“Attack is the best defense.”

If I had to sum up this quarter (and perhaps the year) with one line, this would be it.

Welcome to another episode of my diary, (again) at new all-time highs.

Since its launch on 01/01/2021, my portfolio now totals ca. €113K - of which nearly €73K are gains.

This brings my year-to-date return to +124.2%, with an annualized average return (XIRR) of +37.50% since inception on January 1st, 2021.

I know what you’re thinking: this pace is not sustainable - and I completely agree.

That’s why you and I must have an eye on defense.

History doesn't repeat itself, but it often rhymes (?)

I’m sure you’ve heard of this famous quote.

Mark Twains’s words have been echoing in my mind for a while now.

‘Are we back to 2021?’, where peak euphoria set the stage for a -38% peak-to-trough decline for the Nasdaq in 2022?

As usual, I’ll leave next year’s predictions to tactical traders and investment banks, but one thing is certain: we’re seeing a particularly positive scenario unfold.

The S&P 500 is on track for two consecutive years of 20-25% gains - an achievement that doesn’t happen often

The Corporate Executive Sell/Buy Ratio just hit a record 6x, with the previous peak occurring shortly before the 2021 highs

Global Valuation Indicators, like the Shiller PE and Warren Buffett Indicator, are at new highs (check out this previous article, where I explained why I’ve stopped using them).

The list of ‘shocking’ macroeconomic or valuation indicators could go on, but creating panic or uncertainty is the last thing I intend to do.

As I mentioned in my previous episode of Zen, we need to be both mentally and financially prepared to face any future scenario, especially a (very) negative 2025.

To preserve my 15% XIRR target return, I’m personally positioned to absorb a potential -20% year-end performance for the S&P 500 without major issues.

Here’s the math:

With an unchanged beta of 1.8 (likely to be reduced in Q1 next year with new adjustments in the portfolio) and assuming no Alpha, a -20% decline in the S&P 500 would theoretically translate to a -35% portfolio performance

Despite this conservative scenario - where beta remains unchanged, no Alpha is generated, and no portfolio moves are made (unlikely in reality) - my XIRR would still land at 15%

Once again, this is purely a theoretical exercise. While 15% remains my long-term target, it’s clear this number will fluctuate lower or higher on any given year along the way.

My first 10X

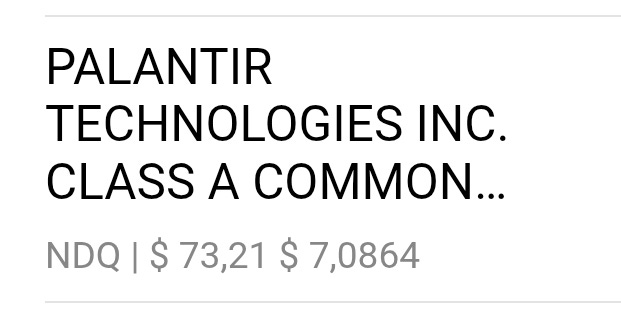

Yes, technically I hit my first 10-bagger. And the company is… Palantir.

As always, there’s nothing to celebrate. Price actions are beyond our control, and the focus must remain on the process that delivers these results.

I first became a Palantir shareholder on September 14, 2022, at an average purchase price of $7.08. To date, I haven’t sold a single share.

My journey with this stock holds significant lessons. Here are the key takeaways:

1 | Doing nothing had the biggest impact

What I didn’t do mattered far more than what I did. For months, amid divisive opinions, "strong sell" and "strong buy" labels, rumors, and endless headlines, I chose to tune out the noise.

Instead, I focused on Palantir’s rising business quality and decided to wait patiently to see how things unfolded.

2 | Risk-Reward made all the difference

When I entered, Palantir was unprofitable on earnings but strongly cash flow positive. Its double-digit free cash flow eliminated concerns about bankruptcy and suggested that downside risk was protected at around $6.

At the same time, I envisioned a potential $100B-$120B market cap scenario (which I detailed in this previous article).

I set my thresholds and I just stayed within my range: no selling below my downside scenario and adjusting my upside expectations as the fundamentals improved.

3 | Quality is my North Star

Why sell a founder-led, owner-operated, customer-centric business operating in a fast-growing blue ocean industry? Palantir has been scaling new segments rapidly, with accelerating growth and improving profitability.

Looking only at its financial metrics, like a P/E of 200 (never look at PE for these type of companies), could have led to premature selling. Business quality remains the ultimate compass for my decisions.

4 | Beta was a factor

Let’s be honest: Palantir’s beta of 2.7 was a major contributor to my performance this year. While Alpha is the goal, this stock's volatility amplified returns significantly.

However, with my bull case for Palantir previously set at $76, I’m reminded that attack means letting winners run, while defense means exercising caution moving forward.

5 | Yes, Luck

For sure, luck was there too. However, as they say: Audentes Fortuna iuvat :)

Personal fun fact

7 years ago yesterday (2017), I graduated in my dual Master of Science in International Business Management at Bocconi University and CEMS Alliance.

I remember every single detail about that day, especially all the attempts to take this picture without anyone else in the scene :)

This reflection has nothing to do with investing, my portfolio, or the markets. But since you’re reading my diary, I think it’s a nice opportunity to step back and reflect on how our experiences cna shape the investors and individuals we become.

Bocconi University passed on to me a few pivotal values:

The answer is always “it depends”: the importance of considering multiple perspectives and scenarios, a skill that’s invaluable for managers, entrepreneurs, and especially investors!

Being bold and ambitious: never settle for less, and always aim higher;

Balance ambition with humility: respect others and stay open to learning from anyone who’s a step ahead of you on the journey;

Practical skills for working life and investing: those years taught me how to analyze companies, prepare business plans, and business cases. I still consider this my little unfair advantage, if applied to investing.

If you ever wondered who Mister Bocconi is, it’s the guy on the.. left!

Join me on the fun ride of equity investing

If you are looking to remove all the blocks that are keeping you from becoming a confident equity investor:

Time constraints (research & analysis take time and self-discipline, if you’re alone without a direction)

Information overload (where do I get the right info?)

Confusion on how to deal with stocks: when do I buy? when do I sell? How can I build scenarios?

Or simply accelerate your journey with a proven risk-first, market-beating strategy.

➡️ Consider applying to The Investor’s Edge, my 1:1 Mentorship Program!

Within the 3+ month program, I will be happy to add unique value to your investing journey with personalized assistance and all the support tools that make the whole process fast and reliable.

✅ Write ‘Edge’ (or whatever you want) here below to discover all the details.

I can’t wait to accompany motivated aspiring investors like you.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest

Buying quality and not messing with it is how all my 10 baggers or better have worked.