Long-term investing is not just about money, but also about purpose.

Tuning into a company’s mission becomes key, if we want to stay invested for many years.

This is why I am starting to look at health-tech with a different eye.

Participating in such stories just feels great.

It’s ethical, it carries integrity.

Let me briefly tell you about 2 intereting stories.

1. RaySearch Laboratories - RAY-B.ST

🧩 Market Cap: $1.08B (in USD)

🌎 Country: Sweden

📈 1-year stock performance: +135.7%

➡️ What they do:

Their ultimate goal is to improve the battle against cancer.

They do so by being owners of specific software solutions for radiation therapy.

Their flagship product, RayStation, is an advanced platform that is used by the hospital’s personnel to treat radiation therapies with higher precision and safety.

In essence, the software is able to precisely calculate the area and intensity where the radiation needs to be executed.

Overall though, they offer an integrated end-to-end suite:

💎 Quality Signals

What triggered my interest? Here’s a non-exhaustive list:

✅ Founder-Led by a charismatic leader, Johan Lof

✅ Owner-operated, as more than 10% of outstanding shares are held by insiders

✅ It’s an R&D company, that “continuously invests in future products that improve cancer care”

✅ Almost 50% of their employees are staffed in the R&D department

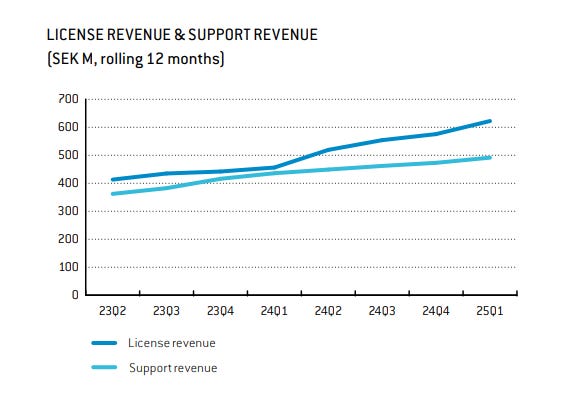

✅ The subscription revenue stream (licenses) is the fastest growing segment

✅ The orders backlog is extremely high

✅ They produce terrific cash flow from operations (37% OCF/Sales)

✅ “Customers stay forever, come back and buy more” - quoting the CEO as per latest conference call

❔Optionalities

As future growth drivers that may not be entirely priced in yet, we have:

🚀 Expansion into Chemo, “a 2026 thing”, according to the CEO

🚀 Expansion into emerging markets (recently signed important deals with Poland, China, Spain)

🚀 Adoption of machine learning and AI models to enhance quality across the suite

⚠️ Risks

Again, take this as brainstorming, high-level exercise.

What could go wrong?

🟡 Strong competition from vertically integrated OEMs - competitors like Varian and Elekta offer a full-stack offer, bundling software with hardware (building switching costs for hospitals)

🟡 Regulatory risks attached to the development of new products lines

🟡 Technological risk, with AI dramatically pushing down the barriers to entry

🟡 Insider activity: CEO sold shares (~5.8% votes) in Q1 2025; a signal that needs monitoring.

🟡 Product concentration: RayStation is still a dominant source of revenues. A potential misuse or unlucky event may trigger a serious reputational damage

💸 Exploring a 2x

The stock has climbed significantly.

Is there still room for outperformance?

As usual, I don’t pretend we immediately find an answer.

I’m not here to present a well-rounded investment case.

Instead, what we need to work on at this stage, is generating the right questions to investigate the feasibility of this scenario.

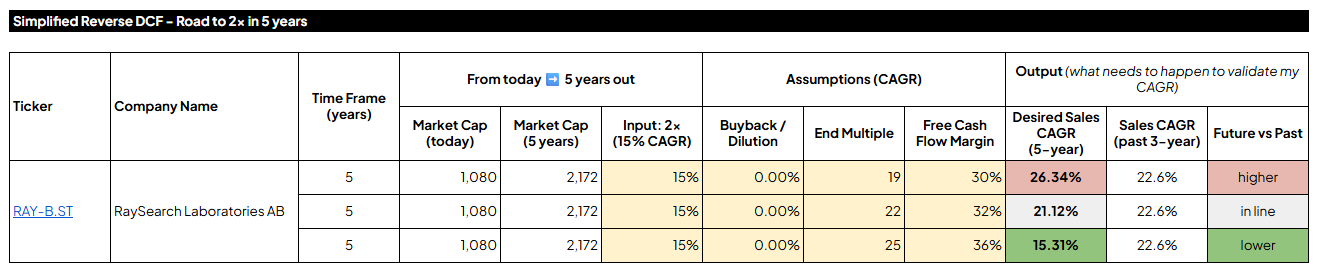

To do so, let me bring up an extract of my screening reverse DCF system I regularly use for myself and my clients.

Let me read this table for you.

To achieve another 2x from here, this is what we need.

➡️ 26.34% revenue growth per year, if these assumptions materialize:

No Buyback/Dilution

19x End Multiple

30% Free Cash Flow Margin

➡️ 21.12% revenue growth per year, if these assumptions materialize:

No Buyback/Dilution

22x End Multiple

32% Free Cash Flow Margin

➡️ 15.31% revenue growth per year, if these assumptions materialize:

No Buyback/Dilution

25x End Multiple

36% Free Cash Flow Margin

Which leads me to these first observations:

→ If the growth trajectory stays in line with recent years, there seems to be additional upside potential despite the terrific 12-month performance.

→ However, a double in size by 2030 does seem ambitious. Optionalities must play out with excellent execution for this to become true.

→ The business (and the stock) remain volatile and difficult to understand. Caution and patience remain key here.

🖥️ System

Write me “SYSTEM” (click the button below)

→ and I’ll share with you a quick video explaining the exact financial model behind these simulations.

Now back to company n. 2.

2. Vitalhub Corp. - VHI

🧩 Market Cap: $447M (in USD)

🌎 Country: Canada

📈 1-year stock performance: +47.6%

➡️ What they do:

To put it in simple terms, they provide a diverse software suite for hospitals and other health organizations.

Their solutions provide - among all:

Patient flow optimization

Workflows optimizations across functions

Electronic health record (EHR) systems

Vertical specializations in several areas (cardiology, mental health, rehabilitation, and many more)

Business Intelligence and Data solutions

On a very important note, they are a serial acquiror.

Since 2017, they have engaged into more than 20 new acquisitions, resulting into an incredibly wide range of product solutions.

💎 Quality Signals

What triggered my interest?

✅ Insider ownerhip = 13.5%

✅ R&D on Sales > 20%

✅ Recurring Revenues (licenses) > 75% of total

✅ OCF on Sales > 20%

✅ Upselling & Cross-selling opportunities

✅ Organic growth > 15% - despite the aggressive M&A activity

❔Optionalities

As future growth drivers, we have:

🚀 The US market seem underpenetrated

🚀 Expansion into new verticals

🚀 Extended external growth activity

⚠️ Risks

The first risk here has to do with our circle of competence.

This one can easily fall outside our confidence zone. That being said, let’s see some additional business risks:

🟡 Leadership: The CEO has joined in 2020, apparently without a specialist background but a generalist one (could also be a positive element though)

🟡 High competition in a fragmented market, where B2B customers might be price-sensitive

🟡 Integration challenges in light of the aggressive external growth that could strain attention and resources from organic growth

💸 Exploring a 2x

The stock has more than 4x in less than 2 years.

So, same question here: is there room for additional appreciation?

Let’s run the screener reverse DCF system:

This means that to achieve another 2x from here, we need either:

➡️ 33.8% revenue growth per year, if these assumptions materialize:

12% dilution - assuming additional M&A deals with new share issuance

14x End Multiple

18% Free Cash Flow Margin

➡️ 21.20% revenue growth per year, if these assumptions materialize:

8% dilution - with significant yet reduced external growth

18x End Multiple

21% Free Cash Flow Margin

➡️ 9.17% revenue growth per year, if these assumptions materialize:

4% Dilution - still high but in sharp decline

22x End Multiple

24% Free Cash Flow Margin

Which leads me to these first observations:

→ A narrower focus on organic growth only might be okay for investors! a 9% revenue growth per year without massive dilution seems feasible.

→ Given how conservative I was on sentiment, I can see the stock higher 5 years out, but execution can’t underdeliver.

The Full System

The first half of 2025 is already gone.

6 months ago I opened the doors of my 1:1 educational program and that has filled me both with joy, responsibility, and unlocked tremendous value (both financial, and non-financial) for my students.

Returns are just the tip of the iceberg.

It’s the organization, the order, and peace that makes the difference:

If you’re looking for fast and effort-less answers, that’s not for you.

But - if you want to truly build an investment plan that can earn you a decade or two of corporate work, with equities as sustainable wealth engine, that’s for you.

If that somehow resonates:

➡️ Schedule your free chat (click here)

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest