Buffett finally unveiled the mistery.

Berkshire Hathaway’s new position is Chubb Limited, a Zurich-based global insurance company.

In today’s focus, we will briefly introduce the business model and analyze the company using my leading indicators and financial health checklists.

In addition, I will show how the stock risk reward profile looks like in 5 years from now by using my anticipated valution check-up tool.

Let’s go!

The business in brief

Chubb Limited, based in Zurich, Switzerland, is a global leader in insurance and reinsurance. It offers property and casualty insurance, accident and health insurance, reinsurance, and life insurance.

Product Lines

The company operates through several segments: Commercial P&C, Personal P&C, Accident and Health, Life Insurance, Agriculture, Wholesale, Reinsurance. Here’s a snapshot of a well diversified product breadth:

Geographies

Chubb operates in 54 countries and territories. I found particularly interesting how the company was able to diversify its US exposure with solid international expansion.

In particular, the US share of revenues went from 63% back in 2021 to 52% in 2024 so far.

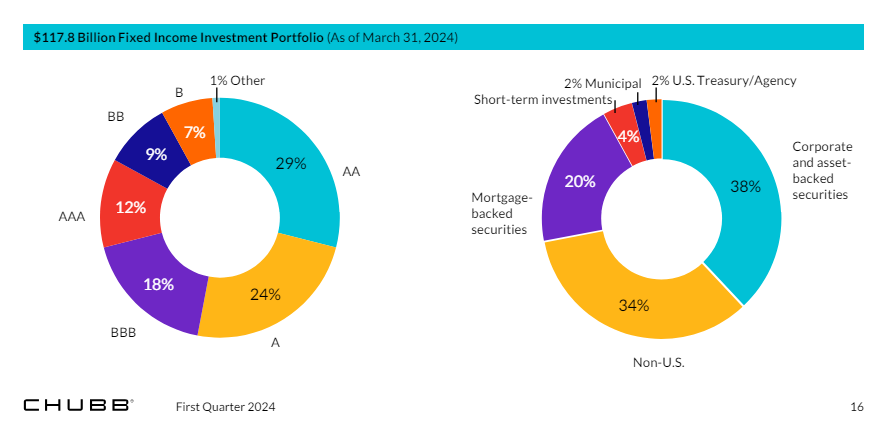

Investment Portfolio

For an insurance business, it’s crucial to analyze how proceeds are invested.

Quoting the recent investor presentation, “84% of Chubb’s investment portfolio is in fixed income securities, with an average credit quality of A (S&P) and A (Moody’s) and a duration of nearly five years. The portfolio’s asset allocation is well diversified across issuers, geographies and sectors.”

Below you can see how the company invests mainly in risk-free, diversified, fixed income:

Cherry on top: M&A

Chubb has grown through strategic acquisitions, most notably the merger with The Chubb Corporation by ACE Limited in 2016, which led to its rebranding as Chubb Limited.

Diversification both into new business segments and markets was possible also thanks to the ability of the firm to conduct successful acquisitions.

Quality Checklist

Leading Indicators

In previous articles, I introduced a checklist I use to filter stocks based on what I define “leading signals” of potential future business success.

For Chubb, here’s how it looks like:

Founder still CEO: ❌ Yet Evan G. Greenberg has been serving as CEO for more than 20 years now.

Owner-operated Company (Insider Ownership > 20%) ❌ 0.60%

Net Promoter Score > 50 ❌ according to Comparably.com, NPS lands at 43, not that far.

Proven track record of winning M&A deals ✅

Innovator: R&D spending > 15% of Revenues ❌ data not available

Brand: growing global brand value ranking(s) ❌ data not available

Blue Ocean Sectors: growing industries, with multiple winners ✅ Insurance

Financial Health Summary

3Yr Revenue Growth (% CAGR) > 20% ❌ 10.5%, in re-acceleration in light of a 9.6% 5-year trend

Gross Margin (% of Sales) > 50% ❌ 28.2%

Return on Invested Capital (%) > 15% ❌ 4.8%

Shares Outstanding (% change y/y) negative ✅ reduction of >10% of outstanding shares in the past 5 years

Free Cash Flow margin (% of Sales) > 15% ✅ 26.3%

Conclusion

Chubb looks like a solid, well-managed insurance business, a typical Munger-Buffett stock operating successfully in the financial sector.

This is clearly not my usual business profile.

However, I must clarify how it’s not mandatory for me to necessarily witness all green in the aforementioned checklists (otherwise I would be probably left with nothing at all in my hands) but rather to formulate an initial view on the quality of the business.

Despite marking several X-es on the checklists, the profile still remains interesting for 3 reasons:

Free Cash Flow: abundant free cash flow does not exclude the possibility both for future new acquisitions and investments in new business lines;

Shareholder Yield: Significant shareholder yield is expected for the next few years, with a sustainable dividend yield (15% payout) and remarkable shares repurchasing activity;

Resilient Management: Management seems very reliable and able to deliver constant, positive results over long periods of time: both growth in revenues and net profits stability are impressive.

Bonus: 5-year check-up projections

In brief, I’d like to share what my check-up tool gives out in terms of stock price. Before reading, please note the following:

Assumptions are yet to be tested and confirmed with deeper research

I never buy or sell based on these projections: the exercise goal is to provide me a first flavor on how interesting or not the stock is

For the sake of Chubb, I’m basing the assumptions mainly upon past performance.

So, the assumptions are - from the bear to the bull case, with a base case in the middle:

Revenue Growth of 5%, 7%, or 9%

2028 Net Profit Margin of 13%, 16%, or 19%

Ending Multiple of 10, 12.5, or 15

Shares outstanding in line with the past only for the bull case (-2%/year)

Overall, the initial Risk-Reward Profile looks interesing to me:

Looking down first, the downside risk seems somehow limited;

Looking up then, the reward seems nice provided the company keeps executing and delivering shareholder yield.

To Sum Up

Expressing conclusions without conducting in-depth research on any stock is a mistake. Therefore, all I can tell for today is how interesting the stock looks from an initial screening.

Whether W.B. delivered another home-run or not, only time will tell. For sure, he picked a well-run, solid business that provides on the surface a certain stability.

If you liked the post, feel free to subscribe and restack!

As usual, I appreciate your valuable time.

Happy Investing,

Francesco - Business Invest

Fantastica analisi, Francesco! Complimenti!

Un solo appunto: non credi che la tua checklist sullo stato di salute finanziario si sposi poco con players di settori piu' "tradizionali" e poco innovativi come l'Insurance?

Potrebbe essere quindi spiegato il fatto che Chubb non incontri il tuo favore su Revenue / GM / ROIC.