How to sleep well with equities?

Own Quality.

But how do we define quality?

Good news: there are many perspectives to do so.

Today, I’m identifying it through… ARR.

Annual Recurring Revenue is a KPI I love to check.

Why?

Imagine a company with 95% recurring revenue: it means that if the company itself stopped existing, it would still likely generate 95% of revenues next year.

Powerful, right?

In this episode, I’ll let some incredible charts do the talking, showing why I’m closely monitoring these 10 stocks amid a healthy market pullback.

Also, on top of ARR, I’ll report a short “anti-fragile” recap with some other KPIs showing financial robustness.

🚀 Stay until the end!

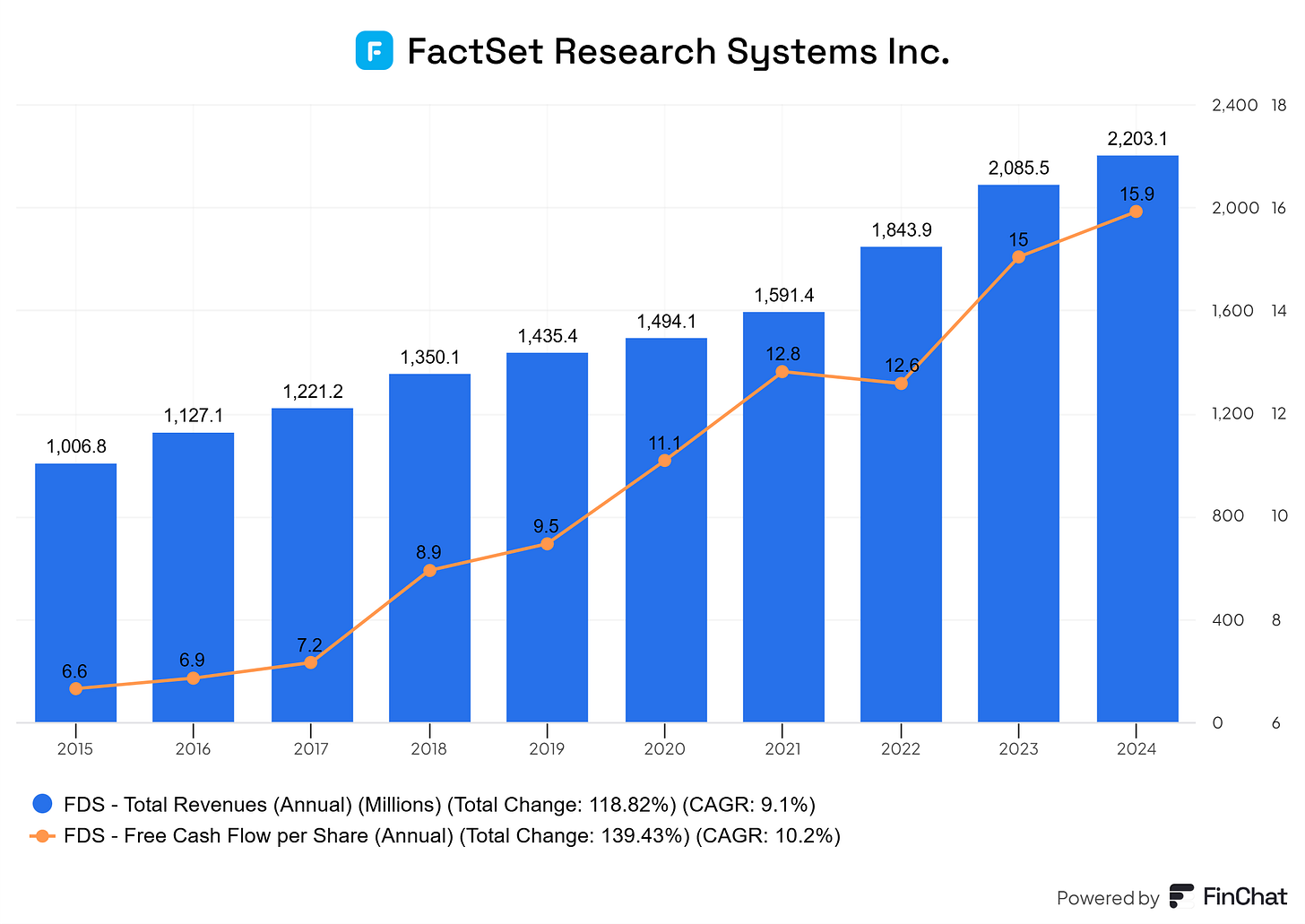

10. FactSet - FDS

🤌🏼 What they do: if you’re into investing and macroeconomics, you may be familiar with the platform. FactSet is a financial data and analytics provider that offers insights, research, and portfolio management tools.

Market Cap: $17.1

📊 Anti-fragile KPIs:

ARR % = 98%+

Revenue Growth (3Yr CAGR) = 11.1%

Gross Margin = 54.3%

Free Cash Flow Margin = 24.1%

Return On Invested Capital (3Yr avg) = 16.1%

Net Debt (Cash - LT Debt) = 1.2B

Stock Beta = 0.76

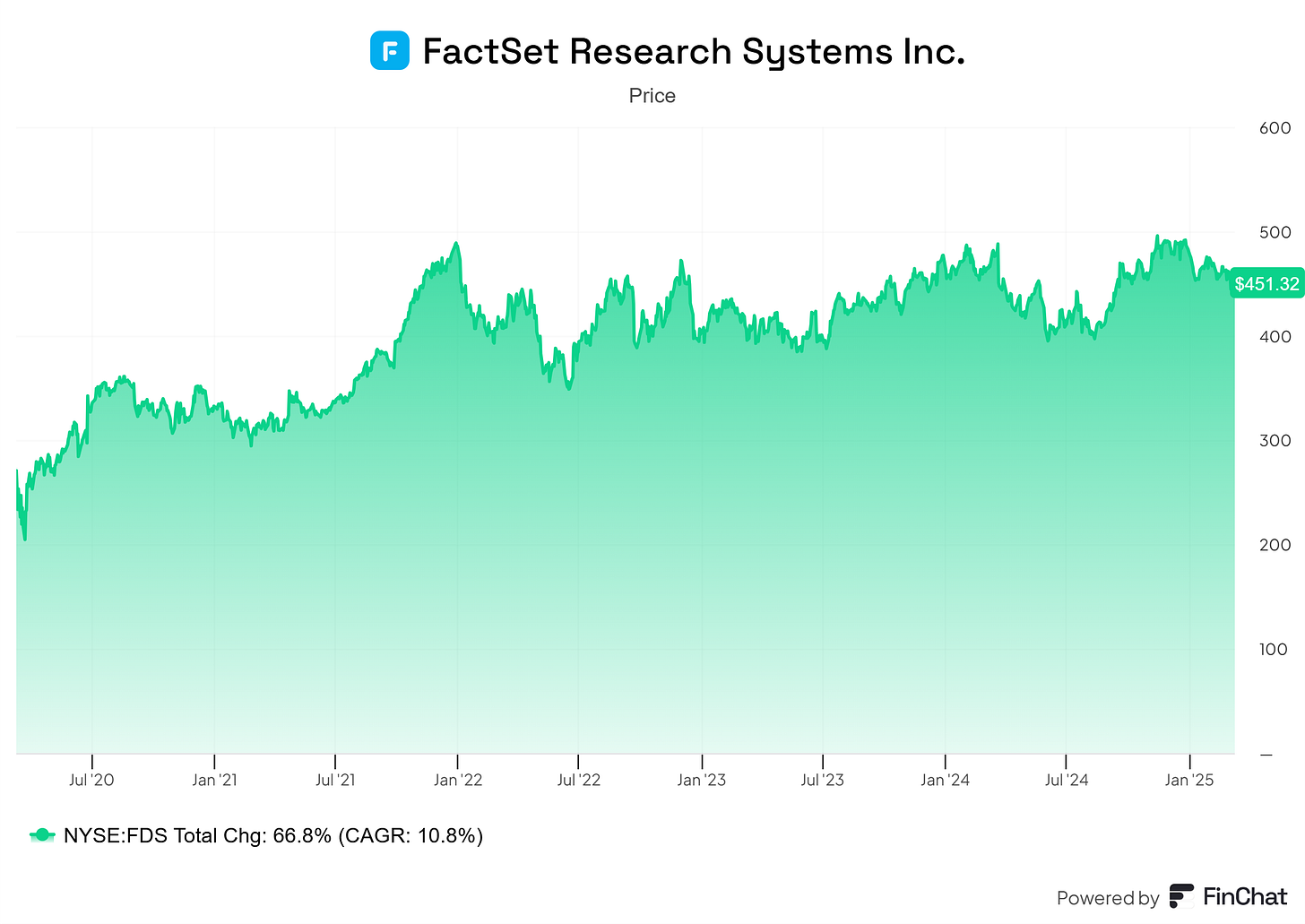

📈 Stock performance: 10.8% CAGR in the past 5 years

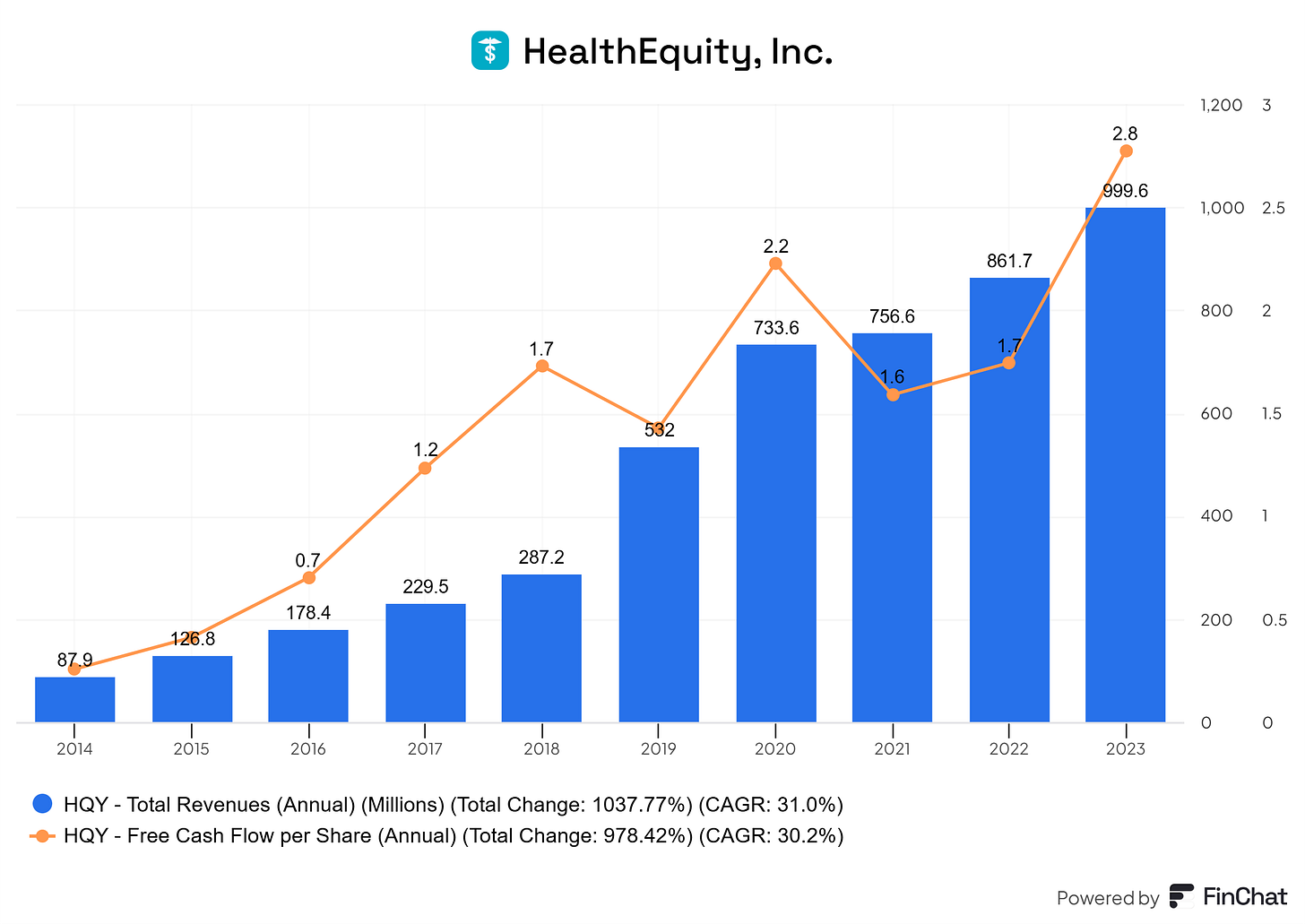

9. HealthEquity - HQY

🤌🏼 What they do: the company is a leading provider of healthcare financial solutions, specializing in Health Savings Accounts (HSAs). They offer a cloud-based service to assist individuals and employers in optimizing healthcare spending, manage savings, and navigate tax-advantaged health benefits.

Market Cap: $8.3B

📊 Anti-fragile KPIs:

ARR % = 84%

Revenue Growth (3Yr CAGR) = 15.8%

Gross Margin = 65.3%

Free Cash Flow Margin = 29.5%

Return On Invested Capital (3Yr avg) = 3.43%

Net Debt (Cash - LT Debt) = 0.8B

Stock Beta = 0.62

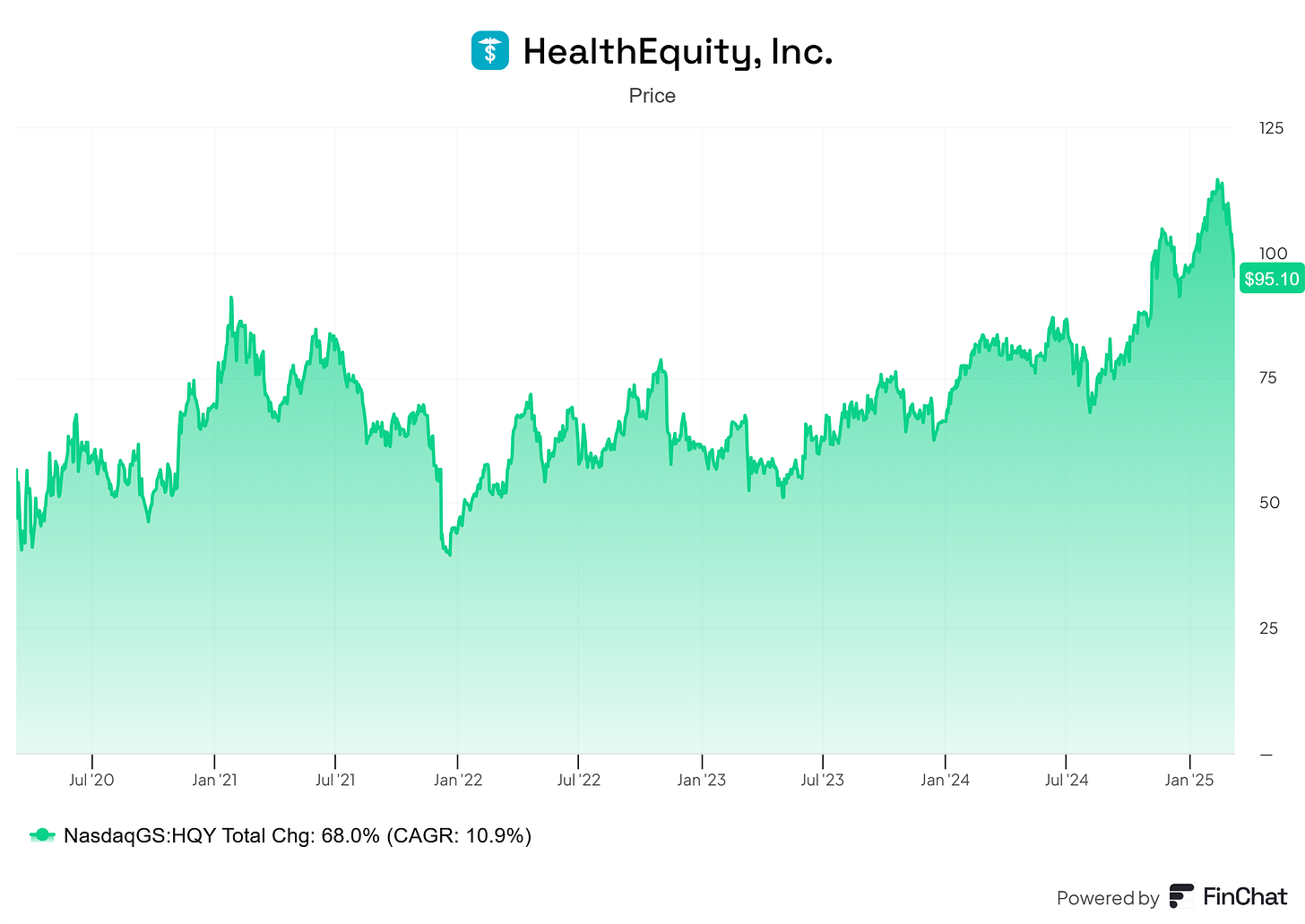

📈 Stock performance: 10.9% CAGR in the past 5 years

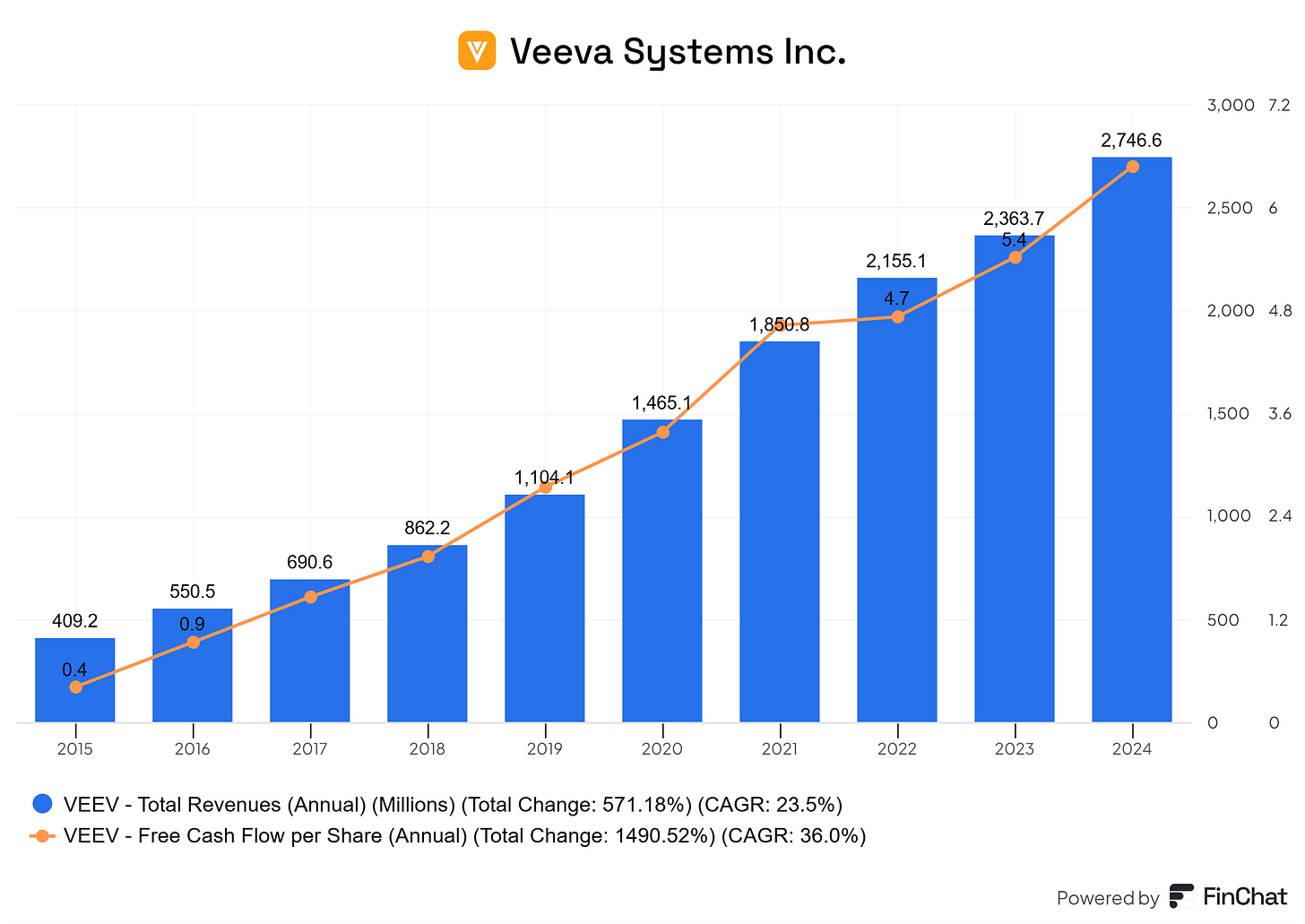

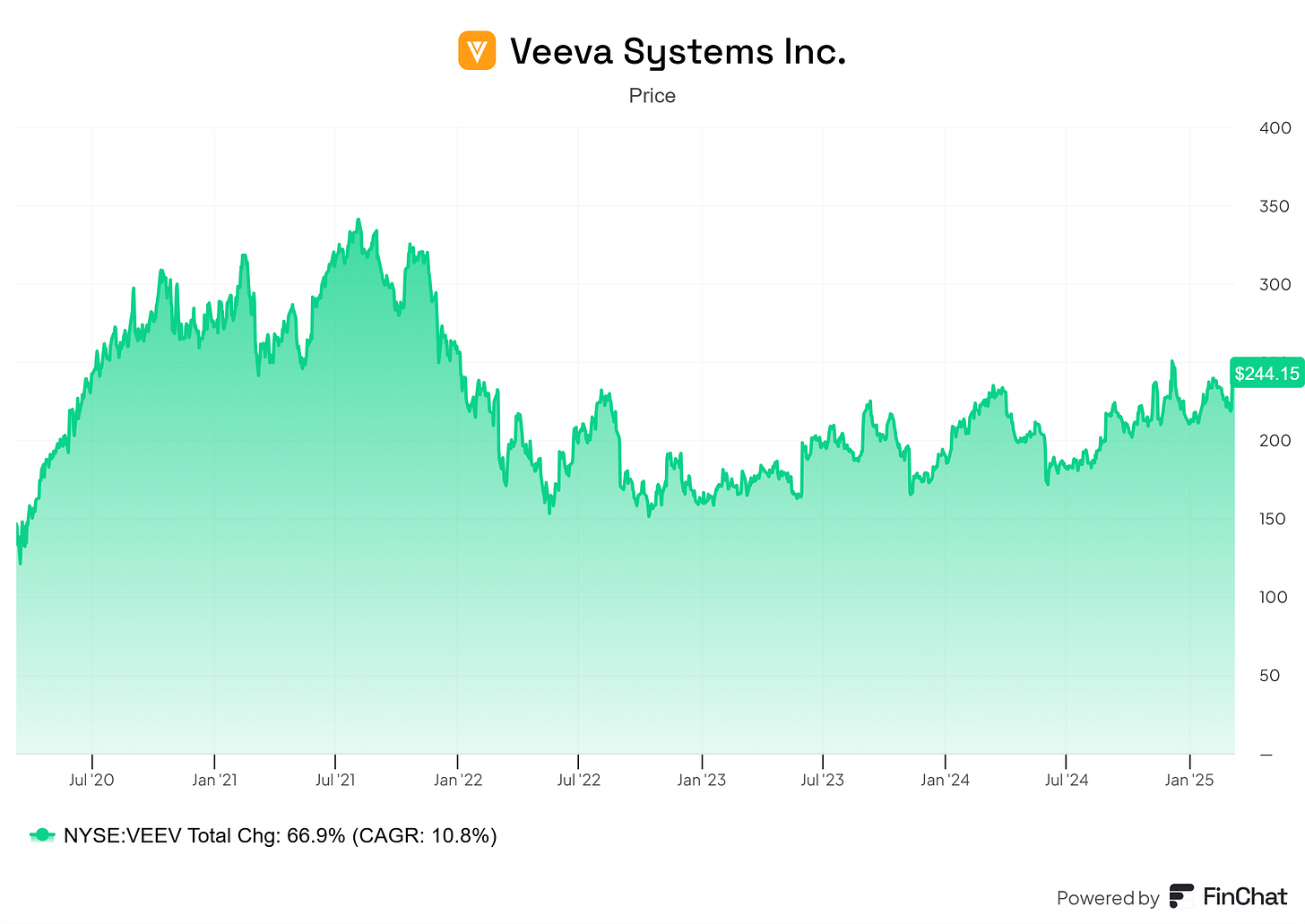

8. Veeva Systems - VEEV

🤌🏼 What they do: A cloud software provider vertically specialized in the life sciences industry, helping pharmaceutical and biotech companies manage research, sales, and compliance.

Market Cap: $39.4B

📊 Anti-fragile KPIs:

ARR % = 83%

Revenue Growth (3Yr CAGR) = 14.1%

Gross Margin = 74.5%

Free Cash Flow Margin = 38.9%

Return On Invested Capital (3Yr avg) = 25.7%

Net Debt (Cash - LT Debt) = -5.0B (negative!)

Stock Beta = 0.88

📈 Stock performance: 10.8% CAGR in the past 5 years

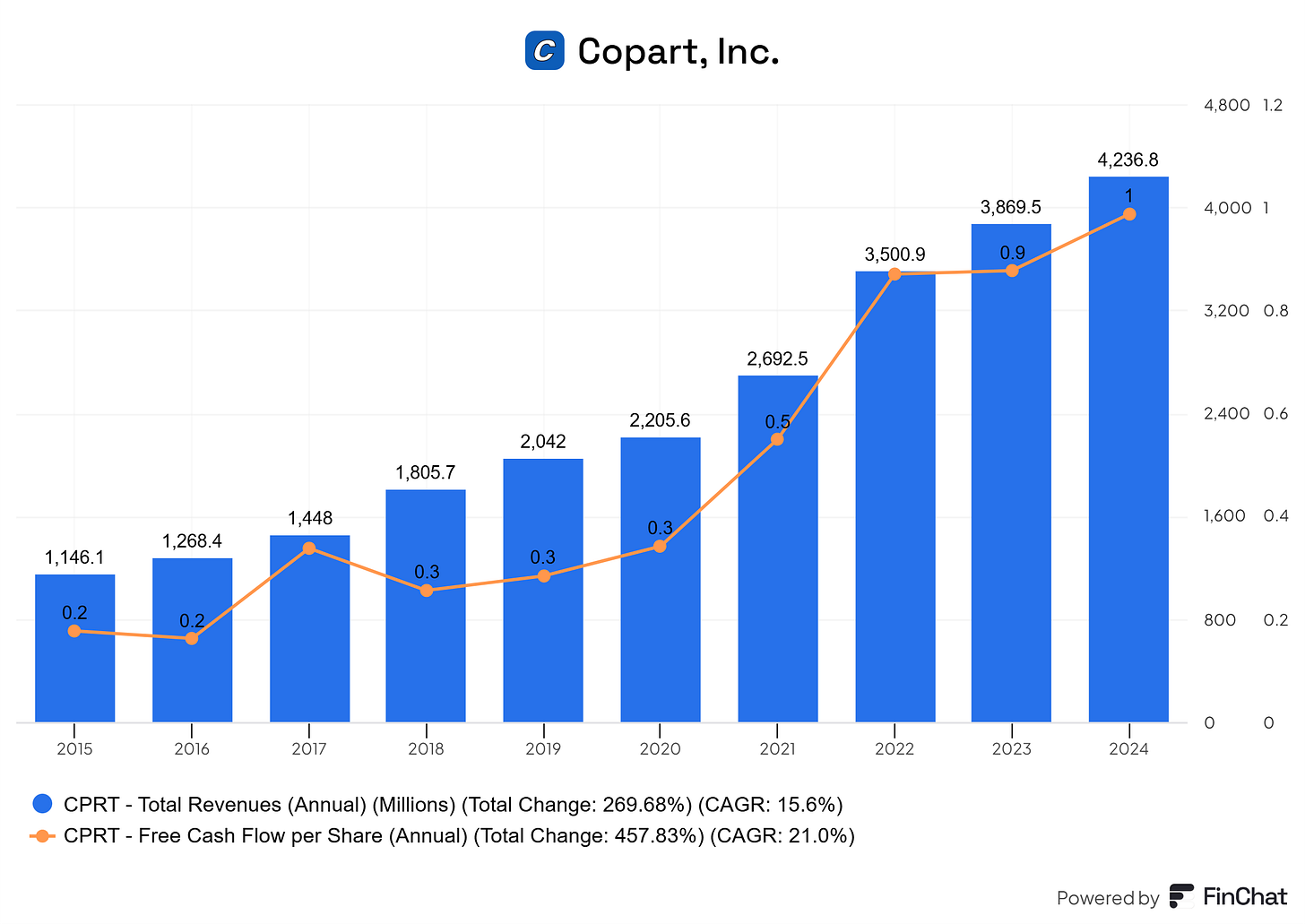

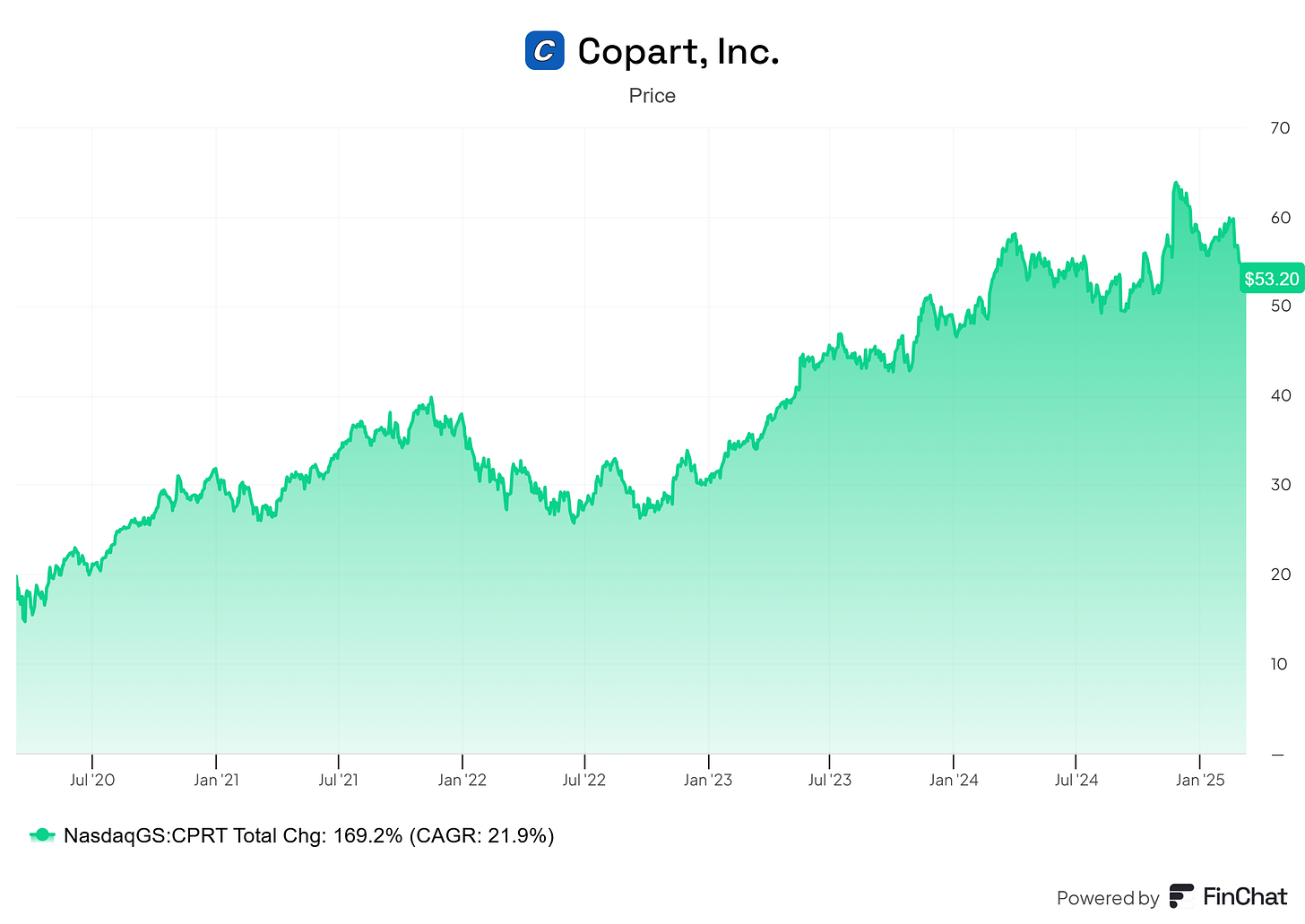

7. Copart - CPRT

🤌🏼 What they do: Copart is a leading online auction company that sells used and salvaged vehicles, connecting buyers and sellers worldwide in the automotive industry.

Market Cap: $51.5B

📊 Anti-fragile KPIs:

ARR % = 85%

Revenue Growth (3Yr CAGR) = 12.6%

Gross Margin = 45.5%

Free Cash Flow Margin = 22.6%

Return On Invested Capital (3Yr avg) = 30.6%

Net Debt (Cash - LT Debt) = -3.7B (negative!)

Stock Beta = 1.3

📈 Stock performance: 21.9% CAGR in the past 5 years

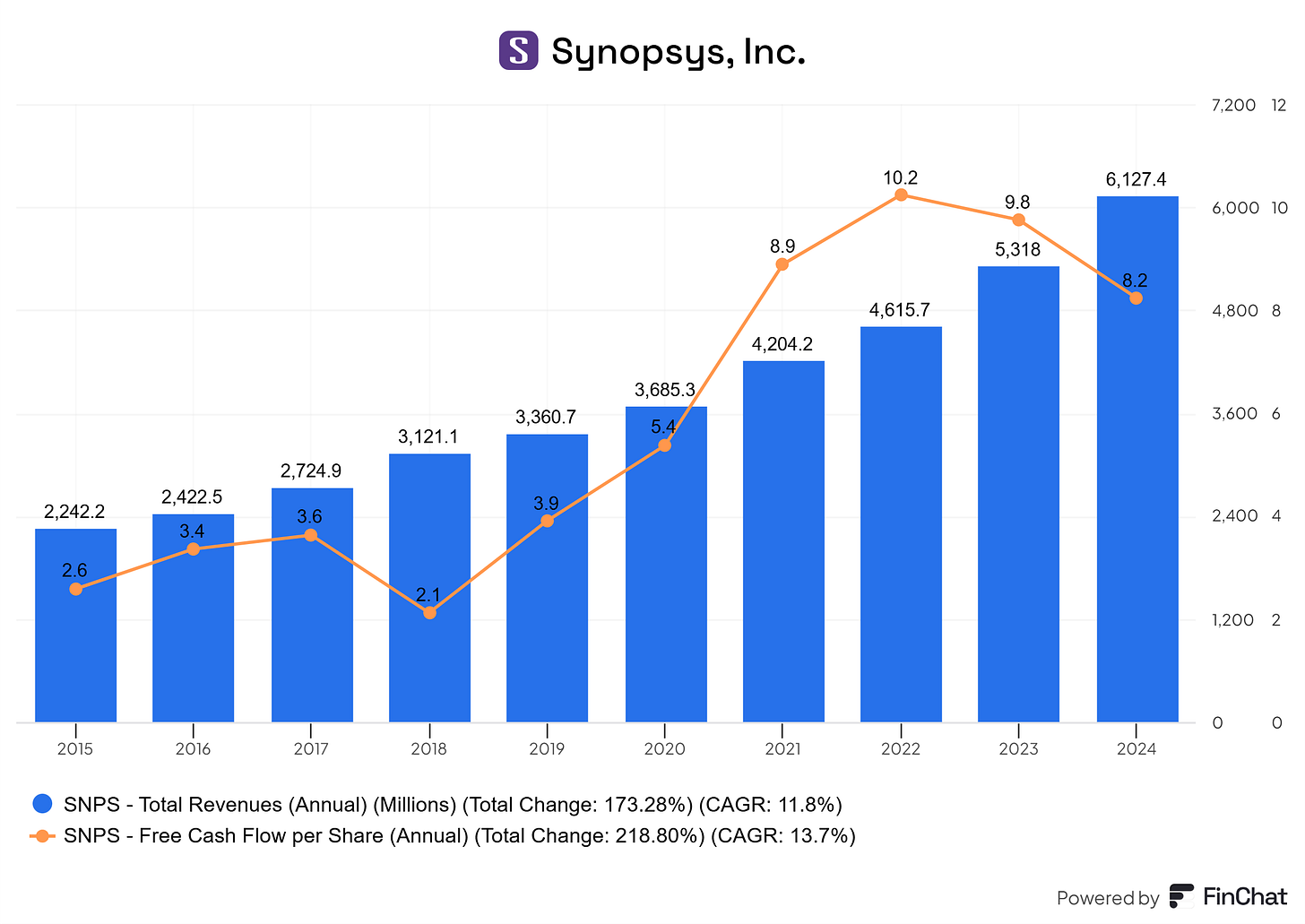

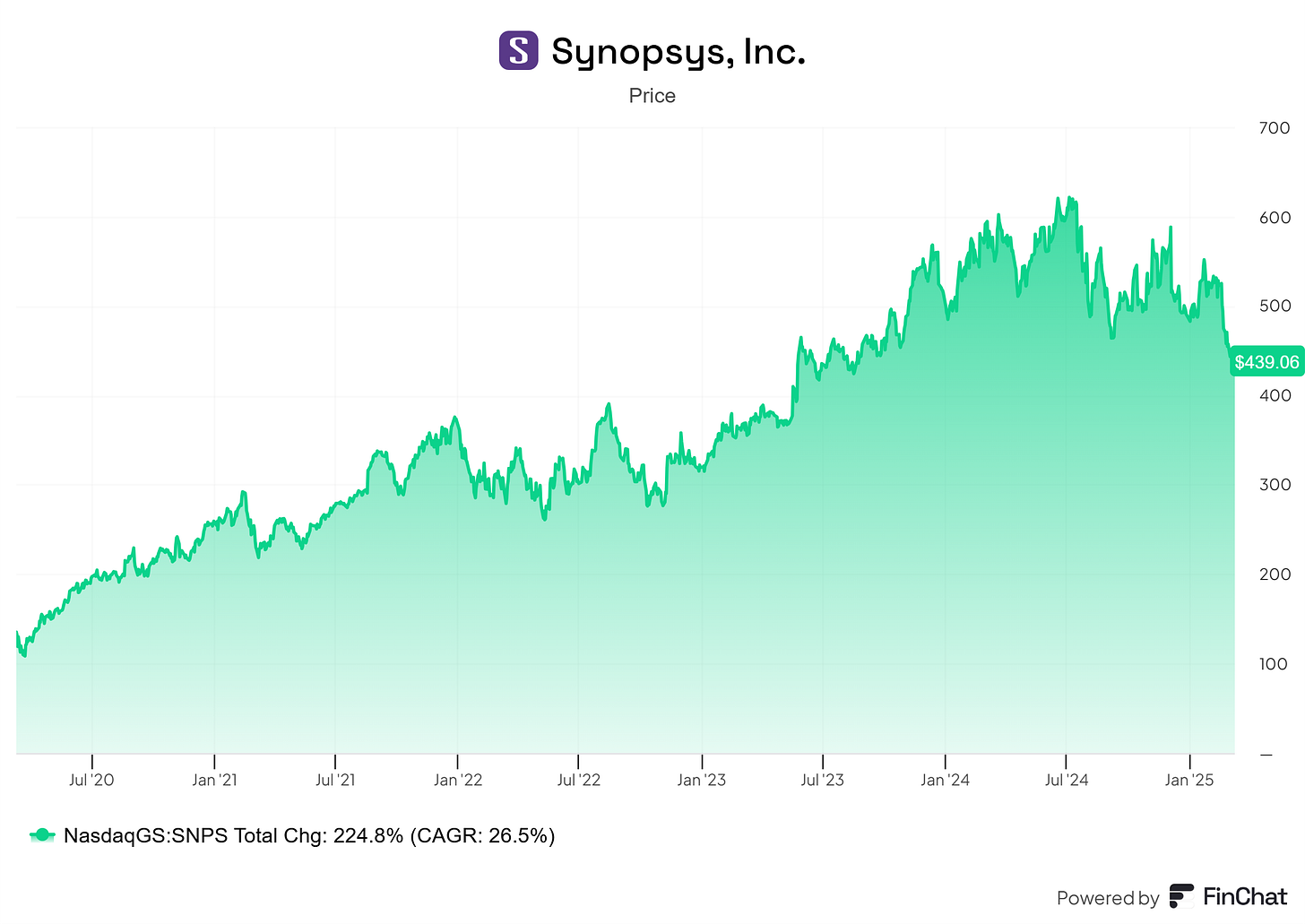

6. Synopsys - SNPS

🤌🏼 What they do: The company is one of the very few leaders of EDA (Electronic Design Automation) for the global semiconductor industry. The company supports the entire value chain with proprietary IPs and software solutions to design and test chip circuits.

Market Cap: $67.3B

📊 Anti-fragile KPIs:

ARR % = 77%

Revenue Growth (3Yr CAGR) = 10.5%

Gross Margin = 81.3%

Free Cash Flow Margin = 21.5%

Return On Invested Capital (3Yr avg) = 14.0%

Net Debt (Cash - LT Debt) = -3.1B (negative!)

Stock Beta = 1.15

📈 Stock performance: 26.5% CAGR in the past 5 years

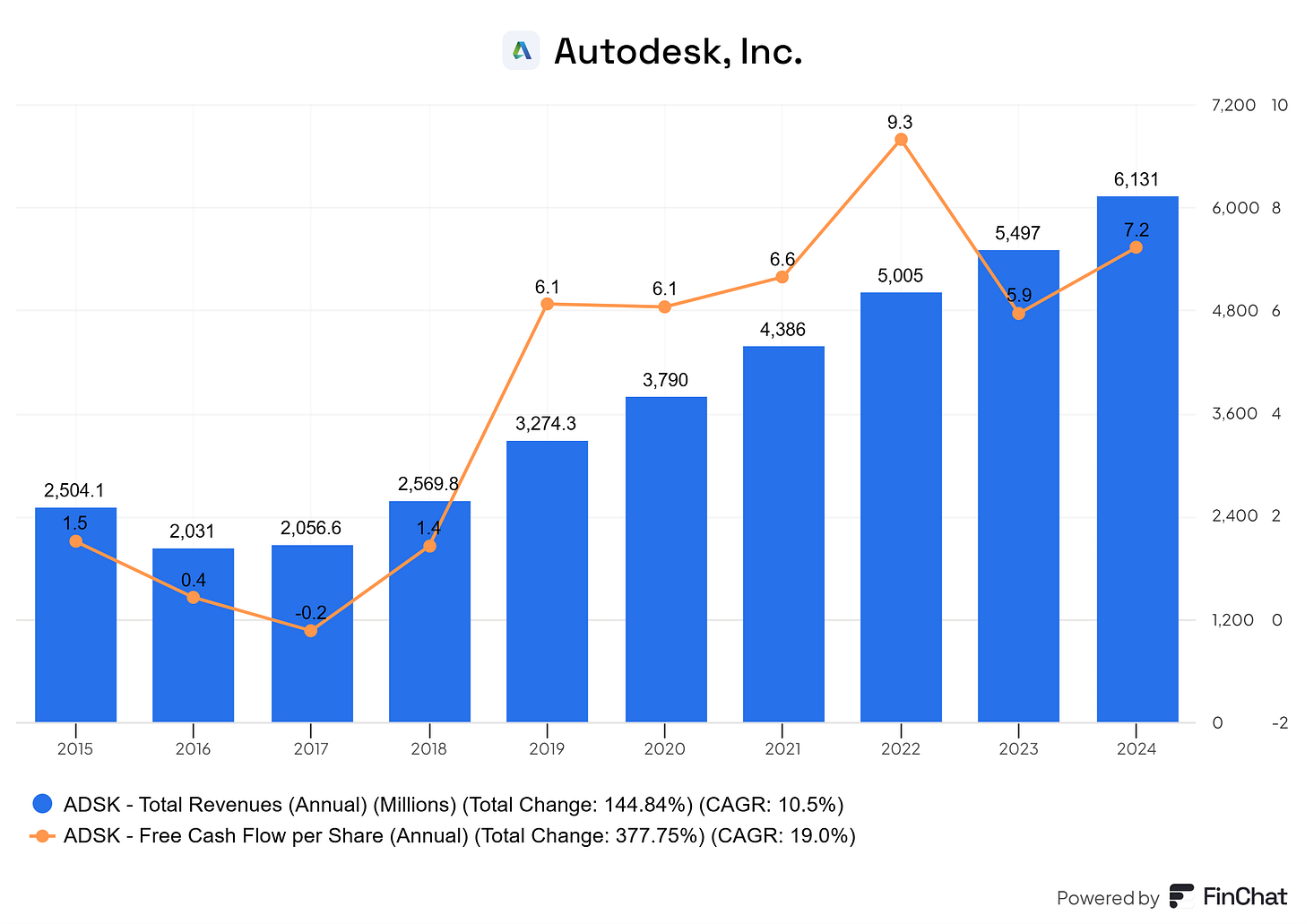

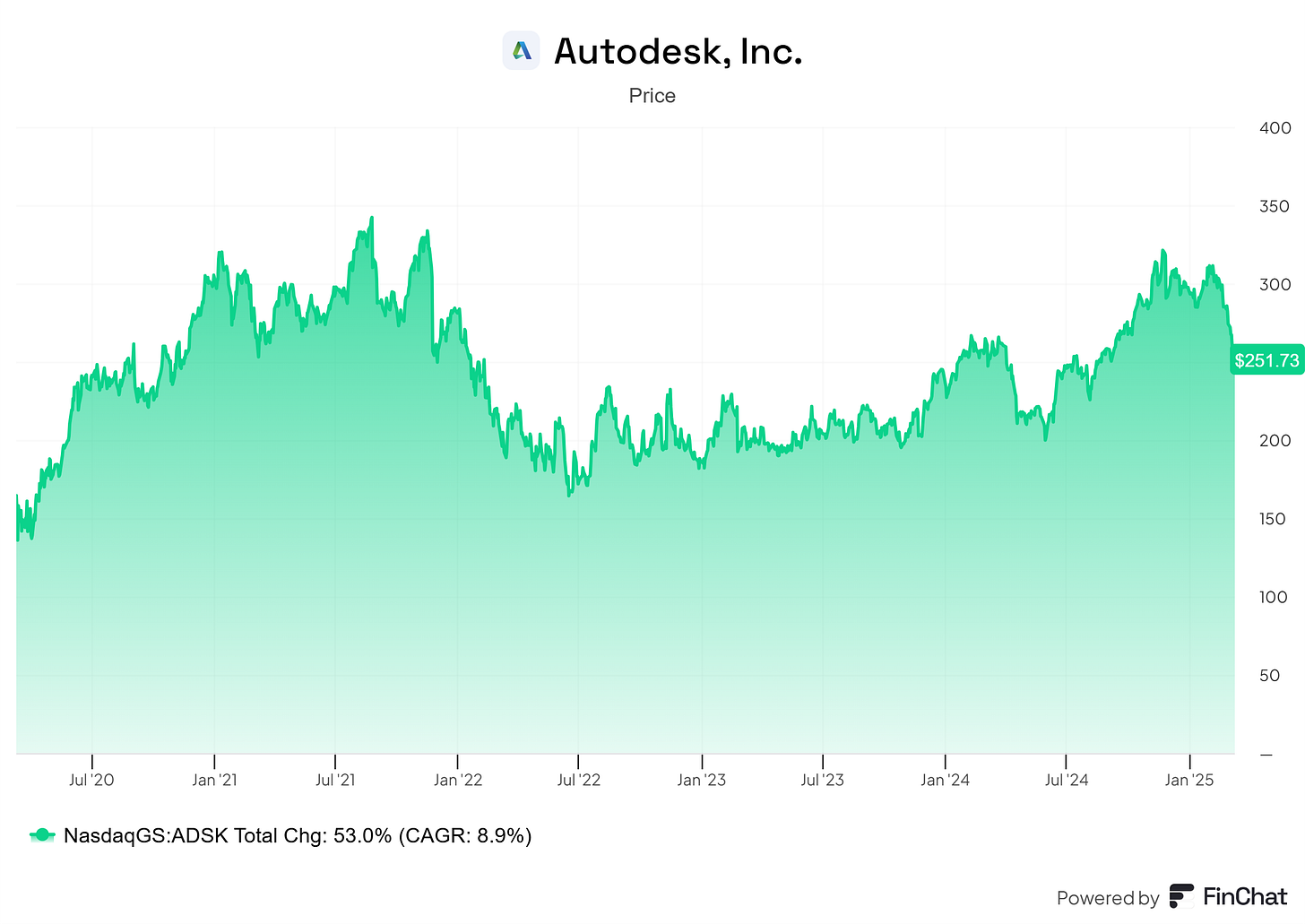

5. Autodesk - ADSK

🤌🏼 What they do: they’re a leading provider of design and engineering software, known for AutoCAD and other tools used in architecture, construction, and 3D modeling.

Market Cap: $54.2B

📊 Anti-fragile KPIs:

ARR % = 93%

Revenue Growth (3Yr CAGR) = 11.8%

Gross Margin = 92%

Free Cash Flow Margin = 25.6%

Return On Invested Capital (3Yr avg) = 9.9%

Net Debt (Cash - LT Debt) = 0.4B

Stock Beta = 1.51

📈 Stock performance: 8.9% CAGR in the past 5 years

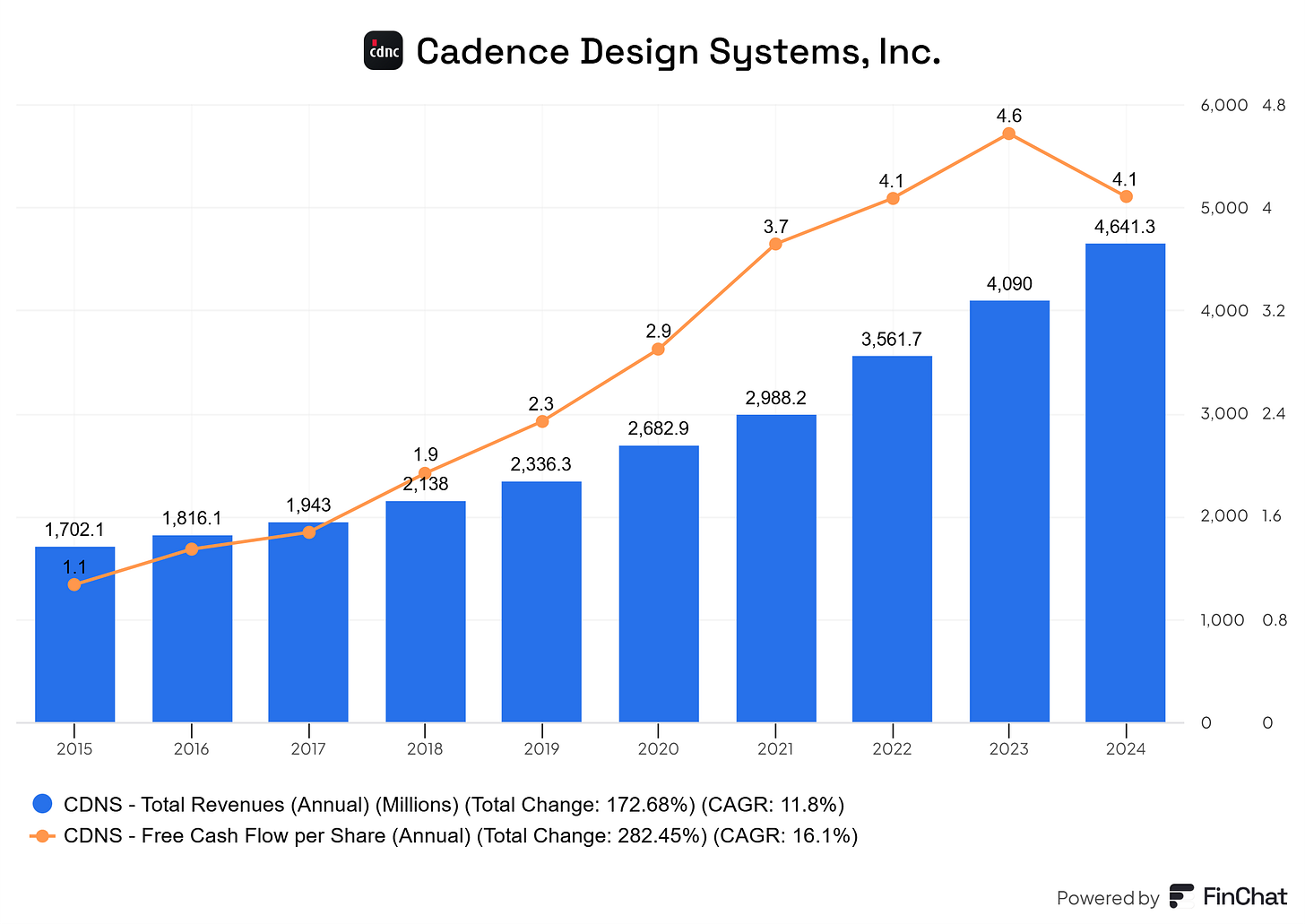

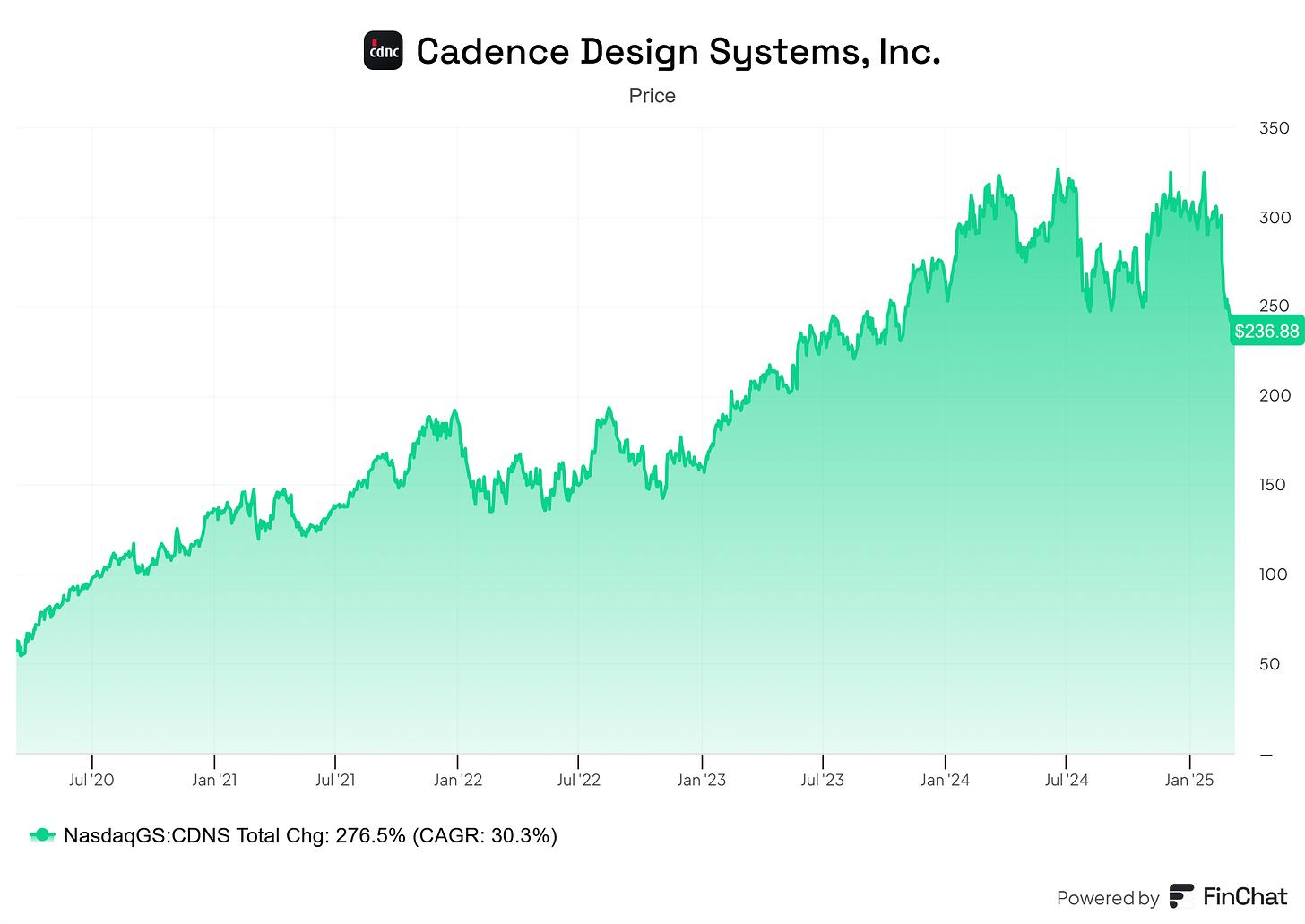

4. Cadence Design Systems - CDNS

🤌🏼 What they do: another leader inside the design and verification segments of the semicondutors value chain.

Market Cap: $64.7B

📊 Anti-fragile KPIs:

ARR % = 82%

Revenue Growth (3Yr CAGR) = 15.8%

Gross Margin = 86.0%

Free Cash Flow Margin = 24.1%

Return On Invested Capital (3Yr avg) = 21.8%

Net Debt (Cash - LT Debt) = -0.2B (negative!)

Stock Beta = 1.05

📈 Stock performance: 30.3% CAGR in the past 5 years

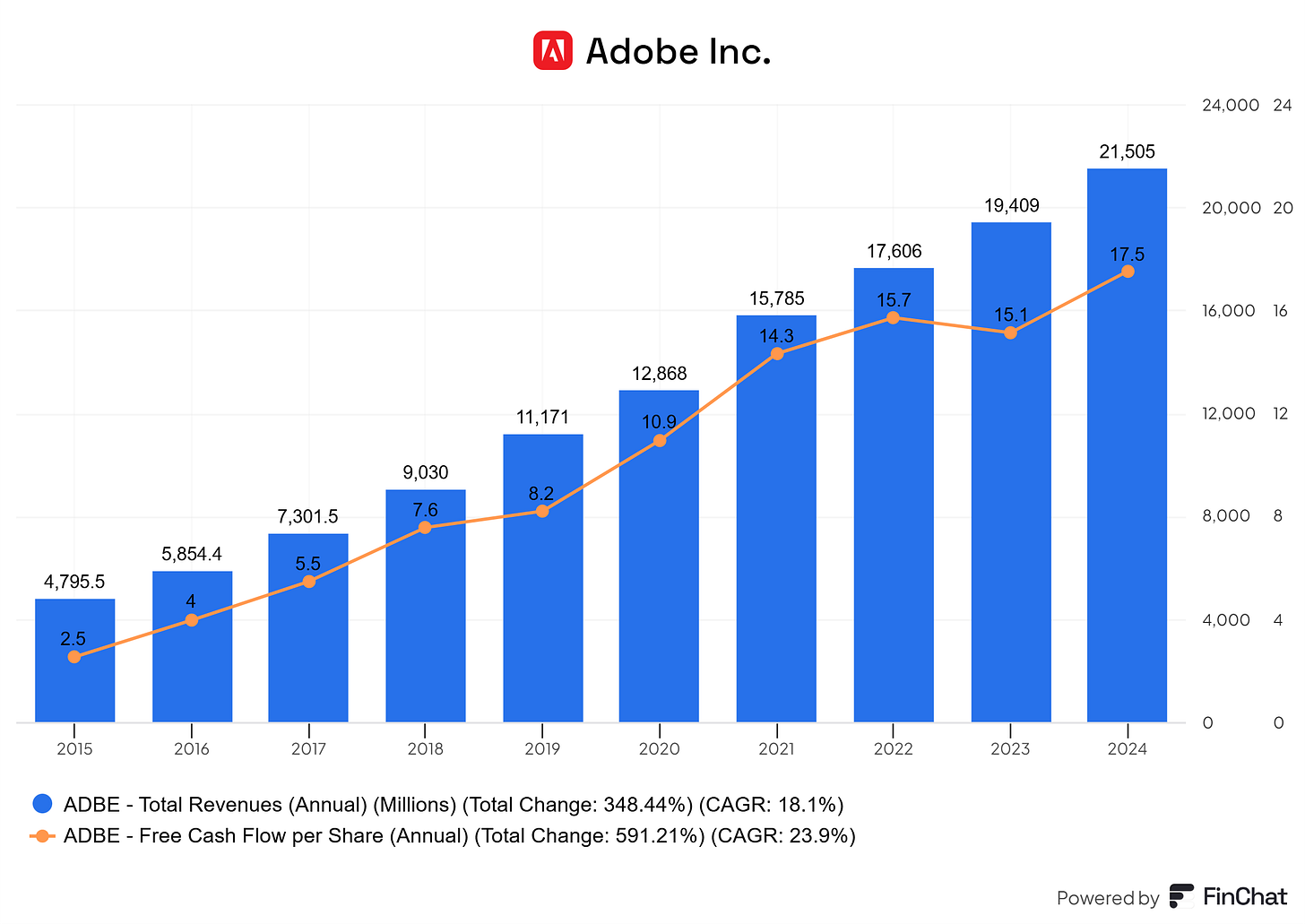

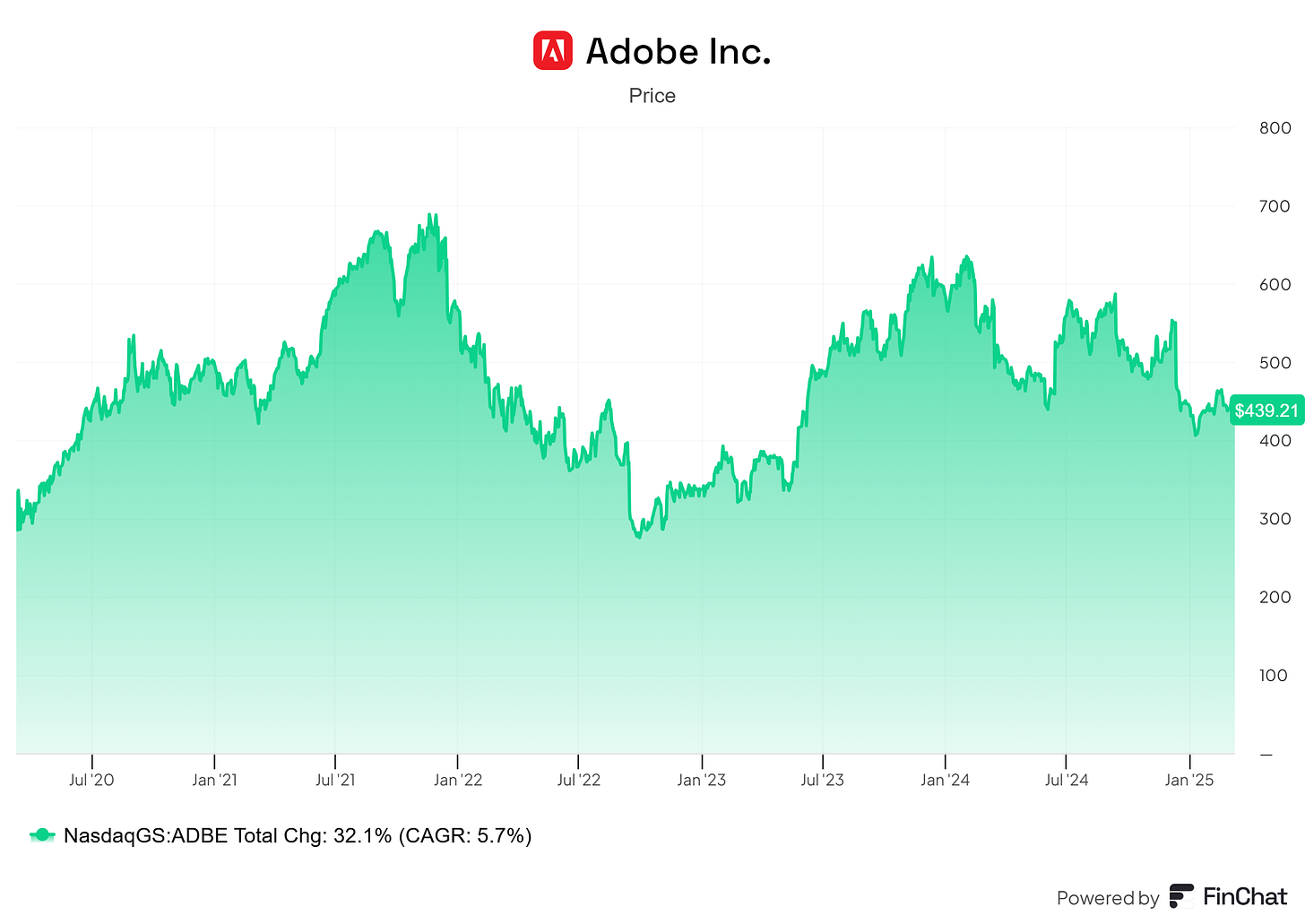

3. Adobe - ADBE

🤌🏼 What they do: no introduction needed.

Market Cap: $190.6B

📊 Anti-fragile KPIs:

ARR % = 95%

Revenue Growth (3Yr CAGR) = 10.9%

Gross Margin = 89%

Free Cash Flow Margin = 36.6%

Return On Invested Capital (3Yr avg) = 21.6%

Net Debt (Cash - LT Debt) = -1.8B (negative!)

Stock Beta = 1.37

📈 Stock performance: 5.7% CAGR in the past 5 years

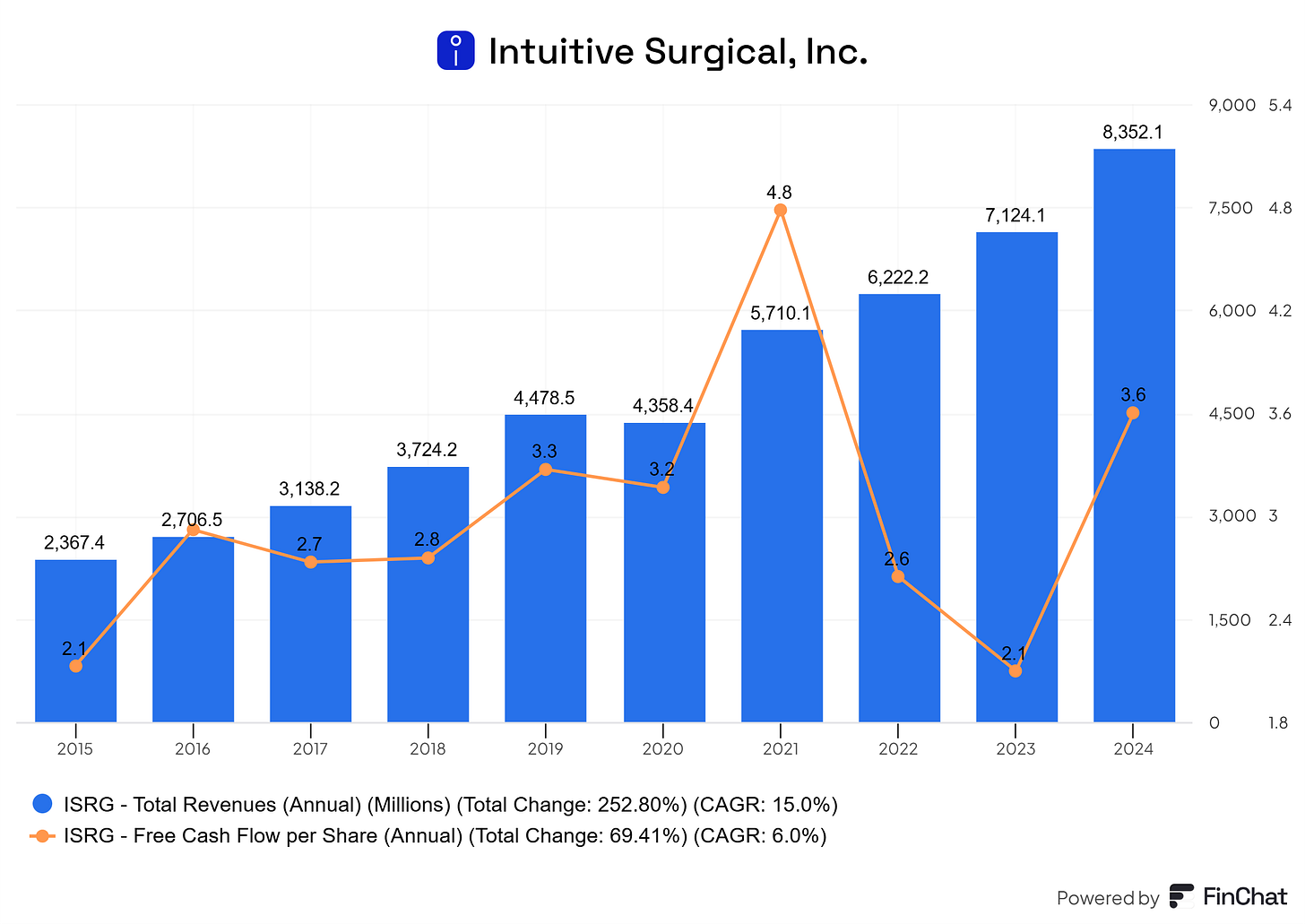

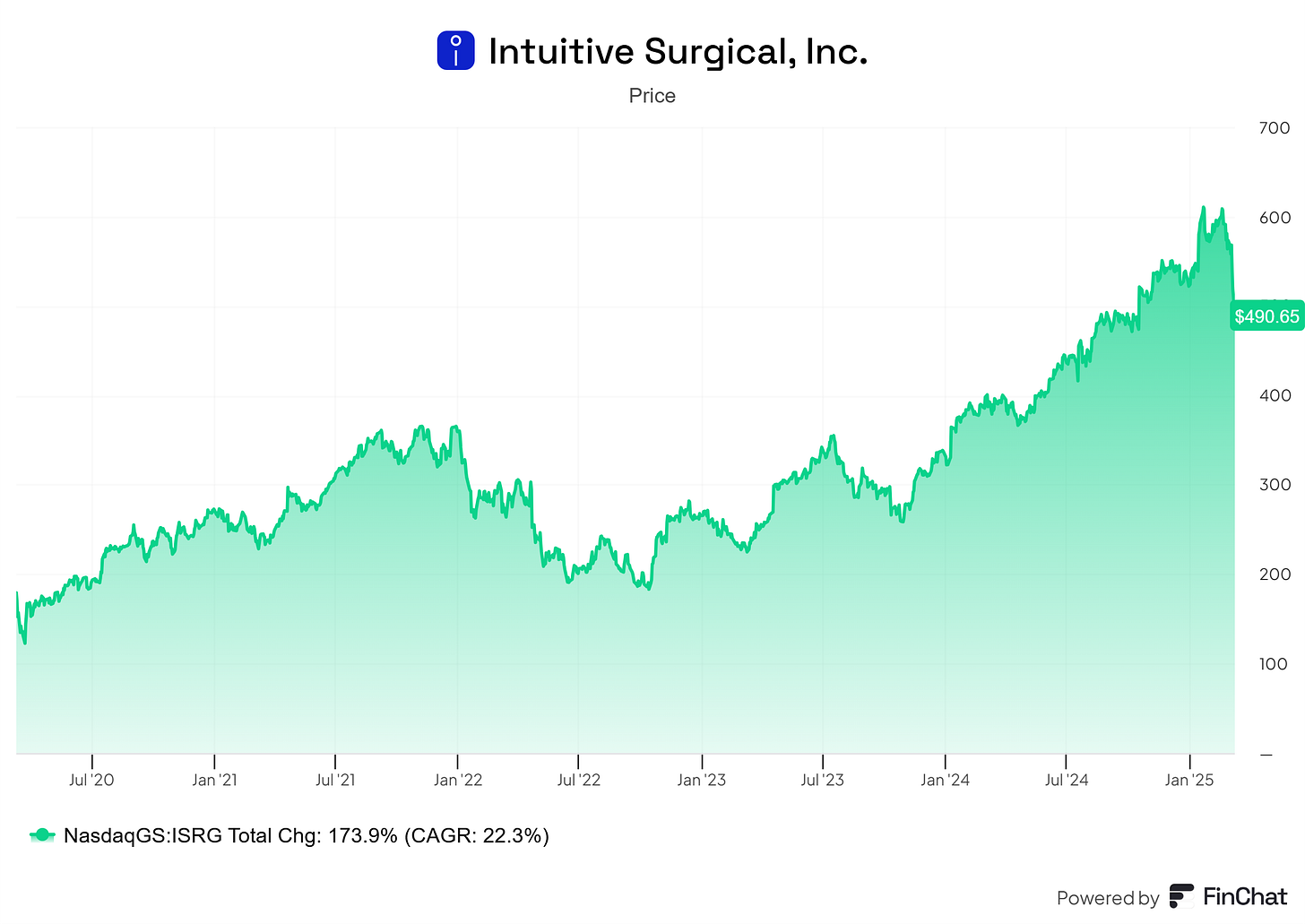

2. Intuitive Surgical - ISRG

🤌🏼 What they do: ISRG is the maker of the da Vinci robotic surgical system, enabling minimally invasive surgeries with precision and efficiency.

Market Cap: $174.1B

📊 Anti-fragile KPIs:

ARR % = 84%

Revenue Growth (3Yr CAGR) = 13.5%

Gross Margin = 67.5%

Free Cash Flow Margin = 15.6%

Return On Invested Capital (3Yr avg) = 18.5%

Net Debt (Cash - LT Debt) = -3.9B (negative!)

Stock Beta = 1.43

📈 Stock performance: 22.3% CAGR in the past 5 years

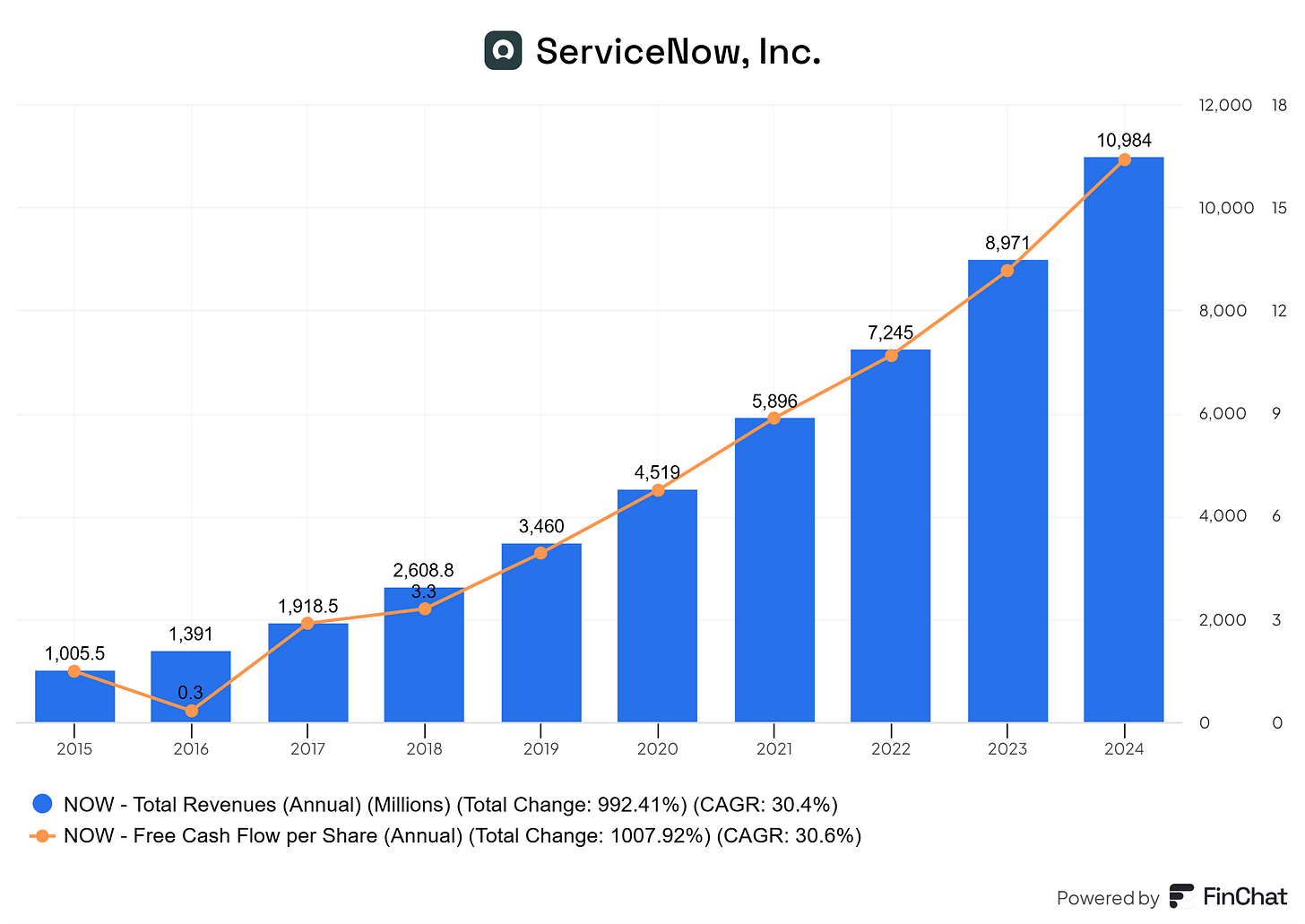

1. ServiceNow - NOW

🤌🏼 What they do: again, no introduction needed.

Market Cap: $164.7B

📊 Anti-fragile KPIs:

ARR % = 97%

Revenue Growth (3Yr CAGR) = 23.0%

Gross Margin = 79.2%

Free Cash Flow Margin = 31.1%

Return On Invested Capital (3Yr avg) = 6.5%

Net Debt (Cash - LT Debt) = -7.6B (negative!)

Stock Beta = 1.03

📈 Stock performance: 20.6% CAGR in the past 5 years

Ideas are just the start

If you’re thinking:

"a bullet-proof process to invest in quality companies without stress and time waste for long-term wealth accumulation → is exactly what I need", feel free to:

🎯Book a call here

We'll build your entire investing process, end-to-end.

Not by telling you “what” fish to buy now - useless info in 3 months from now…

But rather “how to fish” for the next 30 years.

Some details below.

If you have further questions and want to speak directly for more info:

Are you taking the ongoing correction as a shopping opportunity, or is it too early?

I hope this episode helps you stay balanced and remember how quality is key for long-term successful investing.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest