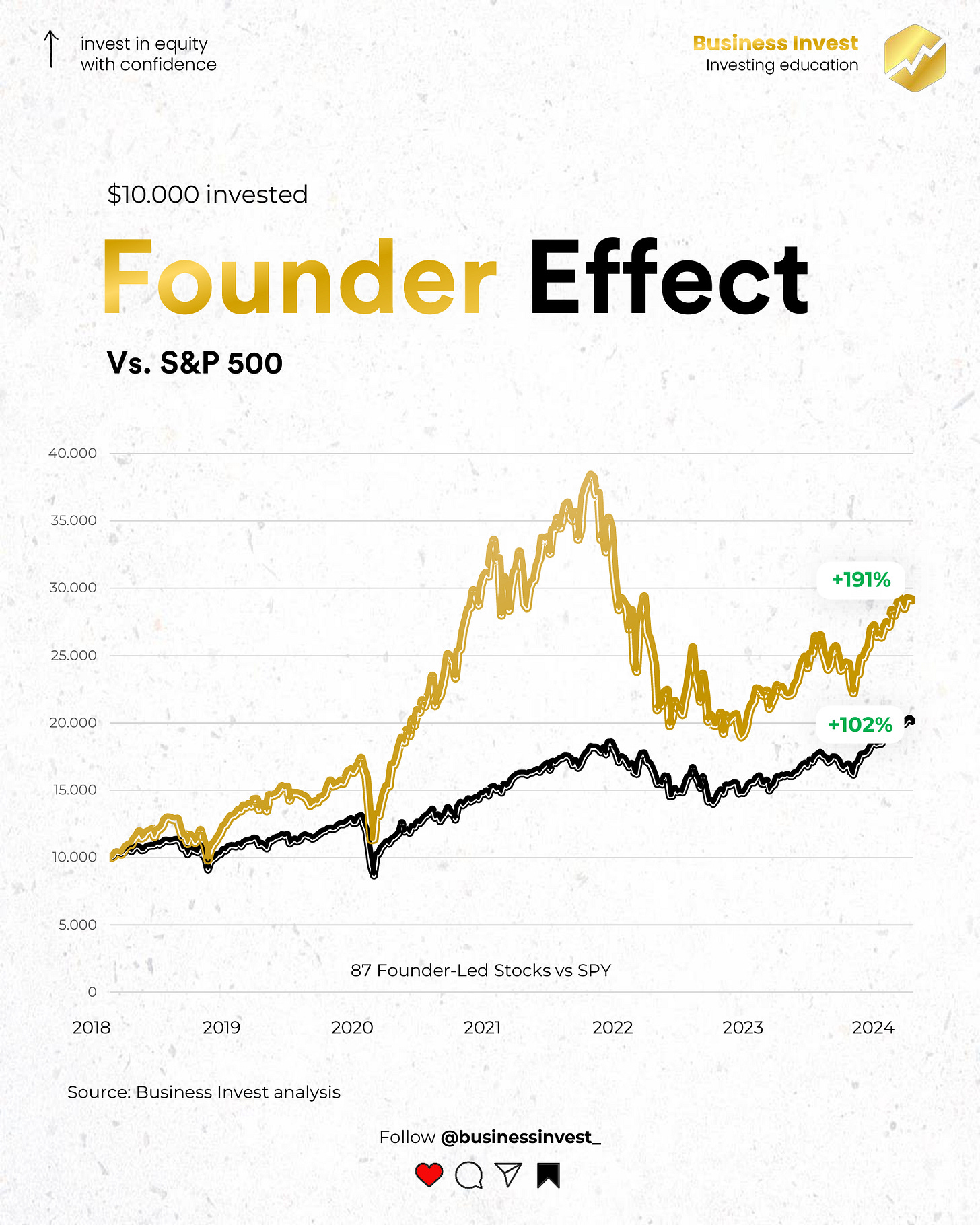

Founder-led Stocks vs S&P 500

Simulating a 6-year $10.000 investment

Can you beat the market by investing in founder-led stocks?

My recent study shows interesting data points.

But wait a second: why does this matter and why should we consider these companies?

The Founder Effect

As I was writing in a previous article, Founder still CEO is one of the leading indicators I love to see. The reasons are straightforward:

Founders tend to be more aggressive on innovation and infrastructure spending. They are not scared to sacrifice short-term profits to achive long-term competitive advantage.

Founders tend to have a clearer and more ambitious vision of the company; they can see far beyond what Mr. Market himself can project, thus creating opportunities for patient long term investors.

Founder-led companies more than double their peers on sales growth (Schroeders, 2016).

My Research in brief

So here’s how I built this quick study:

I took 87 founder-led stocks and their price performance since beginning of Q2-2018. I had to exclude some names (ABNB, PLTR, CRWD, DDOG, for instance) due to IPO being more recent than that date.

I simulated equal initial weight for each of them (1.15%). The fallacy here is that it would have been impossible to build a portfolio with this exact weights unless we used fractional shares for each stock.

I simulated the performance of the combined stocks vs SPY since 08/04/2024.

Broker commisions are not considered here.

Let’s have a visual look at the results!

In essence:

Founder-led stocks beat the index by a mile. We’re talking of an amazing 19.5% CAGR vs 12.4% of the S&P 500 and a total return of +191% vs 102%!

However, please note the following:

This portfolio would have suffered a much more significant drawdown in 2022

It would still be far from its all-time highs

What would be the top names of this portfolio?

TTD: 7.1% weight

NVDA: 6.2% weight

TSLA: 4.1% weight

MDB: 3.2% weight

AXON: 3.1% weight

SNPS: 2.8% weight

ZS: 2.7% weight

FTNT: 2.6% weight

DELL: 2.5% weight

HUBS: 2.5% weight

The largest 10 positions would account for 36.8% of the overall portfolio.

Interesting, right?

What can you take from the study?

This study is just an educational illustration of how founder-led stocks might be interesting to consider for your equity investment portfolio.

As always, statistics are there to be broken and the past is never a safe projection of the future.

That being said, the objective of the study was for me to back up with some data the idea of how qualitative factors matters a lot for equity investors.

This data helped me confirm my belief that having the founder still on board is one of the most important leading signals of a successful business… and a successful stock.

I will keep this research updated in the next quarters.

Should you have questions or if you’d like to see more data, feel free to DM me or send me an email at businessinvestbi@gmail.com

That’s it for today! As usual, thank you so much for your valuable time.

Happy Investing,

Francesco - Business Invest

Damn, how’d you come up with the list? So cooo