Looking for the next Microsoft, Amazon, or Palantir?

I have good news for you. Successful investing is not only about the next Tech ‘magnificent’.

In today’s episode, I’ll briefly present 10 unpopular winning companies, to show you how opportunities lie everywhere.

Even where you’d never expect: pet care, apparel, baked goods, surgery, public safety.

As usual, I’m using FinChat for stock charts, company overviews, and financial analysis.

Check them out if you haven’t already. It’s my favorite stocks research & analysis platform. And I can get you 15% off Pro and Plus for 1 year.

Let’s go!

10. Intercontinental Exchange

Intercontinental Exchange (ICE) operates global financial and commodity markets, including the New York Stock Exchange (NYSE). Founded in 2000, it provides electronic trading platforms, clearinghouses, and market data, helping businesses and investors manage risk and access liquidity efficiently.

Market Cap: $92B

Gross Margin: 100%

Operating Margin: 47%

5Yr Revenue CAGR: 11.7%

ROCE 5Y-avg: 9.25%

FCF / Net Income (LTM): 159%

9. Guidewire Software

Guidewire Software (GWRE) provides software solutions for the property and casualty (P&C) insurance industry. Its platform includes cloud-based applications for core insurance operations like underwriting, billing, and claims management.

Market Cap: $14.5B

Gross Margin: 59.5%

Operating Margin: -5.4%

5Yr Revenue CAGR: 6.4%

ROCE 5Y-avg: -5.6%

FCF: 19.3%

8. Gildan Activewear

Gildan Activewear (GIL) is a Canadian manufacturer of everyday basic apparel, including T-shirts, underwear, socks, and fleece. The company produces its clothing in a vertically integrated system, controlling all aspects of production from fabric to finished products.

Market Cap: $10B

Gross Margin: 29.7%

Operating Margin: 17.2%

5Yr Revenue CAGR: 1.9%

ROCE 5Y-avg: 14.2%

FCF / Net Income (LTM): 120%

7. TransDigm Group

TransDigm Group (TDG) designs, produces, and supplies highly engineered aerospace components for commercial and military aircraft. Its products include control systems, pumps, valves, and sensors that are critical for flight safety and performance. TransDigm operates through a model of acquiring niche aerospace businesses, focusing on aftermarket sales and maximizing profitability through innovation and operational efficiency.

Market Cap: $80B

Gross Margin: 59.3%

Operating Margin: 45.8%

5Yr Revenue CAGR: 10%

ROCE 5Y-avg: 13.5%

FCF / Net Income (LTM): 107%

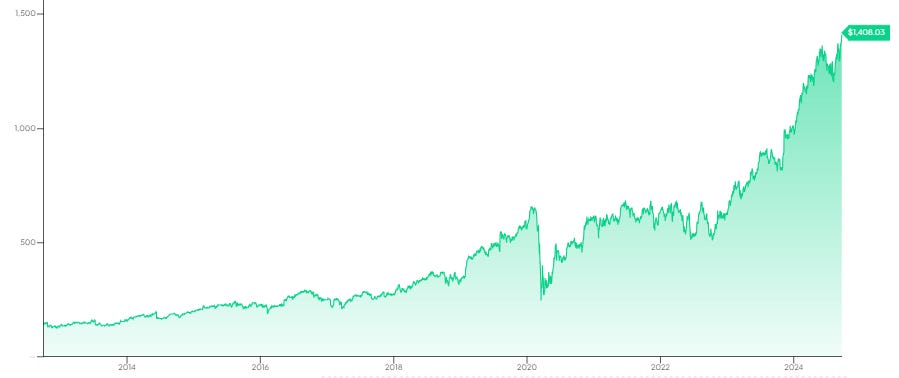

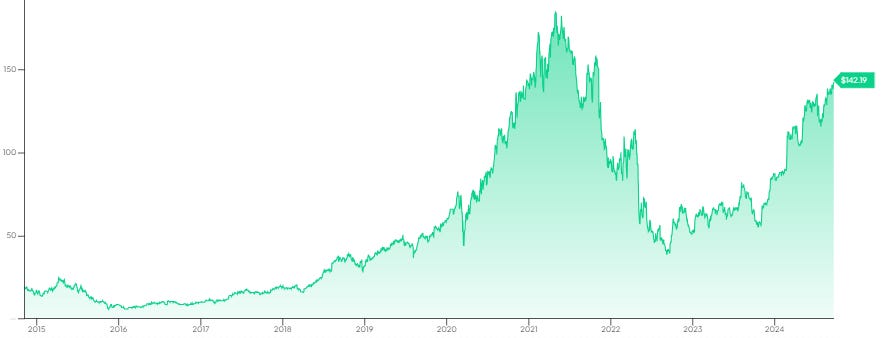

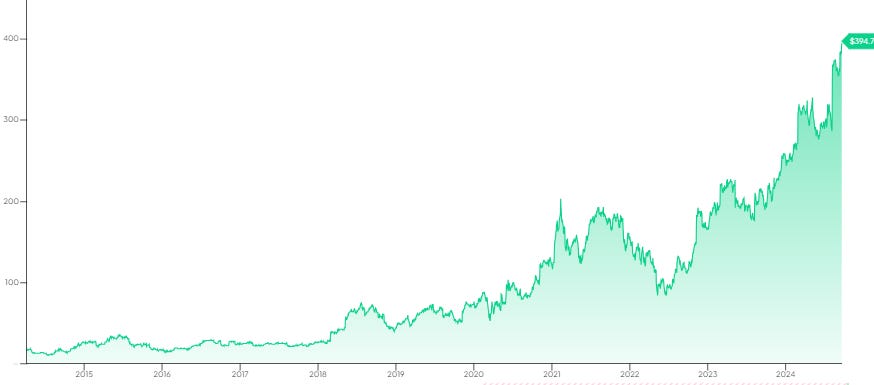

6. Fair Isaac Corporation

Fair Isaac Corporation (FICO) is a pioneer in data analytics and credit scoring. Known for its FICO score, a key metric used by lenders to assess consumer credit risk, the company provides tools and solutions that help businesses manage risk, optimize operations, and improve decision-making.

Market Cap: $47.4B

Gross Margin: 79.3%

Operating Margin: 42.4%

5Yr Revenue CAGR: 8.3%

ROCE 5Y-avg: 42.6%

FCF / Net Income (LTM): 118%

5. Freshpet

Freshpet (FRPT) produces and markets natural, refrigerated pet food for dogs and cats. Its offerings include refrigerated meals, treats, and snacks, all designed to support the wellness and vitality of pets.

Market Cap: $6.8B

Gross Margin: 36.9%

Operating Margin: 1.7%

5Yr Revenue CAGR: 32.1%

ROCE 5Y-avg: -1.9%

FCF: -12%

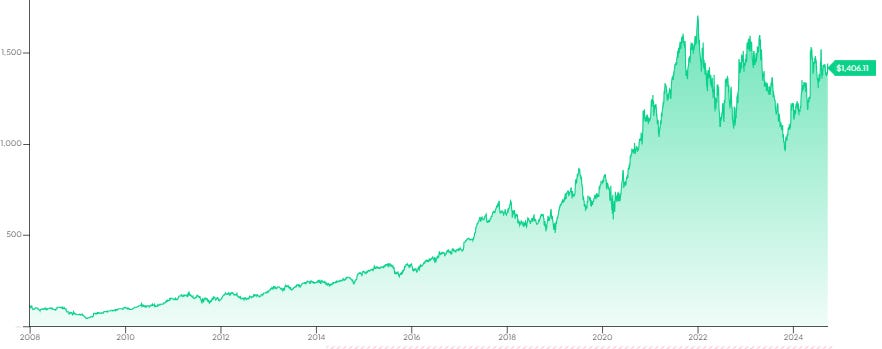

4. Mettler-Toledo International

Mettler-Toledo (MTD) is a global manufacturer and supplier of precision instruments and services for various industries, including laboratories, manufacturing, and food production. Mettler-Toledo is known for its advanced technologies that ensure accuracy and efficiency in processes like drug development, chemical analysis, and product safety testing.

Market Cap: $30.6B

Gross Margin: 59.3%

Operating Margin: 28.4%

5Yr Revenue CAGR: 4.8%

ROCE 5Y-avg: 45.1%

FCF: 24%

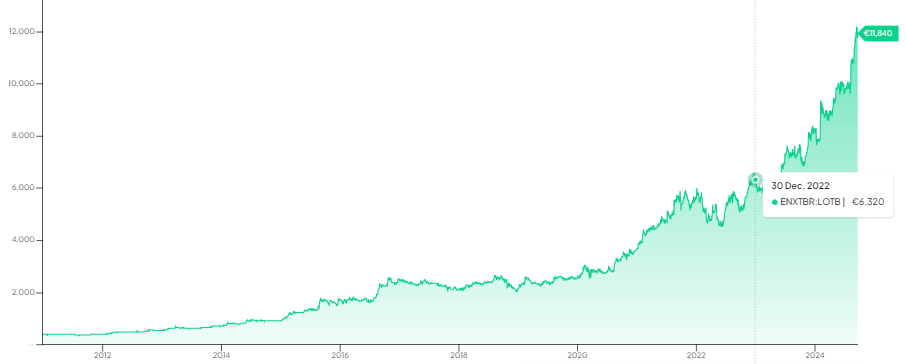

3. Lotus Bakeries

Lotus Bakeries (LOTB) is a Belgian company renowned for its specialty baked goods, particularly its iconic Lotus Biscoff cookies. Founded in 1932, the company produces a range of products, including various cookies, pastries, and snack items.

Market Cap: €9.6B

Gross Margin: 39.3%

Operating Margin: 16.5%

5Yr Revenue CAGR: 14.6%

ROCE 5Y-avg: 16.9%

FCF: 7.8%

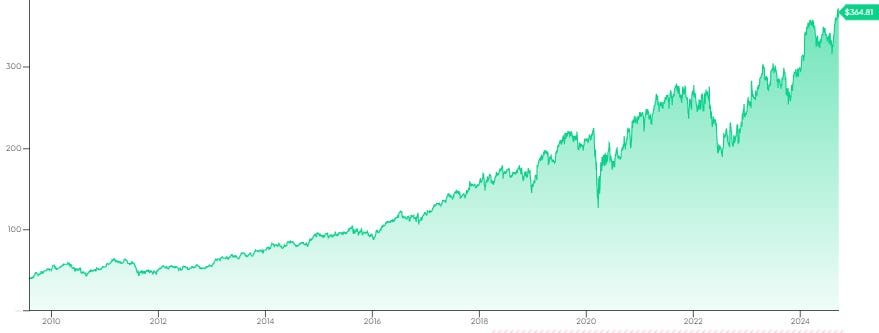

2. Stryker Corporation

Stryker Corporation (SYK) is a leading medical technology company specializing in innovative products and solutions for orthopedics, surgical equipment, neurotechnology, and spine procedures. Founded in 1941, Stryker develops a wide range of devices, including implants, surgical instruments, and navigation systems, aiming to improve patient outcomes and enhance healthcare efficiency.

Market Cap: $139.1B

Gross Margin: 64%

Operating Margin: 20.7%

5Yr Revenue CAGR: 8.5%

ROCE 5Y-avg: 12.5%

FCF: 13%

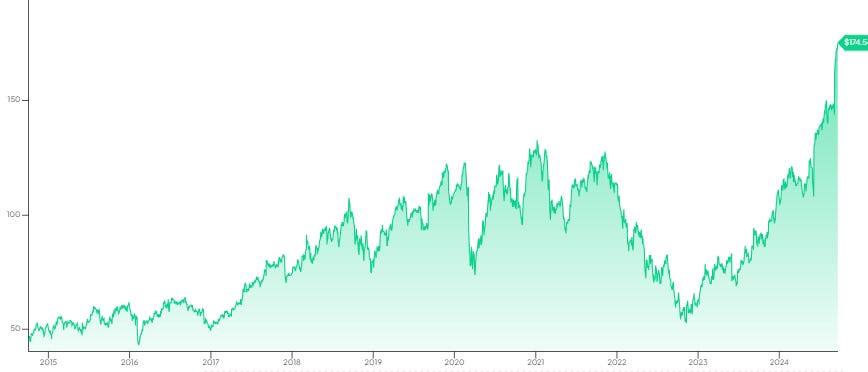

1. Axon Enterprise

Axon Enterprise (AXON) is a tech company operating in law enforcement and public safety. The company provides body cameras, evidence management software, and cloud-based services that enhance accountability and transparency in policing.

Market Cap: $29.5B

Gross Margin: 59.8%

Operating Margin: 8.5%

5Yr Revenue CAGR: 32.2%

ROCE 5Y-avg: -0.8%

FCF: 13%

Let’s connect!

That is all for today.

📢 If you find value in my episodes, feel free to restack, like, or comment below.

For any ideas or request, feel free to reach out via DM.

📈

Thank you again for your valuable time.

Happy Investing,

Francesco - Business Invest

I've got Fair Isaac, Lotus Bakeries (via endlos KO certificate) and Transdigm and they are doing great. Will looking into ICE and AXON.