I see you.

Seeing popular names hitting new lows can be tempting.

Charts are tempting.

“This thing must go up again”.

How many times has your brain tricked you into this quick-wins scheme?

As you know though, not all falling knives are gifts.

Some do hurt.

Plus, being “cheap” (to verify what this means) is by far not enough.

What does it actually take to create the ground for a solid investment?

Namely, a 2x in 5 years - the 15% per year we love.

Today I want to briefly share with you 5 examples.

Without further ado, let’s start.

Methodology

You will now see 5 stock charts until 2030, with relative revenue growth assumptions.

This time, revenue growth (CAGR) is derived as output.

So what are the inputs?

Desired Return (+15% per year)

Implied profitability

Implied sentiment

Net buyback/dilution

For the analysis, I leveraged on my own financial modeling tools.

I input conservative yet realistic assumptions to generate a desided sales growth required to hit my 100% 5-year target return.

➡️

Quick note: write me “SYSTEM” (click the button below)

→ and I’ll share the exact financial model behind these simulations.

Now onto the names.

#5 Copart - CPRT 0.00%↑

📈 Past 5-year Sales CAGR → +15.6%

🎯 Required Sales CAGR ‘25-’30 to generate 2x in Market Value → +26.98%

Assumptions:

Desided return: +100%

Net dilution: +0.50%

End Profit Margin: 32%

End Sentiment Multiple: 30x

By implying a more reasonable multiple (even though it remains high), the implied growth seems unrealistic.

Only relying on sentiment to drive our investments up can be a dangerous floor to dance on.

#4 LVMH - $LVMUY

📈 Past 5-year Sales CAGR → +9.6%

🎯 Required Sales CAGR ‘25-’30 to generate 2x in Market Value → +12.15%

Assumptions:

Desided return: +100%

Net buybaack: -0.20%

End Profit Margin: 15%

End Sentiment Multiple: 20x

The million dollar question around luxury remains whether the entire sector can return to profitable growth.

LVMH is acquiring market share from lagging competition, but this doesn’t clearly seem enough.

#3 Lululemon - LULU 0.00%↑

📈 Past 5-year Sales CAGR → +22.8%

🎯 Required Sales CAGR ‘25-’30 to generate 2x in Market Value → +14.61%

Assumptions:

Desided return: +100%

Net buybaack: -1.90%

End Profit Margin: 15%

End Sentiment Multiple: 16x

A 14.61% implied sales CAGR equals double in size for the company in 5 years.

In light of the recent headwinds, this sounds pretty ambitious.

But if I was forced, I’d put a few chips on this horse - without too many expectations.

#2 Pool Corp. - POOL 0.00%↑

📈 Past 5-year Sales CAGR → +9.9%

🎯 Required Sales CAGR ‘25-’30 to generate 2x in Market Value → +12.95%

Assumptions:

Desided return: +100%

Net buybaack: -2.00%

End Profit Margin: 9%

End Sentiment Multiple: 25x

A generous 25x multiple is not enough to keep implied sales growth below 10%.

Considering how the past 3 years have been negative (-2.3%!), this is another ambitious case.

The cyclicality of the business might entail return to growth, which remains to be analyzed with vertical research.

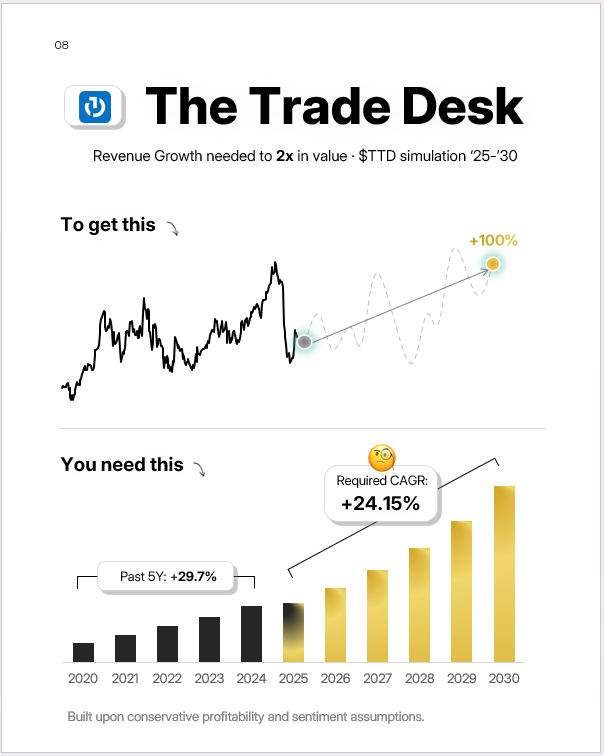

#1 The Trade Desk - TTD 0.00%↑

📈 Past 5-year Sales CAGR → +29.7%

🎯 Required Sales CAGR ‘25-’30 to generate 2x in Market Value → +24.15%

Assumptions:

Desided return: +100%

Net dilution: +0.9%

End Profit Margin: 28%

End Sentiment Multiple: 35x

24% growth doesn’t seem impossible for TTD but it still appears as quite challenging to me.

Somehow the market will need to keep it up with more generous multiples.

You draw your own conclusion.

Enjoy being highly selective

As you can see, man of these growth rates are not realistic.

Or at least they don’t look appealing from a first glimpse.

But don’t be frustrated: that’s perfectly fine.

To enjoy a high-quality, no-stress portfolio, we’ll be saying no 99% of the time.

We only need a handful of great business stories in our life.

Plus, a system to quickly spot them.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest