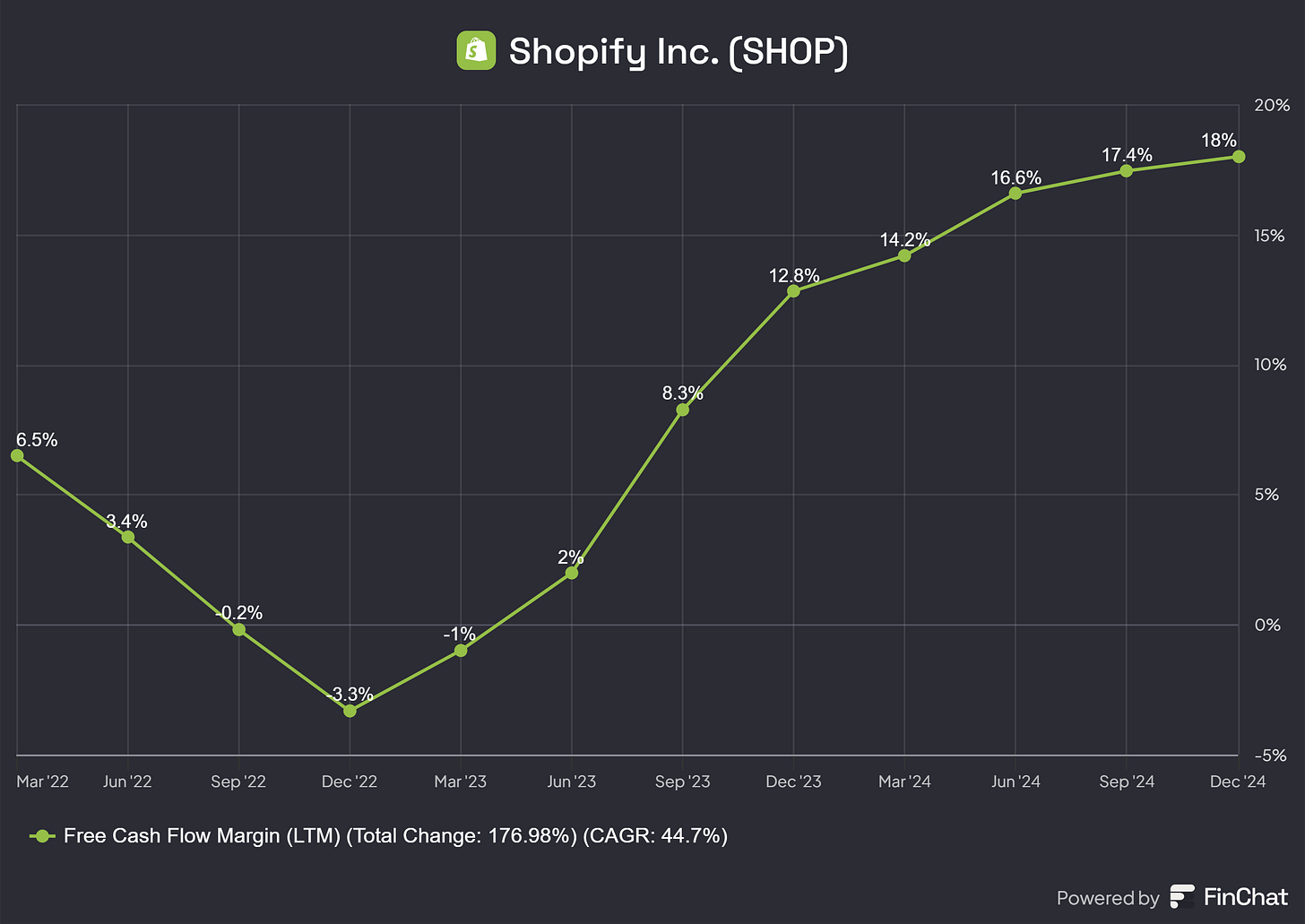

Free Cash Flow Margin on a stable uptrend after the dismissal of the logistics business at the end of 2022.

Operating Leverage confirmed with constantly decreasing incidence of R&D and SG&A to Revenue metrics.

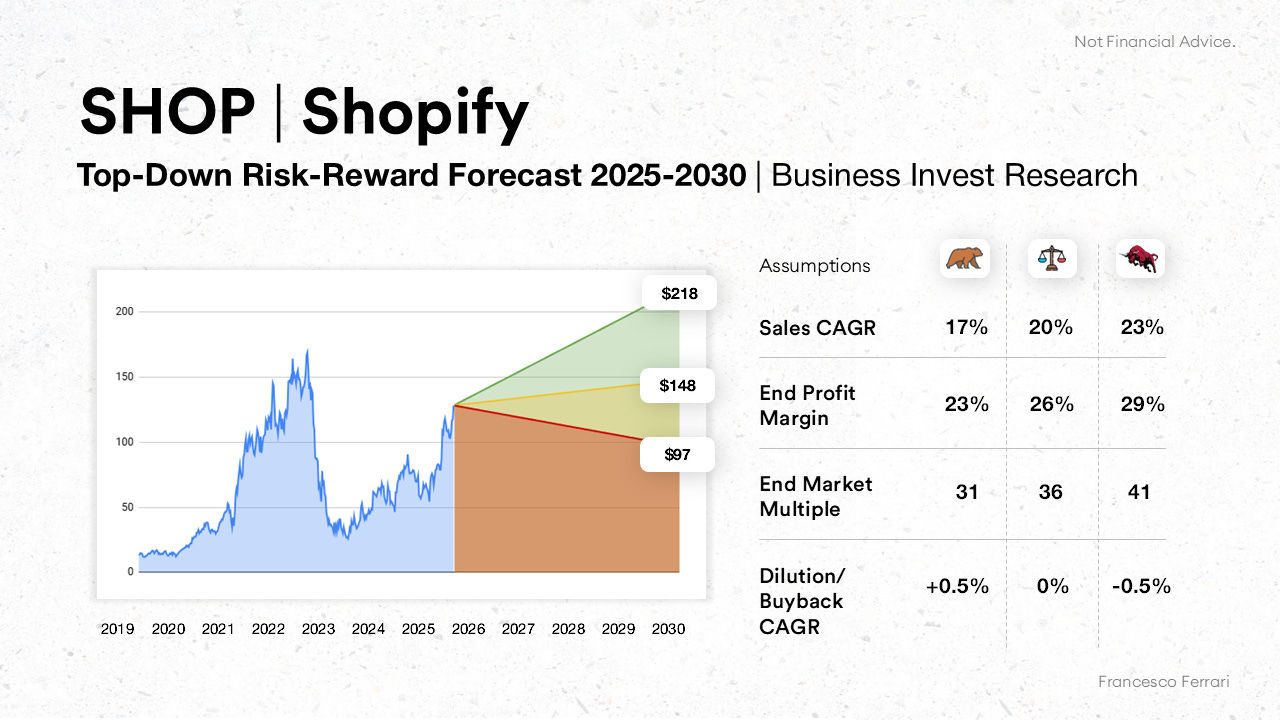

And, in terms of Risk-Reward?

➡️ The overall Risk-Reward does not scream for a buy, but it still remains promising after an incredible 2-year rally.

I’ll keep monitoring the attach rate and the operating leverage ramp-up, to see if and how this can result into significant profit margin expansions.

The sponsor of this episode is… me.

If I was able to 3x my investable savings in less than 5 years, it’s because I’ve made every possible mistake.

Many times at the beginning, I was hit by the temptation to sell my shares, go back to ETFs and call it a day.

But at the end, I was too curious to lift up the covers and see what was inside those ETFs: I knew that some companies were indeed better than others.

So I turned my mistakes into an actionable process:

As a former full-time professional, I’m now on a mission to help other non-investing aspiring investors do the same, but with much more speed and ease.

➡️Book a chat here

If that sounds relatable: we’ll see if my coaching program is a good fit for you!

Or directly message me here:

That’s it for today.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest

Thanks Francesco! Didn't know Airbnb pursued strategic acquisitions, that's interesting to know. Still looks like it could have some upside today, appreciate it!